Hard Kombucha Industry Overview

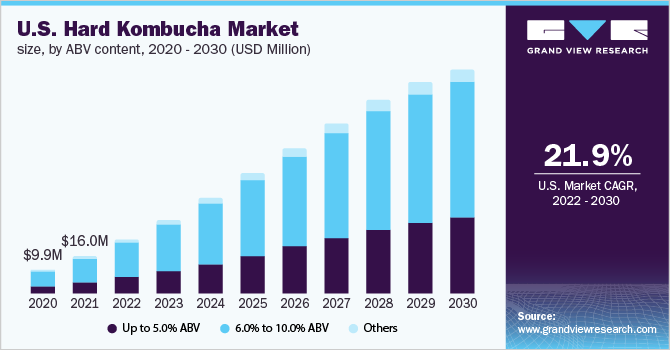

The Hard Kombucha Market was valued at USD 40.9 million in 2021 and is projected to experience substantial expansion, with a compound annual growth rate (CAGR) of 23.5% from 2022 to 2030. This growth is largely fueled by consumers, particularly millennials and the younger generation, increasingly opting for beverages with moderate alcohol content. A January 2020 article from PennState Extension highlighted this trend, noting that approximately 64% of millennials expressed a preference for new beverages like kombucha, in stark contrast to only 29% of baby boomers. Additionally, a broader shift towards reduced alcohol consumption and a rise in "sober-curious" individuals have further boosted the demand for low-alcohol alternatives.

The COVID-19 pandemic significantly altered alcoholic beverage consumption patterns, leading to a move away from high-alcohol options as health consciousness grew. During the pandemic, sales of hard kombucha surged, particularly via e-commerce channels, due to widespread stay-at-home mandates. For instance, in May 2020, Dubai-based Saba Kombucha saw a 30% increase in online orders, largely attributed to the limited availability of these beverages in traditional retail settings. This consumer pivot towards convenient, ready-to-drink options like kombucha is expected to align well with the market's continued growth in the coming years.

Detailed Segmentation:

- ABV Content Insights

The up to 5.0% ABV segment is projected to register the fastest CAGR during the forecast period owing to the rising consumer focus on overall health and wellness. Consumers of all ages are trying to limit the consumption of alcoholic beverages, which is expected to bode well for the segment’s growth. According to an article published by What’s Next Media & Analytics, in April 2021, 25% of consumers in the U.S. are drinking less, compared to only 22% who are drinking more. Over the last two years, there has been a significant increase in online discussions about low- and no-alcohol drinking and a noteworthy decrease in conversations about casual and heavy drinking occasions, which is expected to drive the segment growth.

- Distribution Channel Insights

The on-trade channel segment is anticipated to register the fastest growth rate during the forecast period. The on-trade category includes outlets, such as restaurants, bars, clubs, hotels, and lounges. The opening of the abovementioned outlets post-pandemic and the addition of a range of beverages including hard kombucha on the menu will boost the segment growth. For instance, in May 2022, Shorebirds, a new hard kombucha brewery and bar was launched in Rancho Cordova near Sacramento, California.

- Regional Insights

The Asia Pacific is estimated to be the fastest-growing regional market from 2022 to 2030. The growing awareness and product visibility among consumers of countries, such as China, Japan, and Australia, are expected to boost the market growth in this region. For instance, Zestea, a Chinese beverage brand offers hard kombucha in various flavors, such as peach pie, blueberry, strawberry, mint lime mojito, pumpkin spice, and apple cinnamon, and ginger pepper. Furthermore, the availability of a variety of flavors will further increase product penetration, thereby supporting regional market growth.

Gather more insights about the market drivers, restraints, and growth of the Hard Kombucha Market

Key Companies & Market Share Insights

The market is fragmented with the presence of many global and regional players. These players are engaging in major acquisition and promotional activities to increase their customer base and brand loyalty. For instance:

- In April 2022, Hooch Booch, a hard kombucha brand based out of Denver, Colo., was launched in Minnesota

- In June 2021, Sierra Nevada Brewery Co. expanded its line of “Strainge Beast” hard kombuchas, available in ginger, lemon, and hibiscus flavors

- In May 2021, North KC’s Brewery launched a new line of alcoholic kombucha, Lucky Booch, which is available in four flavors, namely peach blossom (4% ABV), lavender lemon (4% ABV), tart raspberry (7% ABV), and hops & passion (7% ABV)

Some of the prominent key players operating in the global hard kombucha market include:

- Remedy Drinks

- Jiant

- Flying Embers

- JuneShine

- Boochcraft

- Kyla

- Unity Vibration

- Dr Hops

- Ventura Brewing Company

- Allkind

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment