PET Scanners Industry Overview

The worldwide PET Scanners Market reached $2.64 billion in 2023 and is predicted to expand at a CAGR of 3.65% from 2024 to 2030. This growth is primarily fueled by continuous advancements in PET imaging technology, leading to more sophisticated diagnostic tools, particularly in oncology. Additionally, the increasing need for PET analysis in radiopharmaceuticals and a notable move towards image-guided interventions are significant drivers. As the healthcare landscape evolves, the integration of these innovations is expected to significantly boost the adoption of PET scanners across various medical fields. For example, in November 2023, Siemens Healthineers secured FDA clearance for their Biograph Vision.X PET/CT scanner, which boasts an industry-leading time-of-flight (TOF) performance of 178 picoseconds and cutting-edge detector technology, resulting in enhanced sensitivity and image quality for improved diagnostic capabilities.

Detailed Segmentation:

- Modality Insights

PET-CT dominated the PET scanner market, holding the largest revenue share of 81.91% in 2023. It is expected to continue its dominance with the fastest CAGR of 5.5% over the forecast period. The drivers behind this growth include technological advancements that improve image quality and reduce scan times, the rising prevalence of cancer and cardiovascular diseases necessitating early diagnosis, and increasing research activities focusing on personalized medicine. For instance, In June 2024, Siemens Healthineers introduced its latest PET/CT scanner, the Biograph Trinion, at the Society of Nuclear Medicine and Molecular Imaging's annual meeting.

- Application Insights

The cardiology segment is expected to witness the fastest growth rate over the forecast period. This is owing to the rising incidence of cardiovascular diseases and increasing demand for non-invasive treatments for cardiovascular disease management. As per the article "Epidemiological Features of Cardiovascular Disease in Asia," published by JACC journals, cardiovascular disease (CVD) continues to be the leading cause of death and premature death worldwide.

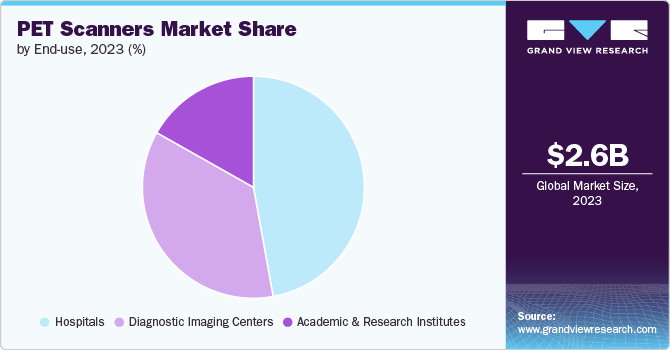

- End-use insights

The diagnostic imaging centers are expected to witness the fastest growth rate over the forecast period. Diagnostic imaging centers are expanding their services to provide a more comprehensive range of patient diagnostic options. PET scan imaging is a valuable add-on to these services, allowing these centers to offer more complete testing for various diseases. In addition, PET scanners were traditionally expensive. They were mainly used in hospitals, but advanced and innovative technology has decreased the costs, and diagnostic imaging centers can invest in PET scanners and try to provide imaging services at a lower cost to their patients.

- Regional Insights

North America PET scanners market held the largest revenue share, over 34.11%, in 2023. Technological advancements in PET imaging for oncology and advanced diagnostic applications, along with the high demand for precision diagnostics, drive market growth significantly. The increasing prevalence of cancer, particularly breast and prostate cancer, further enhances this trend. According to the American Cancer Society's 2022 update, approximately 1,918,030 new cancer cases were expected in the U.S. in 2022, including an estimated 290,560 cases of breast cancer, 268,490 cases of prostate cancer, and 151,030 cases of colorectal cancer. These statistics underscore the urgent need for advanced cancer detection and treatment imaging technologies.

Gather more insights about the market drivers, restraints, and growth of the PET Scanners Market

Key Companies & Market Share Insights

Key PET scanner companies focus on providing a more comprehensive range of advanced imaging products that incorporate cutting-edge technology, driving market growth. For instance, in October 2022, GE Healthcare launched the "Omni" PET/CT platform, designed to enhance operational efficiency. This platform features AI-driven workflow solutions, including an Auto Positioning Camera and Precision DLi for deep learning image processing, addressing healthcare challenges effectively.

Key PET Scanners Companies:

The following are the leading companies in the pet scanners market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Medical Systems

- GE Healthcare

- Kindsway Biotech

- Koninklijke Phillips N.V.

- Mediso Ltd.

- PerkinElmer

- Positron

- Shimadzu Corporation

- Siemens Healthineers AG

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In June 2024, a recently launched technology known as augmented whole-body scanning via magnifying PET (AWSM-PET) has shown significant advancements in image clarity and system sensitivity for clinical whole-body PET/CT imaging.

- In April 2024, CDL Nuclear Technologies announced the launch of its innovative Mobile dedicated Cardiac PET/CT Trailer, designed to transform cardiac care by providing advanced PET/CT imaging services directly to medical facilities as per their schedules.

No comments:

Post a Comment