U.S. Behavioral Health Care Software and Services Industry Overview

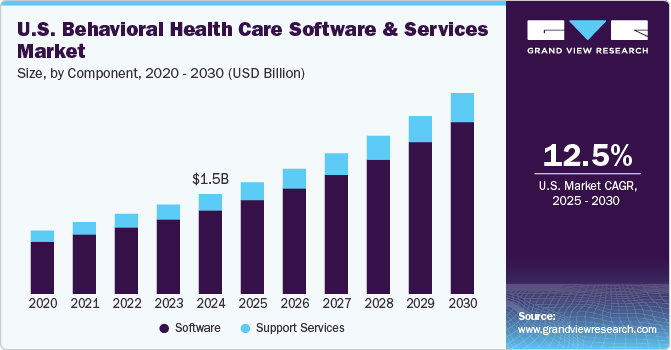

The U.S. Behavioral Healthcare Software and Services Market was valued at an estimated USD 1.49 billion in 2024. Projections indicate a compound annual growth rate (CAGR) of 12.5% from 2025 to 2030. This growth is being driven by the emergence of new technologies for behavioral health management, increasing public awareness surrounding substance abuse, and expanding reimbursement coverage.

The adoption of behavioral healthcare software by care providers is expected to significantly improve the management of mental health issues and treatment outcomes. For example, in April 2024, Talkspace, an online behavioral health company, launched its Behavioral Health Consortium. This network of specialty providers includes Ria Health, Charlie Health, and Bicycle Health, all focused on treating substance use, alcoholism, and eating disorders.

Detailed Segmentation:

- Delivery Model Insights

The subscription segment dominated the market with the largest revenue share in 2024 and is anticipated to register the fastest growth with a CAGR of 12.7% over the forecast period. Unlike larger hospitals, small-scale mental healthcare providers have limited financial resources to invest in technological solutions. Moreover, many of these practitioners are ineligible for incentives for meaningful use of EHRs due to the small size of their practices. Given the high upfront costs of such software, many small practices prefer subscription-based services as a more affordable alternative. For instance, Valant, a behavioral health care software provider, offers Behavioral Health EHR subscription-based software that provides mental health practices.

- Component Insights

The software segment dominated the market with the largest revenue share in 2024 and is anticipated to grow with the fastest CAGR of 12.9% over the forecast period. Behavioral health care software provides care providers to design and choose the optimal treatment plan for a person suffering from mental illnesses such as depression, stress, anxiety, substance abuse, and addiction. Moreover, it designs treatment plans based on clinical evidence and related patient records. Growing awareness regarding the benefits of behavioral health care software such as consumer engagement & mobile services, workflow management & appointment scheduling, care coordination, and claims & billing further fuels the market growth.

- Functional Insights

The administrative segment in the U.S. behavioral health care software and services market is anticipated to witness the fastest CAGR growth over the forecast period. The segment comprises patient scheduling, documentation management, case monitoring, employee management, and business intelligence. Large hospitals and clinics require centralized scheduling systems to view multiple providers in one place. InfoMC, a software company, provides solutions for managed behavioral health, offering efficient end-to-end administrative and clinical workflows.

- Disorder Insights

The substance abuse segment in the U.S. behavioral health care software and services market is anticipated to witness significant CAGR growth over the forecast period. Factors such as supportive government initiatives and growing investments in treating substance abuse fuel the market growth. For instance, the President's fiscal year (FY) 2025 Budget proposal allocates USD 8.1 billion to the Substance Abuse and Mental Health Services, continuing to promote the President's Unity Agenda to tackle the nation's ongoing mental health challenges.

- End-Use Insights

The payers segment in the U.S. behavioral health care software and services market is anticipated to witness the fastest CAGR growth over the forecast period. The reimbursement outlook for software for behavioral health is favorable in the U.S. Services covered under insurance include consultation fees, clinic visits, psychotherapy, medication management, and interactive audio & video sessions. Medicare offers coverage for telepsychiatric services. Approximately 39 states in the U.S. have enacted reimbursement policies for telehealth. Thus, such factors are anticipated to boost the segment growth.

Gather more insights about the market drivers, restraints, and growth of the U.S. Behavioral Health Care Software and Services Market

Key Companies & Market Share Insights

Key participants in the U.S. behavioral health care software and services market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. Behavioral Health Care Software and Services Companies:

- Oracle (Cerner Corporation)

- Core Solutions, Inc.

- Epic Systems Corporation.

- Meditab

- Holmusk

- Netsmart Technologies, Inc.

- Qualifacts

- Welligent

- SimplePractice, LLC

- TherapyNotes, LLC.

- TheraNest

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2024, the Center for Technology and Behavioral Health (CTBH) at the Geisel School of Medicine at Dartmouth collaborated with Boehringer Ingelheim to develop behavioral health care platforms to help providers and patients treat severe mental illness.

- In January 2024, the Centers for Medicare & Medicaid Services selected eight states to launch behavioral health models to treat substance use disorders and mental health conditions.

No comments:

Post a Comment