Vendor Risk Management Industry Overview

The global Vendor Risk Management Market was valued at USD 10.67 billion in 2024 and is projected to expand at a CAGR of 15.2% from 2025 to 2030. This expansion is primarily driven by the growing dependence on third-party vendors across various sectors. As organizations increasingly outsource crucial operations to external suppliers, they expose themselves to inherent risks, including data breaches, regulatory non-compliance, and damage to their reputation. Consequently, the demand for comprehensive VRM solutions to effectively assess, monitor, and mitigate these risks has become indispensable.

The escalating prevalence of cyber threats and data breaches has intensified the focus on vendor cybersecurity. Companies are now heavily investing in VRM tools to meticulously evaluate the security postures of their vendors, thereby ensuring the protection of sensitive data across the entire supply chain. Notably, cloud-based VRM platforms are gaining significant momentum, attributed to their inherent scalability, cost-effectiveness, and real-time monitoring functionalities. According to Verizon's "2024 Data Breach Investigations Report," a U.S.-based telecommunication company, there was a substantial 180% increase in the exploitation of vulnerabilities to initiate data breaches in 2023 compared to 2022. Among these breaches, a notable 15% were directly linked to third parties or suppliers, encompassing elements such as software supply chains, hosting partners, or data custodians.

Detailed Segmentation:

- Solution Insights

The compliance management segment is expected to grow to a significant CAGR of 16.7% over the forecast period. VRM compliance management solutions are increasingly being integrated into broader Enterprise Risk Management (ERM) frameworks. This integration ensures that compliance is managed in tandem with other risk factors and provides a more comprehensive view of the risks posed by vendors. By integrating these systems, businesses can identify compliance risks earlier, reduce the likelihood of costly compliance violations, and improve overall risk mitigation efforts.

- Deployment Insights

The cloud segment is expected to grow at a significant CAGR over the forecast period. The global shift towards digital transformation is a primary driver of the growing need for VRM solutions in the cloud segment. As organizations across industries such as finance, healthcare, retail, and manufacturing adopt cloud-based platforms and Software-as-a-Service (SaaS) solutions, they become increasingly dependent on third-party cloud service providers.

- Enterprise Size Insights

The small & medium enterprises segment accounted for a largest revenue share of over 68.0% in 2024. With the advent of more affordable VRM tools and solutions tailored for SMEs, organizations are increasingly able to manage their vendor-related risks without straining their budgets. Many VRM vendors now offer cloud-based and SaaS solutions that are scalable and cost-effective for smaller organizations.

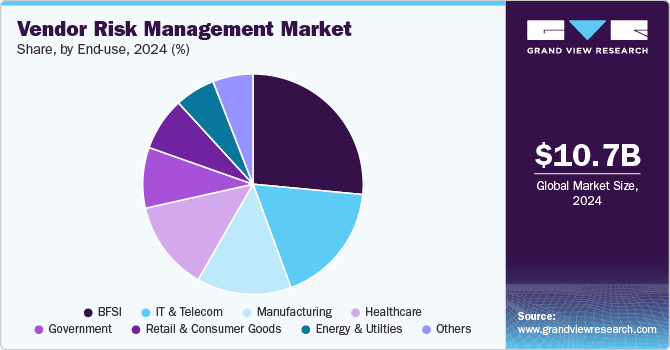

- End-use Insights

The BFSI segment accounted for a largest revenue share of over 26.0% in 2024. Digital transformation initiatives are driving growth in the VRM market for the BFSI segment. The adoption of technologies like AI, blockchain, and IoT increases the complexity of vendor ecosystems, necessitating sophisticated VRM systems. These tools leverage analytics and machine learning to assess risks proactively and streamline vendor lifecycle management.

- Regional Insights

The vendor risk management market in North America held a largest share of nearly 59.0% in 2024. The digital transformation and adoption of cloud technologies are also fueling VRM market growth in North America. As businesses migrate to cloud-based environments, they are more reliant on third-party service providers, raising concerns about data privacy, uptime, and service reliability. Cloud-based VRM platforms offer organizations scalability, cost-efficiency, and real-time monitoring capabilities, which are essential for managing and mitigating risks associated with cloud vendors.

Gather more insights about the market drivers, restraints, and growth of the Vendor Risk Management Market

Key Companies & Market Share Insights

Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Vendor Risk Management Companies:

The following are the leading companies in the vendor risk management market. These companies collectively hold the largest market share and dictate industry trends.

- BitSight Technologies

- Genpact

- LogicGate

- MetricStream, Inc.

- NAVEX Global, Inc.

- Prevalent, Inc.

- ProcessUnity

- Quantivate, LLC

- SAI Global

- ServiceNow

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment