Australia Medical Cannabis Market Growth & Trends

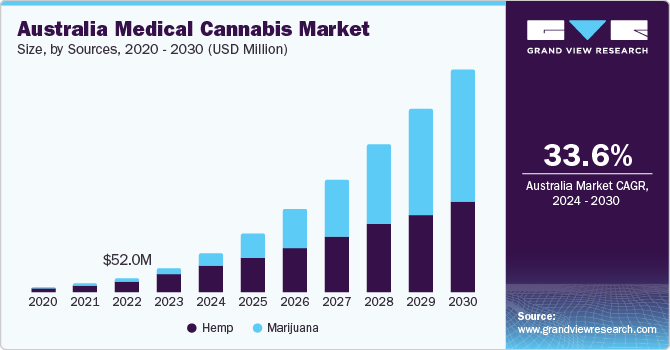

The Australia Medical Cannabis Market is experiencing significant growth, with projections indicating it will reach USD 860.74 million by 2030, exhibiting a robust Compound Annual Growth Rate (CAGR) of 33.6% from 2024 to 2030. This expansion, as detailed in a new report by Grand View Research, Inc., is primarily driven by increasing public awareness of the health benefits associated with cannabis consumption and the expanding legalization of marijuana, particularly for medical purposes.

Key Market Drivers

The market's acceleration is fueled by several interconnected factors:

- Growing Legalization: The ongoing trend of legalizing cannabis for medical use across Australia is a major contributor. For instance, the Australian Capital Territory (ACT) introduced specific regulations in October 2023, permitting individuals over 18 to possess up to 150 grams of fresh cannabis or 50 grams of dried cannabis. While federal law still classifies cannabis as illegal, it is effectively unenforced in the ACT for personal use within these limits.

- Expanding Patient Pool: A rising number of patients are seeking medical cannabis as an alternative treatment option for various conditions.

- Increasing Government Initiatives: Government efforts to streamline access and regulate the market are proving beneficial.

- Active Industry Participation: Both domestic and international players are actively investing and innovating in the sector, fostering competition and product development.

Favorable Regulatory Environment

The easing of regulatory restrictions by bodies such as the Therapeutic Goods Administration (TGA) has created a more conducive environment for market growth. The TGA has simplified approval procedures for medicinal cannabis products, thereby improving patient access. Data from the Australian Journal of General Practice indicates that as of 2021, over 130,000 medicinal cannabis approvals have been granted in Australia, with a significant majority (approximately 65%) for the treatment of chronic non-cancer pain. The authorization of medical cannabis use across various Australian states has further enhanced market conditions, facilitating greater production, distribution, and usage of these products. Patients typically access these products via the Special Access Scheme (SAS) or Authorised Prescriber (AP) pathways, requiring a prescription from a registered medical doctor or specialist.

Dynamic Industry Landscape

The market's dynamism is also attributed to the diverse range of industry stakeholders. Established pharmaceutical companies, cannabis cultivators, research institutions, and startups are actively investing in the sector. This competitive landscape not only encourages product development and innovation (such as scented or tear-resistant bags, or eco-friendly options) but also contributes to driving down prices, making medical cannabis more accessible. An example of this market expansion is Cronos Group Inc., which announced its entry into the Australian market in January 2024 by commencing the delivery of cannabis flowers to Vitura Health Limited, a company in which Cronos holds approximately 10% of common shares. This strategic partnership positions Cronos as a key cannabis supplier for Vitura, further highlighting the sustained growth and promising future prospects for the Australian medical cannabis market.

Curious about the Australia Medical Cannabis Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Australia Medical Cannabis Market Report Highlights

- Hemp dominated the source segment of the market in 2023 due to rising incidences of conditions such as epilepsy and various sleep disorders, alongside increased consumption of hemp-derived products, including hemp CBD and supplements, renowned for their numerous health benefits, are further driving the market

- The chronic pain segment held the largest share, driven by the increasing demand for alternative treatments. Medical cannabis products, particularly THC-rich products, are being recognized as a potential solution for managing chronic pain

- CBD dominated the derivatives segment with a share in 2023. The growth in this market is linked to the legalization of low-dose CBD products by the Therapeutic Goods Administration (TGA). Despite this legalization, these products are still pending approval by the Australian Register of Therapeutic Goods (ARTG)

- Key players operating in the market are focusing on technologically advanced devices that offer users comfort. New product development and strategic alliances, including partnership agreements, promotional activities, and acquisitions, keep market rivalry high

Australia Medical Cannabis Market Segmentation

Grand View Research has segmented the Australia medical cannabis market based on sources, derivatives, and application:

Australia Medical Cannabis Sources Outlook (Revenue, USD Million, 2018 - 2030)

- Hemp

- Hemp CBD Oil

- Industrial Hemp

- Marijuana

- Flower

- Oil And Tinctures

Australia Medical Cannabis Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

- CBD

- THC

- Others

Australia Medical Cannabis Application Outlook (Revenue, USD Million, 2018 - 2030)

- Cancer

- Chronic Pain

- Anxiety and Depression

- Arthritis

- Diabetes

- Glaucoma

- Migraines

- Epilepsy

- Multiple Sclerosis

- AIDS

- Amyotrophic Lateral Sclerosis

- Alzheimer's Disease

- Post-traumatic Stress Disorder (PTSD)

- Parkinson's Disease

- Tourette's Syndrome

- Others

Download your FREE sample PDF copy of the Australia Medical Cannabis Market today and explore key data and trends.

No comments:

Post a Comment