China Business Process Outsourcing Industry Overview

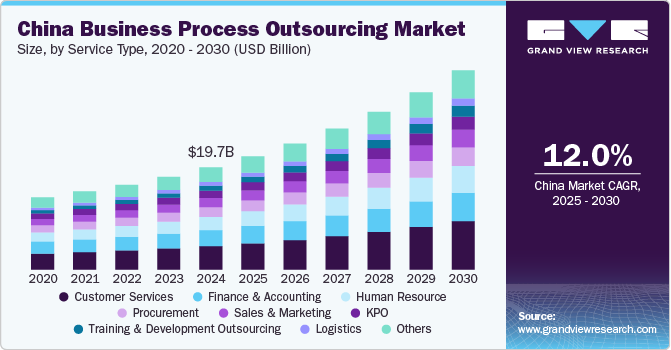

The China Business Process Outsourcing Market reached a valuation of $19.68 billion in 2024. Projections indicate a compound annual growth rate (CAGR) of 12.0% between 2025 and 2030 for this sector. The escalating adoption of digital transformation strategies by companies operating within China, both domestic and international, is a significant factor propelling the demand for business process outsourcing (BPO).

As organizations aim to optimize operational efficiency, decrease expenditures, and improve customer interactions, they are increasingly choosing to outsource non-essential business functions, including customer support, IT services, human resources, and finance and accounting. China's extensive and skilled workforce, coupled with relatively lower labor costs compared to Western markets, positions it as a compelling location for outsourcing activities.

Detailed Segmentation:

- Service Type Insights

The human resource segment is anticipated to grow at a significant CAGR over the forecast period. The rising demand for workforce management solutions in China is a major contributor to the growth of the HR BPO segment. Companies are increasingly turning to specialized HR outsourcing providers to manage tasks such as recruitment, employee training, performance evaluations, and retention strategies. This is especially prevalent in sectors experiencing rapid growth, such as technology, manufacturing, and e-commerce, where companies must efficiently scale their workforce.

- Outsourcing Type Insights

The onshore segment accounted for the largest market share of over 69.0% in 2024. The increasing complexity of regulatory requirements in China, particularly in sectors such as healthcare, finance, and telecommunications, has driven demand for onshore BPO services. As companies face more stringent regulations and compliance obligations, outsourcing specialized functions like legal processing, regulatory reporting, and compliance management to domestic BPO providers has become a practical solution.

- Deployment Insights

The on premise segment is anticipated to grow at a significant CAGR over the forecast period owing to the stringent regulatory landscape in China, particularly with the implementation of laws like the Cybersecurity Law and the Data Security Law. These regulations impose strict data localization requirements, mandating that companies store sensitive data, especially related to Chinese citizens, on servers within the country.

- Application Insights

The IT & telecommunications segment accounted for the largest market share of over 24.0% in 2024 as cloud computing and big data analytics are significantly shaping the IT outsourcing landscape in China’s BPO market. As telecom companies collect vast amounts of data from their users, they require advanced analytics and data management solutions to derive insights, improve service delivery, and enhance customer experiences. BPO providers in China have responded by offering cloud-based IT solutions and data analytics services that help telecom companies store, process, and manage this data more efficiently.

Gather more insights about the market drivers, restraints, and growth of the China Business Process Outsourcing Market

Key Companies & Market Share Insights

Key players operating in the China BPO market include Accenture, Amdocs Ltd., Capgemini SE, Wipro Ltd., and China Customer Relations Centers, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

- In August 2024, Accenture and S&P Global announced a strategic partnership to advance generative AI innovation within the financial services sector. This collaboration empowers customers and S&P Global’s workforce to adopt and effectively utilize generative AI at scale. To facilitate this, S&P Global plans to implement a comprehensive generative AI learning program for its employees, equipping them with the necessary skills to harness this transformative technology. The two companies are also working together to enhance AI development and benchmarking solutions tailored to the financial services industry.

- In January 2024, Amdocs unveiled its new End-to-End Service Orchestration (E2ESO) solution to improve operational efficiency and streamline business intent delivery. The E2ESO solution bridges desired business outcomes and the required network resources and configurations. The solution enhances interactions between service providers and their customers by simplifying network complexity and intelligently orchestrating various actions, ensuring successful outcomes throughout the complete lifecycle in various network conditions.

Key China Business Process Outsourcing Companies:

- Accenture

- Amdocs

- Capgemini SE

- China Customer Relations Centers, Inc.

- China Data Group Co., Ltd.

- Chinasoft International Co., Ltd.

- Infosys Ltd.

- M&Y Global Services

- Northking Information Technology Co., Ltd.

- Wipro Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment