Heat Treating Industry Overview

The global Heat Treating Market, valued at an estimated USD 107.18 billion in 2023, is projected to expand at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030. This growth is anticipated to be driven by the rapid advancement of the electric vehicle industry, alongside the increasing demand for metallurgical alterations to meet specific application requirements. The rising need for heat treatment in EVs is fueled by its vital role in improving the performance, efficiency, and longevity of critical components within EV drivetrains and battery systems.

In the pursuit of optimizing the efficiency of electric propulsion systems by automakers, heat treatment is becoming essential for components like electric motor components, gears, and battery cells. Moreover, heat treating contributes to enhancing the hardness, durability, and overall structural integrity of materials, ensuring that components can withstand the rigorous demands of EV operations.

Detailed Segmentation:

- Material Insights

The demand for cast heat treating services remains robust, driven by the persistent growth in industries such as automotive, aerospace, construction, and oil and gas, all of which heavily rely on cast components for various applications. The automotive sector, in particular, continues to expand, fueled by increasing consumer demand and technological advancements, thereby elevating the need for heat-treated castings to enhance component durability and performance.

- Process Insights

The demand for annealing processes in the market remains significant, driven by industries that prioritize material refinement, stress relief, and improved mechanical properties. Annealing is widely employed in sectors such as metallurgy, electronics, and manufacturing, where it is instrumental in reducing hardness, enhancing ductility, and relieving internal stresses in metal components. In the electronics industry, annealing is crucial for optimizing the electrical properties of semiconductor materials.

- Equipment Insights

The demand for fuel-fired furnace equipment remains robust, particularly in industries where high-temperature processes are essential, such as metal casting, heat treatment, and glass manufacturing. Fuel-fired furnaces powered by natural gas, propane, or other fuels offer a cost-effective and versatile solution for achieving elevated temperatures required in various industrial applications. These furnaces are crucial for processes like melting, forging, and annealing, providing efficient heat transfer and precise temperature control. Low cost as compared to electrically-heated furnaces has led to a high preference for fuel-fired furnaces among the industry players. However, unstable fuel prices and emissions of greenhouse gases have restrained the growth of conventional fuel-fired furnaces. The demand for natural gas-fired furnaces from developing economies is likely to boost the segment growth.

- Application Insights

The demand for heat treating in the aerospace industry remains high, driven by the stringent requirements for precision, reliability, and material performance in critical aerospace components. Heat treating plays a pivotal role in enhancing the strength, hardness, and structural integrity of materials used in aircraft parts, such as turbine blades, landing gear components, and structural elements. Aerospace manufacturers rely on heat treatment processes to achieve specific metallurgical properties that meet the demanding standards for safety, weight reduction, and performance in extreme operating conditions.

- Regional Insights

Asia Pacific led the market with a revenue share of 39.6% in 2023. The demand for heat treating in the region is experiencing significant growth, driven by the burgeoning industrialization, expanding automotive and aerospace sectors, and the continuous development of infrastructure projects. As manufacturing activities surge in countries like China, India, Japan, and South Korea, there is an increasing need for heat treating processes to enhance the mechanical properties of critical components across diverse industries. The rising automotive production, coupled with the expansion of aerospace and electronics manufacturing, underscores the pivotal role of heat treating in ensuring the quality, durability, and performance of materials. In addition, the construction boom in the region fuels demand for heat-treated components in infrastructure projects. With a dynamic and rapidly evolving industrial landscape, the Asia Pacific region stands as a key driver in the global demand for heat treating services.

Gather more insights about the market drivers, restraints, and growth of the Heat Treating Market

Key Companies & Market Share Insights

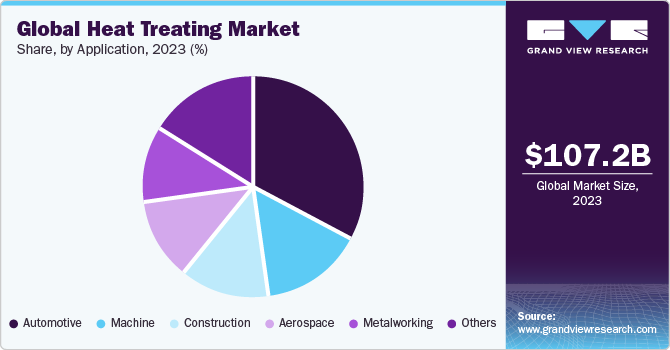

To increase market penetration and cater to changing technological requirements from various end-uses, such as automotive, machine, construction, aerospace, and metalworking, manufacturers use a variety of strategies, such as joint ventures, mergers, acquisitions, new product launches, and geographical expansions. Manufacturers are undertaking strategic acquisitions to gain an edge in the industry and increase their geographic presence. For instance, in January 2022, Honeywell International Inc. inaugurated a new production facility in Jubail, Saudi Arabia, outfitted with Callidus Flare technology. This technology is specialized in manufacturing products utilizing thermal combustion for the oil and gas industry. The range of flares produced encompasses basic utility flares to high-performance ultra-low steam flares.

Key Heat Treating Companies:

The following are the leading companies in the heat treating market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these heat treating companies are analyzed to map the supply network.

- Bluewater Thermal Solutions LLC

- American Metal Treating Inc.

- East-Lind Heat Treat Inc.

- General Metal Heat Treating, Inc.

- Shanghai Heat Treatment Co. Ltd.

- Pacific Metallurgical, Inc.

- Nabertherm GmbH

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- SECO/WARWICK Allied Pvt. Ltd. saw an increase of 15% in its production in 2023 compared to that of 2022, and in January 2024, invested in production capacity development, by expanding its plants in China, India, and the U.S., by as much as 60%.

- In August 2022, SECO/WARWICK delivered a Vector vacuum furnace to Atlas Autos Ltd. The furnace is designed for tempering and hardening processes, featuring a unique design that enables efficient gas cooling of elements and dies essential for automotive production components.

No comments:

Post a Comment