Swine Vaccines Industry Overview

The global Swine Vaccines Market was estimated at USD 1.75 billion in 2024 and is predicted to expand at a CAGR of 5.51% from 2025 to 2030. This growth is primarily driven by increasing concerns about food security due to rising disease outbreaks and zoonoses, alongside the widespread adoption of antibiotic-free disease prevention methods. Highly contagious diseases like porcine reproductive and respiratory syndrome (PRRS) and swine influenza continue to be prevalent in Asian, European, and American pig herds, causing significant economic losses. Consequently, swine producers are extensively implementing biosecurity measures and vaccination programs to mitigate these impacts.

Detailed Segmentation:

- Product Insights

The Inactivated (Killed) segment led the market with the largest revenue share of 52.03% in 2024. This is attributed to its easy availability, low cost, and stability advantages over live-attenuated vaccines. They minimize the risk of virulence reversion after vaccination, as it prevents the replication process of pathogens. Moreover, it offers pigs better immunization with a rapid cell-mediated immune response. Immunity obtained from Inactivated (Killed) can be further enhanced with adjuvants such as certain types of oils or aluminum hydroxide. However, considerable care must be taken while preparing, storing, and handling Inactivated (Killed) for effective results.

- Disease Type Insights

The FMD segment is anticipated to witness at the fastest CAGR of 6.24% over the forecast period. The rising emphasis on FMD prevention, particularly in pig farming areas, is expected to drive the fastest growth. For instance, the launch of the 4th round of the FMD Vaccination Mission in Nagaland is a significant step toward controlling and eradicating FMD in India, particularly among pig, which are highly susceptible to the virus. With the government’s goal to eradicate FMD by 2030 under the National Animal Disease Control Programme (NADCP), the demand for FMD vaccines in the pig sector is poised to grow rapidly.

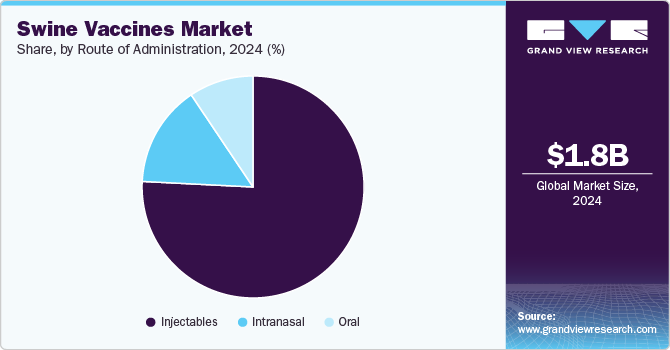

- Route of Administration Insights

Based on route of administration, the injectable segment led the market with the largest revenue share of 75.79% in 2024, due to its efficiency and effectiveness in providing long-lasting protection against major diseases in pigs. Injectable vaccines, such as those targeting PCV2, Mycoplasma hyopneumoniae, and other common pathogens, offer a convenient and reliable solution for farmers to ensure the health and productivity of their herds. These vaccines typically require fewer doses, often providing extended protection with a single injection, which is both time-efficient and cost-effective for large-scale operations. As the industry focuses on improving disease management and biosecurity, the injectable segment is expected to continue driving growth, catering to the growing demand for effective disease prevention in pig farming.

- Distribution Channel Insights

The e-commerce segment is projected to grow at the fastest CAGR over the forecast period. This expansion is driven by the increasing adoption of digital platforms by veterinarians and pig producers, seeking convenient access to a broader range of vaccine products. The rise of e-commerce and D2C channels in the pig circovirus vaccine is reshaping traditional distribution models. This shift is expected to enhance market reach and operational efficiency, contributing to the overall market growth.

- Regional Insights

North America dominated the swine vaccines market with the largest revenue share of 38.46% in 2024. This is attributed to the region's advanced veterinary healthcare infrastructure and the launch of innovative combination vaccines. For instance, in June 2023, Boehringer Ingelheim Animal Health Canada Inc. introduced a unique vaccine that protects pigs against PCV2 and PRRSv in a single dose. This advancement, enabled by a proprietary purification process, allows the seamless mixing of Ingelvac CircoFLEX with Ingelvac PRRS MLV without compromising efficacy. Such offerings address critical health challenges while enhancing operational efficiency, thus driving market growth in the region.

Gather more insights about the market drivers, restraints, and growth of the Swine Vaccines Market

Key Companies & Market Share Insights

The market is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market shares. Owing to constant research initiatives, this industry can be seen as moderate to high in innovation.

Key Swine Vaccines Companies:

The following are the leading companies in the swine vaccines market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- Ceva

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Indian Immunologicals Ltd.

- BiogénesisBagó

- Phibro Animal Health

- KM Biologics

- HIPRA

- Virbac

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In September 2024, Merck & Co., Inc. received marketing authorization from the EMA for PORCILIS PCV M Hyo ID, an intradermal vaccine used in swine. Such milestones support total pig health and contribute to market growth.

- In July 2024, South Africa took a groundbreaking step in combating African Swine Fever (ASF) with the FDA and DA BAI announcing the approval of the country's first ASF vaccine, aiming to stabilize the pork industry and protect the meat supply chain.

No comments:

Post a Comment