DNA Sequencing Industry Overview

The global DNA Sequencing Market, valued at an estimated USD 12.39 billion in 2023, is projected to expand at a compound annual growth rate (CAGR) of 21.65% from 2024 to 2030. This growth is facilitated by the rapid progress in technology and bioinformatics, which has enabled the detection of DNA variations and the subsequent identification of variants associated with an elevated risk of disease.

Furthermore, the increasing utilization of Next-Generation and Whole-Genome Sequencing technologies within clinical diagnosis applications is broadening the scope of DNA sequencing. These advancements are expected to contribute to market growth over the forecast period.

Detailed Segmentation:

- Product & Service Insights

The services segment is anticipated to witness the fastest CAGR over the forecast period. Comprehensive data analysis, library preparation, identification & quantification of the binding sites of proteins of DNA, DNA methylation profiles on a genome-wide scale, shotgun sequencing, primer walking sequencing, bacterial artificial chromosome end sequencing, and expressed sequence tags are among the few sequencing services available in the market. The demand for the services segment is expected to be driven by the availability of several players offering these services. GENEWIZ, Illumina, QIAGEN, Eurofins Genomics LLC, GenScript, Applied Biological Materials Inc., and Agilent Technologies are a few major service providers operating in the market.

- Technology Insights

Based on technology, the next generation sequencing segment led the market with a largest revenue share of 87.29% in 2023. The radical advances in these technologies and the reducing time and declining cost of sequencing have made genome sequencing affordable and more accurate. In addition, NGS technology is gaining popularity as a routine clinical diagnostic test, particularly with the COVID-19 pandemic, which positively impacts the segment’s revenue share.

- Workflow Insights

Based on workflow, the sequencing segment held the market with a largest revenue share of 56.96% in 2023. This step enables the sequence profiling of the genome and DNA-protein interactions. It is an integral part of the entire DNA sequencing workflow in research and discovery studies, which accounts for its larger share. The ability of sequencers to generate a large amount of data in a relatively short period accelerates understanding of human health and disease treatments. Moreover, major players like Illumina, Inc and Thermo Fisher Scientific, Inc. provide novel platforms for sequencing workflow.

- Application Insights

In terms of application, the oncology segment led the market with a largest revenue share of 25.53% in 2023. Technology holds great potential in clinical research and development of cancer diagnostics and therapeutics. The value of these technologies in companion diagnostics and precision medicine is widely recognized by clinicians and companies, which is anticipated to propel the segment over the forecast period. NGS is widely used in oncology, where gene mutations are sequenced and cataloged to develop new cancer diagnoses & treatment methods.

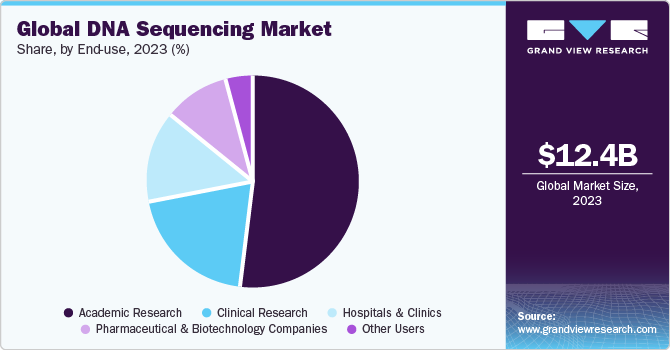

- End-use Insights

The clinical research segment is projected to witness the fastest CAGR over the forecast period. NGS technologies have gained immense popularity because of their massive parallel sequence analysis capability that allows simultaneous screening of multiple genes. This potential of NGS technologies makes it a preferred choice for clinical testing procedures, even in the testing of multiple gene markers with a smaller number of nucleic acids. Moreover, the implementation of DNA analysis for studying tumor heterogeneity, the discovery of new cancer-related genes, and the identification of alterations related to tumorigenesis are expected to result in significant growth of this segment.

- Regional Insights

The Europe market is expected to grow at a significant CAGR during the forecast period, due to the increasing R&D investments and continuous research by scientists which has boosted the demand for innovative NGS solutions. For instance, in March 2020, using Thermo Fisher Scientific’s NGS research assay, a team of Italian researchers analyzed the SARS-CoV-2 genome from specimens collected locally and suggested that the rapidly spreading virus's genome is stable.

Gather more insights about the market drivers, restraints, and growth of the DNA Sequencing Market

Key Companies & Market Share Insights

The following are the leading companies in the DNA sequencing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these DNA sequencing companies are analyzed to map the supply network.

- Thermo Fisher Scientific, Inc

- Agilent Technology

- Illumina, Inc.

- QIAGEN

- F. Hoffmann-La Roche Ltd.

- Macrogen, Inc.

- PerkinElmer Genomics

- PacBio

- BGI

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In November 2023, Illumina, Inc. launched its Global Health Access Initiative to support access to public health sequencing tools in low- and middle-income countries

- In August 2023, PacBio entered into an agreement to acquire Apton Biosystems. This acquisition is anticipated to accelerate the development of Short-read Sequencer, propelling the market growth

- In August 2023, PacBio announced a research collaboration with the University of Washington to analyze the ability of HiFi long-read WGS. This is anticipated to increase the analytical rates in individuals with various genetic conditions

No comments:

Post a Comment