Infection Control Industry Overview

The global Infection Control Market reached a valuation of USD 214.0 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. A primary catalyst for this market expansion is the escalating volume of surgical and clinical procedures, which inherently necessitate robust infection prevention measures. This preference for infection control is likely due to the demonstrable positive clinical outcomes associated with its implementation. Furthermore, the COVID-19 pandemic significantly boosted market growth, leading to a surge in demand for sterilization and disinfection solutions across hospitals, clinics, pharmaceutical companies, and medical device manufacturers.

The potential for continued growth in infection control products is evident; for example, CNBC reported a 60% increase in sanitizer product manufacturing in the U.S. alone during the pandemic. The market is also benefiting from a rise in outsourced sterilization services and the introduction of innovative sterilizing solutions. A crucial driver of growth is the growing number of government initiatives aimed at ensuring highly effective infection prevention. Governmental bodies are increasingly publishing guidelines to enhance global awareness and promote efficient prevention strategies, a trend expected to bolster market growth throughout the forecast period. As a notable example, the World Health Organization (WHO) has issued comprehensive guidelines for preventing and controlling pandemic- and epidemic-prone acute respiratory diseases within healthcare settings, covering everything from standard precautions like hand hygiene and the use of personal protective equipment to detailed recommendations for disinfection and sterilization.

Detailed Segmentation:

- Type Insights

Based on type, the services segment is expected to grow at the fastest CAGR during the forecast period. This fastest growth is attributed to the high inclination of market players to reduce overall healthcare expenditure and the utilization of benefits involved. It primarily includes cost advantages, increased efficiency of services, enhanced productivity, and a significantly higher focus on the core areas of development, which are critical to a company’s overall profit and growth. The organizations also strive to promote the adoption through issuing guidelines and recommendations for selection, risk assessment, rational usage, removal, and considerations to reduce the risk of transmission of respiratory pathogens to healthcare workers and other medical staff within a healthcare facility. Further, services are segmented into contract sterilization and infectious waste disposal. The contract sterilization segment is again classified into ethylene oxide sterilization, e-beam sterilization, gamma sterilization, and others.

- End-use Insights

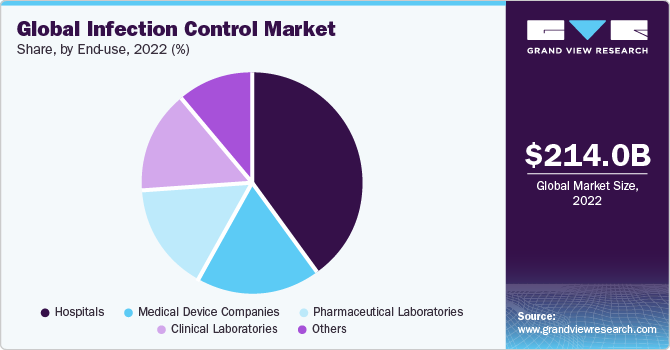

Based on end use, the global infection control market is segmented into medical device companies, hospitals, pharmaceutical companies, clinical laboratories, and others. The hospital segment dominated the market for infection control and accounted for the largest revenue share of around 40% in 2022 and is also expected to grow at the fastest CAGR of 7.4% over the forecast period from 2023 to 2030. The considerable share is majorly a result of the high probability of getting infected on hospital premises by transmitting blood-borne or respiratory pathogens. Hospital-acquired infections require rigorous control as it is one of the major challenges faced by the market. This has urged public health organizations and hospitals to adopt highly effective control systems. Also, as per research published in NCBI, 40% to 60% of hospital infections were estimated to be at surgical sites.

- Regional Insights

Asia Pacific is expected to expand at the fastest CAGR of 8.3% over the forecast period from 2023 to 2030, owing to the growing number of outsourcing organizations, growing expenditure on healthcare, and evolving healthcare standards and infrastructure unprecedently across this region. Government organizations are focusing more on improving infection control standards as it is also one of the important factors contributing to the growth of the Asia Pacific region. The increasing trend of outsourcing by established market players in developed economies to companies in the Asia Pacific region also serves as a key growth impelling factor for the market. For instance, the Asia Pacific Society of Infection Control (APSIC) is a voluntary organization working to establish collaborative partnerships to facilitate quality improvement and conduct infection control research to promote cost-efficient practices throughout the Asia Pacific region.

Gather more insights about the market drivers, restraints, and growth of the Infection Control Market

Key Companies & Market Share Insights

The competition is marked by the extensive implementation of collaborative strategies by major companies such as Advanced Sterilization Products, STERUS Corporation, and Cantel Medical Corporation, which accounts for their dominant market share. These players are highly focused on adopting competitive strategies such as mergers and acquisitions, new product development initiatives, and geographical expansion. For instance, in September 2020, Midmark Corp., a leading company providing dental solutions, announced the launch of the Sterilizer Data Logger and M3 Steam Sterilizer, which will bring speed, compliance, and simplicity to the processing of instruments.

Moreover, in November 2020, Applicon Biotechnology, a part of Getinge, announced the launch of AppliFlex ST, a customizable single-use bioreactor that optimizes processes and reduces labor hours in the lab. Also, companies are entering into collaborative strategies to widen infection control capabilities. For instance, in January 2021, Steris announced the acquisition of Cantel Medical, a global provider of products preventing infection and providing services to dialysis, dental, endoscopy, and life sciences customers. Similarly, 3M launched a four-hour rapid readout biological indicator for vaporized hydrogen peroxide sterilization, designed to give results in 4 hours and monitored steam sterilization loads. The product was launched to expand the company’s product portfolio.

Key Infection Control Companies:

- 3M

- Belimed AG

- O&M Halyard or its affiliates.

- Getinge Group

- ASP

- MATACHANA

- Sterigenics U.S., LLC – A Sotera Health company

- MMM Group

- Cantel Medical Corp.

- STERIS plc.

- Midmark Corporation.

- Medivators Inc

- W&H

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment