U.S. Solar PV Market Growth & Trends

The U.S. Solar Photovoltaic Market is on a significant growth trajectory, projected to hit an impressive USD 96.6 billion by 2030. This expansion represents a robust compound annual growth rate (CAGR) of 13.7% from 2023 to 2030, according to a recent report from Grand View Research, Inc. The increasing adoption of solar PV in the U.S. is largely fueled by the decreasing cost of solar PV systems, making them a more attractive energy solution. Furthermore, a surge in government incentives and diverse financing options is anticipated to further propel the industry's expansion.

Government Initiatives and Utility-Scale Projects

The U.S. government is actively working to lessen the nation's reliance on traditional energy sources, favoring the increased integration of renewables like solar, wind, and hydrogen. A key strategy involves the construction of utility-scale projects designed for large-scale power generation. The utility sector, responsible for providing electricity to entire communities, is seeing substantial investment from the U.S. government. These investments aim to bolster utility-scale solar PV projects and facilitate the phasing out of coal and gas power generation. Recognizing this burgeoning market, many private companies are also investing in utility-scale solar. For example, in April 2022, Primenergy announced plans for the largest solar PV plant in the U.S., located in Nevada, which is set to generate 690MW of electricity and be operational by 2023.

Regional Growth and Market Dynamics

The escalating demand for solar PV across the country is directly linked to the decreasing prices of solar PV technologies, making them increasingly economically viable. States boasting high solar irradiance, such as California, Arizona, and Texas, are expected to experience accelerated growth due to shorter return on investment periods. Conversely, states like New York, New Jersey, and Massachusetts are projected to see growth primarily in the residential segment. This is attributed to their higher population density and relatively limited land availability for large-scale utility projects.

Innovation and Strategic Collaborations

Industry leaders are keenly focused on innovation and technological advancements to drive down the cost of solar PV, making it more competitive with conventional power sources like natural gas and coal. Additionally, market participants are engaging in various strategic initiatives, including joint ventures, partnerships, and mergers & acquisitions, to solidify their market position in the coming years.

Curious about the U.S. Solar PV Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

U.S. Solar PV Market Report Highlights

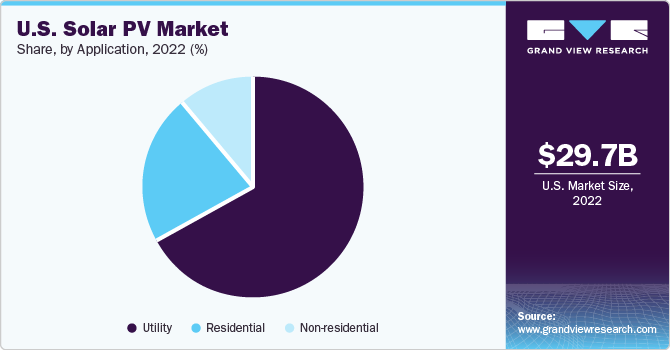

- In 2022, utility emerged as the largest segment with a revenue share of 66.68%, owing to the utility segment being the most cost-effective and higher investments from the government and private companies

- Texas held a dominant market in 2021 due to a higher irradiance factor of the state and the increasing demand for sustainable energy is expected to boost the growth during the forecast period

- New Mexico is estimated to grow at a significant CAGR over the forecast period owing to the lower penetration of renewable energy in the state boosting market demand and the high amount of sunlight in the state

U.S. Solar PV Market Segmentation

Grand View Research has segmented the U.S. Solar PV market based on application & state:

U.S. Solar PV Application Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

- Residential

- Non-residential

- Utility

U.S. Solar PV State Outlook (Volume, MW; Revenue, USD Billion, 2018 - 2030)

- California

- Arizona

- New Jersey

- North Carolina

- Nevada

- Massachusetts

- Hawaii

- Colorado

- New York

- Texas

- Florida

- Georgia

- Utah

- Virginia

- South Carolina

- Maryland

- New Mexico

- Oregon

- Indiana

- Minnesota

- Pennsylvania

Download your FREE sample PDF copy of the U.S. Solar PV Market today and explore key data and trends.

No comments:

Post a Comment