Metalworking Fluids Industry Overview

The global Metalworking Fluids Market reached an estimated $12.17 billion in 2023 and is projected to expand at an annual rate of 4.9% between 2024 and 2030. This growth in product demand is primarily fueled by the increasing needs of the automotive and heavy industry machinery sectors. Key end-use industries, including machinery, metal fabrication, and transportation equipment, are significant contributors to the Metalworking Fluids (MWFs) market's expansion.

Crude oil serves as the fundamental raw material for these products. Through refining, treatment, and blending processes, crude oil is transformed into essential MWF types such as neat cutting oils, soluble oils, and corrosion-preventive oils. Base oil, a derivative of crude oil, constitutes a substantial portion of the total MWF cost, accounting for roughly 40%.

Detailed Segmentation:

- Product Insights

The mineral segment held the largest share of over 48.06% in 2023. The high share has been attributed to the consumption of mineral-based oils owing to their low cost. Due to price-conscious consumers, small- and medium-scale manufacturers typically use mineral oil-based MWFs. Over the forecast period, this is expected to impact the market growth. Mineral-based fluids are also used in machining processes, such as turning, grinding, broaching, drilling, and milling. Synthetic MWFs are anticipated to witness the fastest CAGR over the forecast period.

- End-use Insights

The transportation equipment segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. The growth is attributed to the high product demand for transportation equipment along with the development of infrastructure. Metalworking fluids are used in operations where heat dissipation is critical for effective machining and producing high-quality products. They are found in various transportation equipment, including high-performance railway engines, ships, and planes. The main areas where these oils are employed to improve engine performance are Maintenance, Repair, & Overhauling (MRO).

- Industrial End-use Insights

The automobile industry is anticipated to witness the fastest CAGR over the forecast period owing to a rising spending capacity on luxurious cars globally. Different metals, such as steel, aluminum, and others, need the machine shop to use particular metalworking processes to increase productivity and optimize cost. The machine shops need different MWFs during various product processing operations, which is expected to fuel the segment growth during the forecast period. Increasing awareness about using advanced equipment in farming for enhanced productivity will support the demand for agricultural equipment and tools, thereby boosting the demand for MWFs. Low per capita land holding is a primary reason leading to the high demand for and rapid modernization of farm machinery, which, in turn, will drive the segment.

- Application Insights

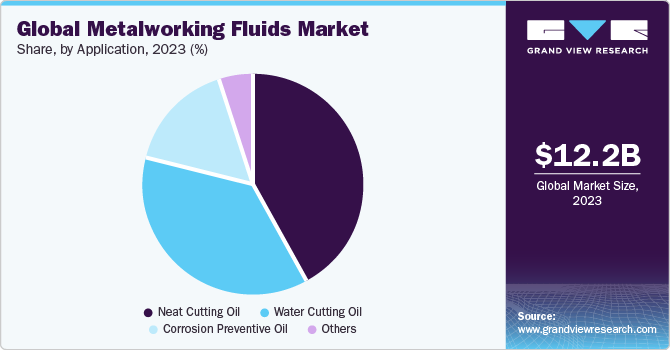

The neat-cutting oil segment accounted for the largest share of more than 42.0% of the global revenue in 2023. The growth is attributed to increased demand from the automobile, aerospace, marine, and construction sectors. They are utilized in a wide range of machining processes, as well as in a variety of cutting operations. Because of their capacity to supply cost-effective solutions, they have significant demand from the high-volume manufacturing industry in Asia Pacific’s emerging economies. The use of high-alloy steels in the heavy equipment manufacturing sector is also likely to drive the demand for neat-cutting oils over the forecast period. The water-cutting oil segment accounted for the second-largest market share in 2023.

- Regional Insights

Asia Pacific Metalworking Fluids market: Asia Pacific dominated the market and held a revenue share of over 42.0% in 2023. The regional market is estimated to expand further at the fastest CAGR from 2024 to 2030. The high product demand is attributed to a rise in manufacturing units in the Asia Pacific region. China and India, in particular, are projected to dominate the demand for mineral and synthetic MWFs. The market for synthetic MWFs is expected to grow in this region.This is due to the increased requirement for superior lubrication performance in automotive grinding and machining operations.

Gather more insights about the market drivers, restraints, and growth of the Metalworking Fluids Market

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

- On January 2023, Univar Solutions B.V. entered a distribution agreement with Graphics Services Ltd. for their products such as inks, rust preventive oils, coatings, lubricants, and metalworking fluids in Europe.

- On September 2022, Clariant announced the extension of support for metalworking fluid manufacturers globally by offering their additives to develop high lubricity and fully-synthetic metalworking fluids.

Key Metalworking Fluid Companies:

- Houghton International, Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment