Surgical Sutures Industry Overview

The global Surgical Sutures Market was valued at $4.56 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030. Several key factors are expected to fuel this market expansion, including increasing healthcare needs due to an aging global population, a rise in chronic illnesses requiring surgical treatment, progress in suture materials and surgical methods, and a growing focus on minimally invasive surgeries. For example, the International Society of Aesthetic Plastic Surgery (ISAPS) Global Survey 2022 reported an 11.2% overall increase in procedures performed by plastic surgeons in 2022, with over 14.9 million surgical and 18.8 million non-surgical procedures conducted worldwide.

The COVID-19 pandemic caused a substantial change in healthcare priorities, with a focus on treating infected individuals and implementing strict lockdowns. Consequently, elective surgeries were delayed or halted to minimize the risk of infection, resulting in a decrease in the demand for surgical sutures in 2020-21. However, as countries move towards economic recovery and a return to normal, healthcare facilities are rapidly resuming surgical procedures. They are implementing innovative approaches such as telehealth consultations, screening tools, and improved coordination systems. Strategies like the use of mobile applications to provide information to surgeons and patients have enhanced healthcare operations, maximizing efficiency while ensuring patient care. These strategies, crucial in recovering from pandemic-related losses, have assisted hospitals and surgical centers in approaching pre-COVID revenue levels, contributing to the rebound of the market.

Detailed Segmentation:

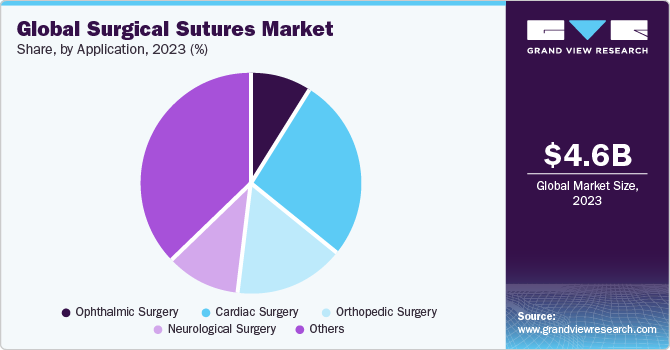

- Application Insights

The cardiovascular surgery segment dominated the market in 2023 due to the high incidence of cardiac diseases, sufficient experts in the field, supportive reimbursement scenarios, and advanced diagnostics. For instance, according to the World Health Federation 2023 report, more than half a billion people around the world continue to be affected by cardiovascular diseases, which accounted for 20.5 million deaths in 2021 – close to a third of all deaths globally and an overall increase on the estimated 121 million CVD deaths. This significant rise in the number of cardiac surgeries, in turn, is leading to an increase in demand for surgical sutures over the forecast period.

- Type Insights

The absorbable segment held the highest market share and is anticipate to grow at the fastest CAGR over the forecast period. The demand for absorbable sutures is continuously rising due to their ability to temporarily support wounds until they heal and can withstand normal stress. In addition, absorbable sutures can degrade naturally, making them a preferred choice. Many companies have launched new products, and some have received approval; for instance, in 2023, Genesis MedTech obtained approval from China's NMPA for the market release of its absorbable sutures with antibacterial protection. These absorbable sutures are designed to provide enhanced healing and reduce the risk of infection. Due to this, key players in the market are investing in R&D activities, which is further expected to help the absorbable segment in the future.

- Filament Insights

The multifilament segment dominated the market with a significant revenue share and is expected to experience maximum growth during the forecast period. This can be attributed to advantages associated with multifilament, such as better compliance, high tensile strength, and flexibility.

- Regional Insights

Asia Pacific is expected to experience maximum growth during the forecast period due to the increasing number of geriatric population, which tends to require more surgical interventions. In addition, increased government investments in healthcare infrastructure across the Asia Pacific aim to address the region's unmet healthcare needs, further fostering the growth of the market. The largest population increase in chronic diseases demands surgical interventions, making the Asia Pacific region a promising market for surgical sutures.

Gather more insights about the market drivers, restraints, and growth of the Surgical Sutures Market

Key Companies & Market Share Insights

Some of the key players operating in the market include Medtronic, and Ethicon US, LLC. (Johnson & Johnson Services, Inc.), B. Braun Melsungen AG, Smith & Nephew, Integra Lifesciences, CONMED CORPORATION.

- Medtronic, is a leading global healthcare products company offering a wide range of medical devices, including surgical sutures, focusing on innovation and quality.

- Ethicon US, LLC. (Johnson & Johnson Services, Inc.): Ethicon, a subsidiary of Johnson & Johnson, is a manufacturer of surgical sutures and wound closure devices, known for its extensive portfolio and commitment to advancing surgical care.

- B. Braun focuses on providing various medical solutions, including surgical sutures, known for its high-quality products and commitment to improving patient outcomes through innovation

Key Surgical Sutures Companies:

- Medtronic

- Ethicon US, LLC. (Johnson & Johnson Services, Inc.)

- Braun Melsungen AG

- Smith & Nephew

- Integra Lifesciences

- Peter Surgical

- Internacional farmaceutica

- CONMED CORPORATION

- Sutures India Pvt. Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In September 2023, Genesis MedTech secured approval from China's NMPA to launch antibacterial absorbable sutures, aiming to improve healing outcomes and lower infection risks in the market.

- In August 2023, Healthium Medtech, introduced TRUMAS, a specialized range of sutures tailored for challenges encountered during suturing in minimal access surgeries

No comments:

Post a Comment