Automotive Adhesive Tapes Industry Overview

The global Automotive Adhesive Tapes Market was estimated at USD 3.62 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2030. A key driver for this market is the increasing replacement of traditional nut and bolt fasteners with adhesive tapes, aimed at reducing vehicle weight and enhancing aesthetic appeal. The market is also expected to see significant demand from aftermarket sales, largely due to the considerable increase in vehicle modifications and performance enhancements. Asian economies, including Japan, South Korea, China, and India, are anticipated to hold the majority of electric vehicle production shares in the coming years. This is supported by a robust manufacturing industry, readily available resources, skilled and low-cost labor, and the presence of prominent automakers in the region. Furthermore, technological advancements by major automobile manufacturers in Europe and North America are expected to provide additional momentum to the market.

Detailed Segmentation:

- Application Insights

The electronics application segment is also expected to witness a notable CAGR of 8.4% over the forecast period, due to the rising demand for tapes in automotive electronics such as light assemblies, air conditioning systems, electronic components, interior & exterior lights, battery connectors & wires, sensors, and several other electronic devices.

- Adhesive Chemistry Insights

Emulsion based adhesive tapes segment is also expected to witness the fastest growth at a CAGR of 8.3% on account of superior properties offered by the tapes such as chemical & heat resistance, and performance profile at low cost. These are water-based adhesives that are composed of EVA or acrylic synthetic resin polymers, and vinyl acetate in water, thus having low VOC contents.

- Backing Material Insights

The demand for polyvinylchloride as a backing material in automotive adhesive tapes is expected to grow at a fastest rate over the forecast period. Automotive adhesive tapes which use polyvinylchloride as a backing material are highly opted for several applications such as electronic components and insulation. Additionally, polypropylene also held significant revenue share in the market on account of its ability to offer superior strength coupled with resistance to heat, pressure, and moisture.

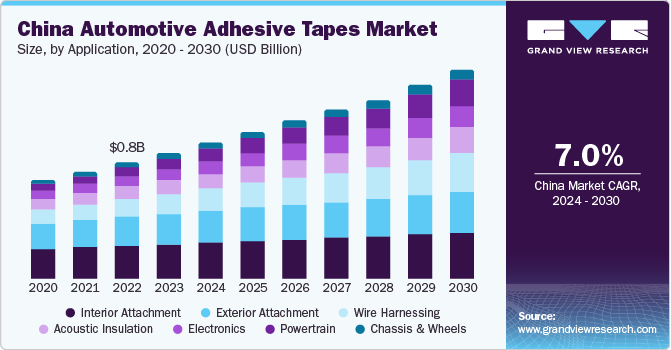

- Regional Insights

The North America automotive adhesive tapes market is expected to witness a notable CAGR of 4.2% from 2023 to 2030, owing to the presence of a robust manufacturing base in the U.S. coupled with the rapid growth of the automotive industry in Mexico is likely to augment the demand shortly.

Gather more insights about the market drivers, restraints, and growth of the Automotive Adhesive Tapes Market

Key Companies & Market Share Insights

The key players in the industry are investing in understanding the emerging subsegment application in automotive. In addition, they are also trying to understand the key specifiers and selection criteria for tapes for these new applications to gauge the expected market potential in the future and employ their growth strategies accordingly.

- In July 2023, Berry Global launched a next-gen version of its flagship Formifor insulation compression films by combining over 30% of recycled materials. The use of recycled content in the film is projected to contribute toward sustainability efforts in automotive manufacturing.

- In April 2023, Berry Global Group, Inc. commenced the expansion of one of its significant manufacturing facilities for stretch films in Lewisburg, Tennessee. The facility is planned to be completed by early 2024 and it will support the proliferating demand for the company’s sustainable, highest-performing stretch films, which also include adhesive tapes for diverse industries.

- In February 2023, L&L Products, Inc., announced its plans to expand its production footmark in the Village of Romeo, Michigan for accommodating the automobile industry’s finished goods. The project is anticipated to confirm the continued business growth of the company in Michigan.

Key Automotive Adhesive Tapes Companies:

The following are the leading companies in the automotive adhesive tapes market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these automotive adhesive tapes companies are analyzed to map the supply network.

- L&L Products, Inc.

- Sika Automotive AG

- The 3M Company

- Nitto Denko Corporation

- Lida Industry Co, Ltd.

- ThreeBond Co., Ltd.

- PPG Industries

- ABI Tape Products

- Adchem Corporation

- Avery Dennison Corporation

- Saint Gobain

- Berry Plastics

- tesa SE

- Lintec Corporation

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment