U.S. Agricultural Tractor Market Growth & Trends

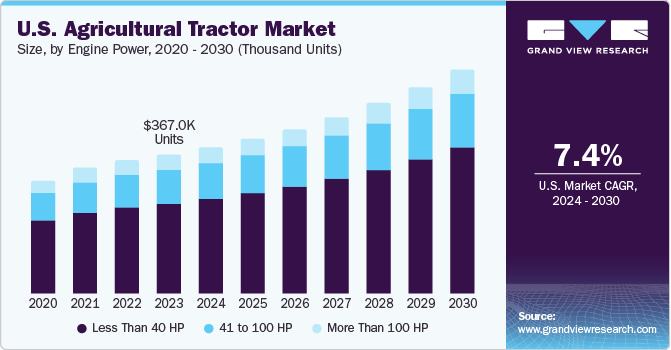

The U.S. Agricultural Tractor Market reached 367.04 thousand units in 2023 and is projected to expand at a Compound Annual Growth Rate (CAGR) of 7.4% from 2024 to 2030. In 2023, the U.S. market constituted a significant 11.8% share of the global agricultural tractors market. This growth is primarily driven by the increasing mechanization within the farm industry, which has boosted the demand for versatile compact tractors that can be customized to specific customer needs. Furthermore, technological advancements, including the integration of telematics and automation into agricultural tractors, are expected to further propel market expansion.

Factors Driving Market Growth

A critical factor contributing to the increased adoption of agricultural tractors is the shortage of skilled farm labor, which necessitates greater mechanization in farming operations. The overall productivity of farming is improving due to the rising integration of mechanization and other farming equipment. This rapid adoption is further enhanced by the technological advancements offered by AI, Big Data, and Machine Learning (ML). Agricultural tractors are an indispensable part of modern farming equipment, playing a vital role in mechanizing numerous farming activities and thereby significantly increasing agricultural productivity. This has directly led to a surge in demand for tractors, consequently fueling market growth.

Government Support and Cost Considerations

Given that farm equipment such as combines, tractors, and harvesters represent substantial investments, farmers often face challenges in acquiring them due to limited financing options. To address this, the government provides various monetary and non-monetary benefits to farmers, including subsidies for the purchase of seeds, fertilizers, and farm equipment. For instance, the U.S. Farm Service Agency (FSA) offers guaranteed and direct farm ownership and operating loans to family-size farmers who may not qualify for commercial credit from traditional lenders. These FSA loans can also be utilized for purchasing livestock, equipment, land, feed, seed, and supplies.

Despite these supportive measures, farm power, equipment, and machinery constitute significant agricultural costs. The introduction of larger machines, technological advancements, increased costs of parts and new machinery, and a substantial rise in energy prices over the years have all contributed to an escalation in power and machinery costs in recent years. Moreover, the use of tractors inherently involves timely repair and maintenance expenses due to routine wear and tear, along with additional costs stemming from accidents. Consequently, these high costs associated with agricultural tractors can act as a restraint on market growth.

Curious about the U.S. Agricultural Tractor Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

U.S. Agricultural Tractor Market Report Highlights

- The less than 40 HP segment held more than 64% of the market share in terms of volume in 2023. This large share is due to the low cost, compact size, and greater convenience offered by less than 40HP tractors to perform all basic farming operations.

- The 2WD segment held more than 80% market share in terms of volume in 2023. The segment is also anticipated to register the fastest CAGR from 2024 to 2030.

- Electric tractors offer high compatibility with evolving regulatory standards and present a cost-effective solution with lower maintenance requirements. This shift reflects the industry's commitment to sustainability and aligns with global efforts to reduce carbon emissions and promote greener technologies in the agricultural sector.

U.S. Agricultural Tractor Market Segmentation

Grand View Research has segmented the U.S. Agricultural Tractor market based on engine power, driveline, and propulsion:

- Engine Power Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- Less Than 40 HP

- 41 to 100 HP

- More Than 100 HP

- Driveline Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

- 2WD

- 4WD

- Propulsion Outlook (Volume, Thousand Units, Revenue, USD million 2017 – 2030)

- Electric

- ICE

Download your FREE sample PDF copy of the U.S. Agricultural Tractor Market today and explore key data and trends.

No comments:

Post a Comment