Salmon Fish Industry Overview

The global Salmon Fish Market was valued at USD 14.87 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 8.5% from 2022 to 2030. The increasing introduction of salmon products in diverse formats, such as frozen, canned, and freeze-dried options, is expected to positively influence overall market expansion. Furthermore, the rising consumer demand for ready-to-eat salads, coupled with the growing popularity of hot smoked salmon, is anticipated to further drive market growth.

For example, in October 2020, BluGlacier launched its inaugural direct-to-consumer brand, OSHĒN, providing premium fresh and frozen Chilean salmon in environmentally friendly packaging to customers throughout the U.S. Such initiatives are likely to complement the overall increasing demand for these types of products.

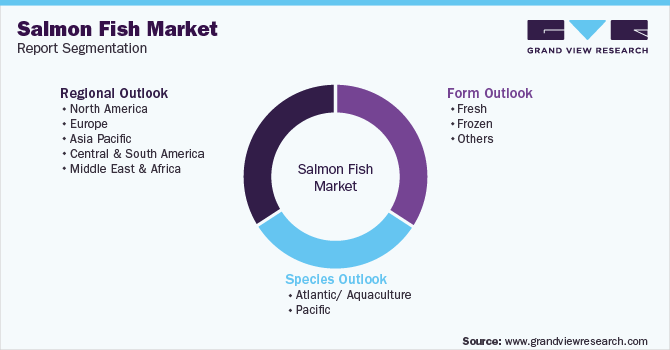

Detailed Segmentation:

- Species Insights

Atlantic species accounted for the largest share of 82.7% in 2021. Atlantic/aquaculture species is an anadromous species that spends part of its time in fresh water and part in salt water; however, most of an adult salmon’s life is spent in the ocean. Aquaculture species have more fat and omega-3s and 46% more calories than Pacific species. Moreover, it is easily available in fresh form. Owing to the rising consumer focus on nutrition and the increased consumption of fresh seafood, the demand for Atlantic species is expected to grow at a rapid pace.

Pacific species are anticipated to register a CAGR of 5.8% over the forecast period. This species group thrives in the North Pacific waters of the U.S. and Canada. It is found in five different species, namely, Chinook/King, Coho, Pink, Red, and Chum. They begin their lives in freshwater streams, rivers, and lakes and then migrate to the sea as small fish called smolts.

- Form Insights

The fresh form segment contributed a share of more than 52.0% in 2021. This form has a high nutrient content and does not contain chemicals or preservatives to ensure its safety. It is high in protein and fat and contains various minerals such as calcium, iron, and potassium. Thus, the increased consumption of the raw fresh form of salmon is expected to drive segment growth.

The frozen form is anticipated to register a CAGR of 8.7% over the forecast period. Freezing helps in the long-term preservation of food. Refrigeration of seafood extends its shelf life and helps maintain its high quality. Furthermore, the increasing demand for frozen seafood has been observed across the globe. This is expected to remain a key driver in the salmon fish market,

- Regional Insights

Asia Pacific is expected to expand with a significant CAGR of 13.0% from 2022 to 2030. Japan, China, South Korea, and Thailand remain the leading consumers and importers of smolt in the Asia Pacific. Supportive government regulations and improved transport infrastructure have propelled the trade of fish in the last few years. Pacific salmon, especially chum, is preferred owing to its low cost and abundant availability. As per the Marine Products Export Development Authority (MPEDA), India shipped 12.8 lakh metric tons of seafood worth USD 6.68 billion in 2019, which is expected to rise by 12.6% by the end of 2032.

Gather more insights about the market drivers, restraints, and growth of the Salmon Fish Market

Key Companies & Market Share Insights

- The market is characterized by the presence of several well-established players and a few emerging players. New product launches, partnerships, and acquisitions are some of the key strategic initiatives in the industry. For instance:

- In May 2022, SalMar ASA acquired Norway Royal Salmon, creating the second-largest Atlantic salmon farming business globally. The acquisition will create a strong dividend capacity and significant synergies for the shareholders.

- In January 2022, Bakkafrost acquired 90% of the shares of the Denmark-based canned fish producer, Munkebo Seafood A/S. The acquisition of Munkebo Seafood will strengthen Bakkafrost’s product portfolio of canned salmon fish and strengthen its ability to increase the value derived from salmon by-products.

Key Salmon Fish Companies:

The following are the leading companies in the salmon fish market. These companies collectively hold the largest market share and dictate industry trends.

- Lerøy

- SalMar ASA

- Cermaq

- Mowi

- Bakkafrost

- SEA DELIGHT GROUP

- Nordlaks Produkter AS

- Atlantic Sapphire

- Ideal Foods Ltd

- BluGlacier

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment