HR Software Industry Overview

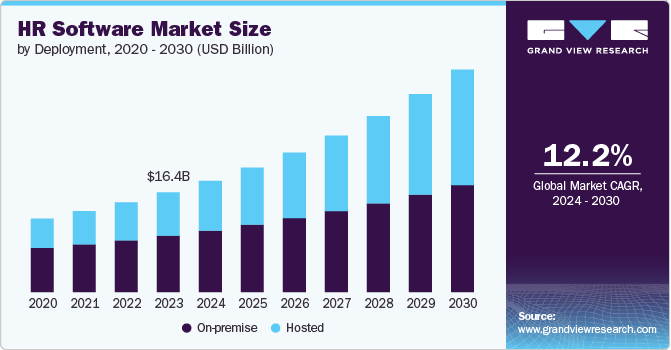

The global HR Software Market was valued at $16.43 billion in 2023 and is projected to experience significant expansion, with a CAGR of 12.2% from 2024 to 2030. This growth is primarily driven by the widespread adoption of cloud-based solutions. Organizations are increasingly migrating from traditional on-premise systems to cloud-based platforms, drawn by their enhanced scalability, flexibility, and cost-effectiveness. These cloud platforms empower companies to manage essential HR functions, including payroll, recruitment, and employee performance, from any location, offering real-time data access and reducing the need for extensive IT infrastructure, thus fueling market growth.

Detailed Segmentation:

- Type Insights

The talent management segment is expected to record a significant CAGR of over 14% from 2024 to 2030, due to the increasing focus on optimizing workforce performance and development. Organizations are investing more in advanced talent management solutions to attract, retain, and foster top talent amidst a competitive job market. These tools enhance recruitment processes, employee development, and performance evaluation, aligning talent strategies with business goals and improving overall organizational effectiveness. The growing recognition of talent management's impact on business success drives this rapid growth.

- End-use Insights

The retail segment is anticipated to expand at a significant CAGR from 2024 to 2030, due to the sector's increasing need for efficient workforce management solutions amid evolving consumer demands and market conditions. As retailers expand their operations and adapt to trends such as omnichannel retailing, they require advanced HR systems to manage large, dynamic teams, streamline recruitment, optimize scheduling, and enhance employee engagement. The rise in automation and data-driven HR practices is also driving the adoption of sophisticated HR software in retail, facilitating better management of both front-line and corporate staff.

- Deployment Insights

The hosted segment is estimated to register the highest CAGR from 2024 to 2030, owing to its flexibility, scalability, and lower upfront costs compared to on-premise solutions. Hosted HR software allows organizations to access and manage their HR functions via the cloud, reducing the need for extensive internal IT infrastructure and maintenance. This model supports remote and hybrid work environments, offers easier updates and integrations, and provides scalability for growing businesses, making it an attractive option for companies seeking efficient and adaptable HR management solutions.

- Organization Size Insights

The large enterprises segment held the highest revenue share in 2023, owing to their extensive and complex human resource needs. These organizations often require comprehensive and scalable HR solutions to manage large and diverse workforces, integrate with existing enterprise systems, and comply with various regulatory requirements. Their larger budgets and greater emphasis on optimizing HR processes and analytics contribute to the high revenue share in this segment.

- Regional Insights

The HR software market in North America accounted for a significant revenue share of over 34% in 2023, driven by the high adoption of advanced HR technologies, a mature market with substantial investments in digital transformation, and the presence of numerous leading HR software providers. Companies in this region are increasingly leveraging sophisticated HR systems to improve workforce management, compliance, and operational efficiency.

Gather more insights about the market drivers, restraints, and growth of the HR Software Market

Key Companies & Market Share Insights

The following are the leading companies in the HR software market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture plc

- Cezanne HR Limited

- IBM Corporation

- NetSuite, Inc.

- Zellis Group

- PwC

- SAP SE

- Talentsoft

- UKG, Inc.

- Workday Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In May 2024, Cezanne HR Limited launched its new payroll solution, Cezanne Payroll, enhancing its HRIS offerings with an integrated, native payroll tool. This solution streamlines payroll processing by combining HR and payroll data in a single system, ensuring compliance with UK regulations and HMRC recognition for RTI submissions.

- In April 2024, Zellis Group launched HCM Cloud 8.0, a major update aimed at enhancing HR and payroll operations. The new version features advanced Power BI dashboard enhancements for better visibility on pay diversity, automatic National Minimum Wage calculations, and improvements to the Zellis Intelligence Platform (ZIP) for better data management and integration.

No comments:

Post a Comment