U.S. Independent Diagnostic Testing Facility Industry Overview

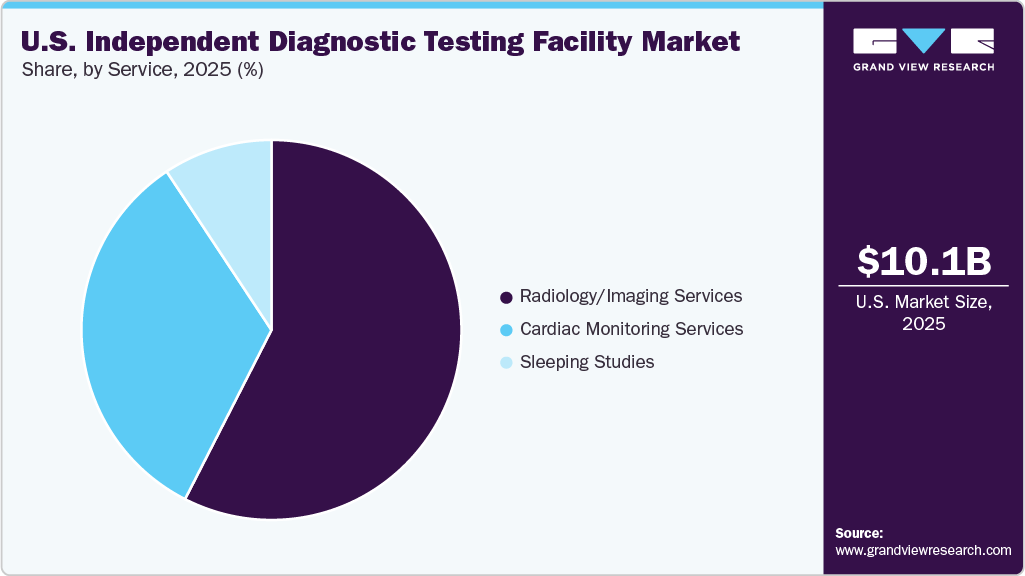

The U.S. Independent Diagnostic Testing Facility Market reached a valuation of USD 3.4 billion in 2022 and is projected to experience a compound annual growth rate (CAGR) of 4.52% from 2023 to 2030. Key factors driving this market expansion include the increasing demand for diagnostic tests, the expanding geriatric population, and the rising prevalence of chronic diseases. For instance, data from the U.S. Census Bureau indicates that in mid-2019, approximately 54 million Americans were aged 65 or older, a demographic projected to grow to over 83 million by 2040.

There's a growing trend towards using noninvasive diagnostic testing, such as voluntary full-body scans, as a screening method for preventive care. Increased patient awareness regarding noninvasive diagnostic options (like X-rays and CT scans) as both preventive and less invasive screening tools has fueled the growth in diagnostic imaging practices. Furthermore, technological advancements enabling the early diagnosis of disorders and diseases through less invasive techniques are expected to further boost the demand for diagnostic imaging services.

Detailed Segmentation:

- Service Insights

The sleep studies segment is expected to witness lower-digit growth during the forecast period. This can be attributed to the less stringent regulations of hospital-based sleep centers and physician-run sleep centers. These services are not limited by stringent regulations and accreditation guidelines such as the Association of Sleep Disorders Centers, the American Academy of Sleep Medicine (AASM), The Joint Commission, and IDTFs.

Moreover, with the growing sleep issues among the population, the demand for sleep studies is rising. According to the CDC statistics, around 32.8% of adults reported short sleep in 2020. Men were the most prevalent population with short sleep duration accounting for around 33.4% of the total men. Lack of sleep leads to various acute health issues which could lead to higher costs of treatments. As per the analysis of Rand Quarterly estimates, in 2020, the projected cost of treating sleep issues in the U.S. was around USD 299 billion to USD 433 billion.

Gather more insights about the market drivers, restraints, and growth of the U.S. Independent Diagnostic Testing Facility Market

Key Companies & Market Share Insights

The U.S. IDTF market is highly fragmented, and many players are entering the market. Market players are undertaking strategic initiatives to address the increasing demand for imaging services. Key players are acquiring small-sized players to diversify their service offerings and expand their regional footprint. Thus, there is significant competition among market players. For instance, in April 2021, Somology, Inc. launched an independent diagnostic testing facility to cater to the growing demand for sleep studies. Some prominent players in the U.S. independent diagnostic testing facility market include:

- RadNet, Inc.

- Vitalistics

- Breathe

- Texas MRI

- The Brookwood Diagnostic Center

- ACS Diagnostics, Inc.

- Houston MRI & Diagnostic Imaging

- TestSmarter Inc.

- Duke University and Duke University Health System

- Covenant Health Diagnostics

- AliveCor, Inc.

- Advanced Cardio Services

- Diagnostic Medical Testing Inc.

- K & T Diagnostic, Inc.

- Vestavia Diagnostic Center (VDC)

- Advanced Imaging Center

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment