U.S. Environment Health and Safety Market Growth & Trends

The U.S. Environment Health and Safety Market was estimated at USD 16.08 billion in 2023 and is projected to expand at a Compound Annual Growth Rate (CAGR) of 6.3% from 2024 to 2030. The U.S. commanded a significant 32.6% share of the global environment health & safety market. This growth trajectory is primarily driven by the stringent EHS standards imposed on companies, which necessitate substantial investment in EHS practices to avoid significant fines and penalties associated with non-compliance.

Regulatory Landscape and Key Players

Government agencies, including the U.S. Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and the U.S. Department of Labor, are responsible for establishing EHS norms and regulations. Companies like Trane Technologies exemplify a commitment to a safety-focused culture, striving for zero accidents and injuries across their organization.

Major market participants in the U.S. include Jacobs; AECOM; Enablon; Tetra Tech, Inc.; and VelocityEHS. These companies offer a broad spectrum of EHS software and services, encompassing ergonomics, engineering and construction, risk assessment, EHS software solutions, and management consulting and compliance.

Impact of Regulations and Public Awareness

Regulations play a pivotal role in shaping the U.S. environmental health & safety market. Government authorities such as OSHA, the EPA, and the Department of Justice (DOJ) mandate that organizations adhere to specific workforce safety and environmental regulations and standards, including the Toxics Release Inventory (TRI). These rigorous norms are anticipated to propel industry growth. Furthermore, rising public awareness regarding environmental issues has led to the development of environmental protection laws, which are expected to further drive market expansion. The high scrutiny and stringent regulations exert economic pressure on organizations to optimize their business processes and make them environmentally friendly. Consequently, management teams are compelled to deploy EHS software solutions in the workplace to reduce the occurrence of incidents.

Demand for EHS Services and Technological Integration

The escalating concern about the environmental footprint of business operations has significantly spurred demand for EHS services. Moreover, the advent and adoption of sophisticated EHS software solutions have streamlined the monitoring and management of EHS practices. Notably, 84% of companies utilizing EHS software have reported an ability to identify and fix potential safety issues before they occur. Beyond regulatory compliance, societal expectations for sustainable business operations have also fueled the EHS market's expansion. Growing consumer consciousness about companies' environmental practices often translates into greater support for those prioritizing EHS.

Curious about the U.S. Environment Health and Safety Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

U.S. Environment Health and Safety Market Report Highlights

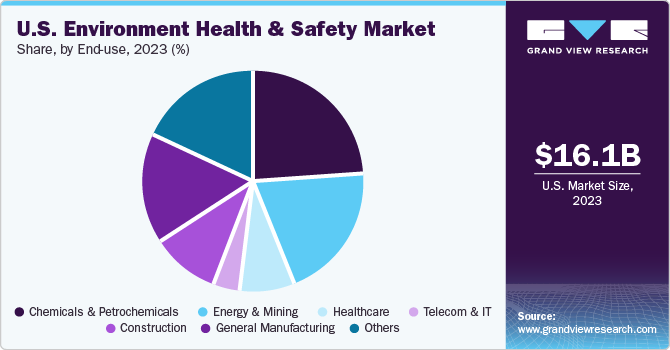

- Chemicals & petrochemicals segment dominated the U.S. market share in 2023. It is also expected to be the fastest growing from 2024 to 2030.

- The software product segment, while currently smaller in size, is projected to be the fastest-growing segment in the U.S. EHS market. It is expected to register a significant CAGR from 2024 to 2030.

- The on-premises deployment type dominated the U.S. market in 2023. This dominance can be attributed to the control, security, and customization that on-premises solutions offer.

U.S. Environment Health and Safety Market Segmentation

Grand View Research has segmented the U.S. Environment Health and Safety market based on product, deployment mode, end-use:

- U.S. Environment Health & Safety Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Services

- Analytics

- Project Deployment & Implementation

- Business Consulting & Advisory

- Audit, Assessment, & Regulatory Compliance

- Certification

- Others

- U.S. Environment Health & Safety Market Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-Premises

- U.S. Environment Health & Safety Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Chemicals & petrochemicals

- Energy & Mining

- Healthcare

- Telecom & IT

- Construction

- General Manufacturing

- Others

Download your FREE sample PDF copy of the U.S. Environment Health and Safety Market today and explore key data and trends.

No comments:

Post a Comment