Aquafeed Industry Overview

The global Aquafeed Market was valued at USD 72.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. The demand for aquafeed is expected to be driven by its increasing use in the farming of various aquatic species, including tilapia, carp, catfish, and salmon. The global market is characterized by a high degree of fragmentation due to the presence of numerous companies, such as BioMar Group, Cargill, Inc., and Charoen Pokphand Foods PCL. These key players are actively pursuing mergers and acquisitions, partnerships, portfolio expansions, and collaborations to enhance their position within the value chain. For instance, Cargill recently introduced a new plant-based aquafeed line called “Ewos Naturligvis” in Norway. This product is formulated with sustainable ingredients like wheat, soy, and corn and is designed to provide optimal nutrition for fish while minimizing environmental impact.

The industry is anticipated to experience robust growth due to the increasing prevalence of fish farming activities. A growing preference for natural and organic feed products among manufacturers has emerged as a significant trend in the industry. This shift is expected to further propel the market for plant-based aquafeed in the coming years. These aquafeed products are produced using both conventional and advanced technology-driven methods.

Detailed Segmentation:

- Form Insights

The dry form type segment dominated the global industry in 2022 and accounted for the maximum share of more than 42.70% of the overall revenue. This is attributed to its ability to increase the feed conversion ratio of fish. The segment is estimated to expand further at the fastest growth rate maintaining its leading position throughout the forecast period as the dry form feed is highly palatable. Wet feeds are also a commonly used form of aquafeed products. It contains moisture levels in the range of 45%-70%.

- Additive Insights

The amino acids segment dominated the industry in 2022 and accounted for the maximum share of more than 32.80% of the overall revenue. This high share is attributed to its advantages, such as enhancing immunity, increasing larval performance, optimizing the efficiency of metabolic transformation in fish, increasing tolerance to environmental stresses, mediating efficiency and timing of spawning, and improving fillet taste and texture when added in aquafeed. In addition to amino acids, antibiotics are also widely used additives in aquafeed. They promote better growth by improving overall health and are used to maximize productivity and efficiency.

- Feed Insights

The grower feed segment dominated the industry in 2022 and accounted for the maximum share of more than 34.25% of the overall revenue. Its high share is attributed to its rising usage in animals, which are between the age group of 6 to 20 weeks, to fulfill their dietary requirements. This type of feed is given to the animal until they are ready to start reproducing and laying eggs. Switching from starter to grower feed is necessary as excessive protein content may cause long-term liver or kidney issues. In addition, finisher feeds are also used widely after grower feeds. Finisher feeds are usually given to adult fish/animals that are more than 20 weeks old.

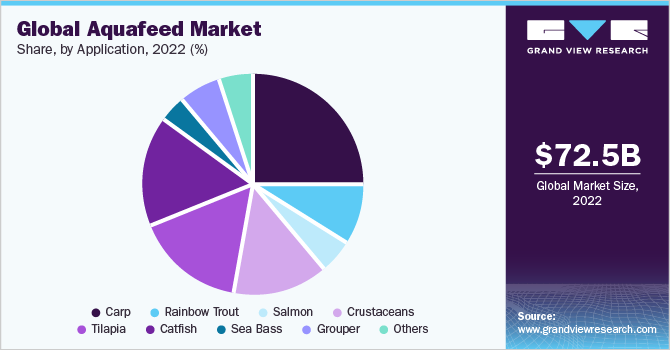

- Application Insights

The carp application segment dominated the global industry in 2022 and accounted for the maximum share of more than 25.00% of the overall revenue. The high share of this segment is attributed to the rising consumption of this species as it promotes overall health, boosts immunity, improves heart health, lowers the risk of chronic diseases, and protects gastrointestinal functions. Catfish, being a sustainable fish species, is farmed in freshwater ponds using rice, corn, and soybean as aquafeed. It is the preferred group of farmed aquaculture species due to its ease of farming in less-than-ideal climatic conditions.

- Regional Insights

The Asia Pacific region dominated the global industry in 2022 and accounted for the largest share of more than 44.10% of the overall revenue. The regional market is estimated to expand further at the fastest growth rate maintaining its dominant position throughout the forecast period. This is attributed to the substantial growth of the regional aquaculture sector. In addition, the availability of cheap labor, inducing conditions to promote the growth of aquaculture, and the presence of natural resources in the region will boost the growth.

Gather more insights about the market drivers, restraints, and growth of the Aquafeed Market

Key Companies & Market Share Insights

The competition in the global industry is highly dependent on the product portfolio, geographical location, and the number of sellers. The aquafeed producers are engaged in constant R&D activities to develop numerous natural and organic aquafeed to be used in the cultivation of various species. For example, BioMar has developed a range of plant-based aquafeed products that are made from sustainable raw materials, such as peas and canola. These feed manufacturers are working on improving their product portfolios as well as undertaking several activities including the production of poultry products, farming, feeding, and marketing to cut down their operational costs and to produce feed with higher nutritional value. Some of the prominent players in the global aquafeed market include:

- Cargill, Inc.

- BioMar Group

- Ridley Corp. Ltd.

- Aller Aqua

- BENEO

- Alltech

- Aker Biomarine

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment