Veterinary Telehealth Industry Overview

The Veterinary Telehealth Market reached a valuation of USD 306.72 million in 2024 and is anticipated to expand at a compound annual growth rate (CAGR) of 20.33% between 2025 and 2030. This growth is fueled by a greater focus on veterinary telehealth and the early detection of animal illnesses, leading to increased adoption of various telehealth modalities such as teleconsultation, teleradiology, and telemonitoring. Key drivers further boosting the market include the growing integration of IoT and artificial intelligence by pet owners, alongside a rise in chronic and zoonotic diseases in animals.

The market's momentum is also strengthened by the increasing occurrence of conditions like diabetes, kidney issues, spinal disc problems, and hypertension in both companion and farm animals. Rising rates of pet obesity are contributing to ailments like osteoarthritis and joint disorders, thereby increasing the demand for more effective treatment solutions. For example, a survey published in May 2024 by the Association of Pet Obesity Prevalence (APOP) indicated that over 59% of dogs and 61% of cats in the U.S. were overweight or obese in 2022. The same 2022 survey also pointed out that while obesity can be life-threatening for pets, awareness of such conditions remains low among pet owners.

Detailed Segmentation:

- Type Insights

Teleradiology segment is anticipated to grow at the highest CAGR over the forecast period owing to the growing adoption of veterinary teleradiology in timely diagnosis of ailments. Furthermore, due to the growing need for prompt diagnosis and remote veterinary care, veterinarians can diagnose patients more quickly and accurately by using veterinary teleradiology, which enables remote analysis of images. As a result, the market is projected to maintain its upward trajectory, with a compelling a long-term outlook.

- Animal Type Insights

Feline segment is anticipated to grow at the highest CAGR of 21.16% over the forecast period. This can be owed to the fact that adoption of cats over dogs as pets is rising in regions with high telehealth adoption like Europe. Furthermore, growing prevalence of infectious diseases among cats is also one of the high impact-rendering drivers for segment growth. Other prevalent conditions in felines such as chronic kidney disease, hyperthyroidism, endocrine diseases, and diabetes have raised clinical urgency to adopt veterinary telehealth, acting as high-impact rendering drivers for segment growth.

- End Use Insights

Patients segment led the market in 2024 in terms of share and is anticipated to grow with the highest CAGR over the forecast period. Given that pet owners are the main users of telehealth services for their animals, this segment is anticipated to hold the largest market share over the forecast period as well. Pet owners are more likely to use telehealth services than veterinarians due to the need for quick and easy access to medical treatment as well as growing consumer awareness of these services. The veterinary telehealth market's emphasis on initiative-taking pet care, remote monitoring, and user-friendly apps and online platforms further emphasizes the importance of this technology for patients.

- Delivery Mode Insights

By delivery mode, cloud/app-based segment held the highest market share in 2024 and is estimated to grow with the highest CAGR over the forecast period. This delivery mode offers scalability, flexibility, and accessibility, allowing veterinary practices and animal owners to easily have remote access to the patient and the patient data, & also collaborate with other veterinarians and animals across locations. Moreover, this mode offers lower upfront costs, reduces IT burden, and automatic updates provided by cloud-based platforms appeal to veterinary professionals and animals owners seeking efficient and cost-effective solutions.

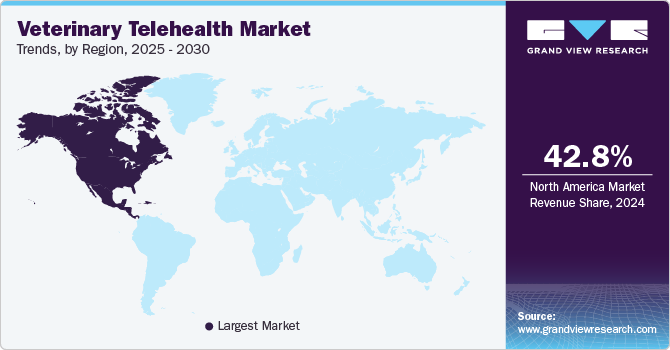

- Regional Insights

North America veterinary telehealth market held the largest share of 42.80% of the global market in 2024, The region is expected to experience record growth as a result of several factors, such as the rise in the number of pets, the prevalence of chronic illnesses, and the amount of money spent on pet insurance. Major market participants and a well-established healthcare infrastructure are other variables. The covered pet population in the United States increased by 28.3% in 2021 over 2020, according to the North American Pet Health Insurance Association (NAPHIA) Organization's 2022 report. Cat population growth of 37% and dog insurance growth of 26.5%, respectively, drove this increase. As per the same source, there was a 22.7% rise in the count of insured pets in Canada between 2020 and 2021.

Gather more insights about the market drivers, restraints, and growth of the Veterinary Telehealth Market

Key Companies & Market Share Insights

The industry is currently evolving at a rapid rate owing to increase in adoption and popularity of telehealth. Market players are collaborating with other veterinary industry players to present a unique product proposition to the customers as well as focusing on expanding into newer and untapped geographies across the globes. Government participation in the form of regulatory guidelines as well as product launches across the world is further helping in increasing the adoption of telehealth among the veterinary community.

Key Veterinary Telehealth Companies:

The following are the leading companies in the veterinary telehealth market. These companies collectively hold the largest market share and dictate industry trends.

- AirVet

- Vetlive

- GuardianVets

- PetCoach

- whiskerDocs Llc.

- Vetster

- TeleVet

- Pets at Home Group Plc

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In October 2024, Dial A Vet acquired SpeakToAVet.com to strengthen its market presence and provide affordable pet-health services across the world. This strategic move will lead to significant market expansion of the company in the telehealth sector.

- In August 2024, Vetster received “Pet App of the Year” award for the third consecutive year. This app is regarded as the fastest growing pet telehealth platform in recent times.

- In July 2024, Ontario-based Canadian telemedicine company, VetSon expanded their existing veterinary telehealth platform by adding novel animal care options to its existing platform.

No comments:

Post a Comment