Industrial Air Filtration Industry Overview

The global Industrial Air Filtration Market, estimated at USD 6.09 billion in 2023, is expected to experience a 6.2% CAGR over the forecast period. This growth is attributable to factors such as rising industrial activities, increasing investments in manufacturing sectors, favorable regulations, and technological advancements in industrial air filtration. Moreover, the global demand for air filters is augmented by the development and introduction of more stringent regulations and standards for various end-use industries and commercial applications. Consequently, the increasing air pollution is leading to a rapid decline in indoor air quality in residential apartments in major metro cities, thus driving the need for air purifiers to maintain overall air quality for individuals.

Encompassing air, fluid (primarily water and beverage), and ICE filters, the global filter market serves diverse residential, commercial, and industrial purposes. The recently increased demand for filters with smart features and energy efficiency is a trend expected to continue. Particularly, HEPA filters, known for their superior capability to trap over 99% of particles between 0.3 and 1.0 microns, are in high demand. Regulatory measures, including government emissions standards and workplace safety regulations, are anticipated to further stimulate market growth. For instance, the U.S. Clean Air Act aims to control national air pollution, resulting in stricter industrial air filtration regulations due to increased industrial and manufacturing activities.

Detailed Segmentation:

- Product Insights

HEPA filters are expected to grow at a CAGR of 6.9% over the forecast period. HEPA filters extensively remove airborne particles, dust, and other contaminants in various industrial facilities. The use of HEPA filters can ensure highly efficient filtration systems with almost 99.5% capture of particulate pollution in the air. These filters effectively remove 99.97% of air pollutants with particle sizes of 0.3 to 1.0 microns.

- End Use Insights

The pharmaceutical segment is expected to grow at a CAGR of 7.0% over the forecast period driven by stringent regulatory requirements for air quality and contamination control in pharmaceutical manufacturing, necessitating implementing advanced filtration systems. In addition, the increasing demand for high-quality products and rising healthcare needs compel pharmaceutical companies to invest in effective air filtration solutions to maintain clean environments. Furthermore, advancements in filtration technologies, such as HEPA filters and fume extraction systems, enhance operational efficiency while ensuring compliance with safety standards, further propelling market growth.

- Distribution Channel Insights

The OEM segment is expected to grow at the fastest CAGR over the forecast period attributed to the increasing vehicle production, particularly in emerging markets, driving demand for high-quality air filters that enhance fuel efficiency and passenger comfort. OEMs prioritize premium products to meet stringent regulatory standards and consumer expectations. Furthermore, strategic partnerships between manufacturers and OEMs facilitate efficient supply chains, ensuring timely delivery of filtration solutions tailored to specific vehicle models, further boosting the OEM segment growth.

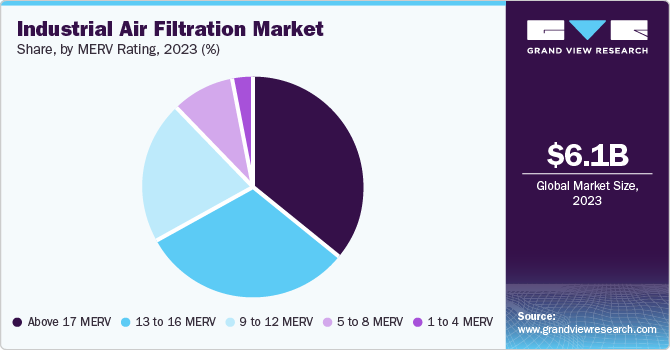

- MERV Rating Insights

9 to 12 MERV rating is expected to grow at a CAGR of 6.6% over the forecast period. These filters effectively capture a wide range of airborne particles, including pollen, mold spores, and dust, making them suitable for both residential and commercial applications. In addition, their moderate efficiency ensures improved indoor air quality without excessively restricting airflow, which is crucial for HVAC system performance. Furthermore, their affordability and availability make them attractive for facilities seeking a balance between cost and air quality enhancement, further fueling their demand.

- Regional Insights

Asia Pacific industrial air filtration market is expected to grow at a CAGR of 6.9% over the forecast period, owing to rapid industrialization and urbanization. Global population growth and the increasing need for various consumer goods and products put enormous pressure on the manufacturing industry to meet this demand. This, in turn, leads to strategies and initiatives to increase the industrial output and construct new industrial facilities. Asia Pacific is becoming a hub for the manufacturing sector due to favorable factors such as affordable and cheap labor, a short supply chain, and a lenient regulatory framework.

Gather more insights about the market drivers, restraints, and growth of the Industrial Air Filtration Market

Key Companies & Market Share Insights

Some key companies include MANN+HUMMEL, Donaldson Company Inc., Honeywell International Inc., and Daikin Industries, Ltd. Companies are focusing on launching new technology and expanding their extensive network. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

- Honeywell Building Technologies business segment offers products such as controls and displays for indoor air quality, cooling, heating, ventilation, combustion, humidification, lighting, switches, sensors, and control systems for energy management; advanced software applications for building optimization and control; remote patient monitoring systems; fire products and others; as well as services such as installation, upgrade, and management of systems.

- Daikin Industries, Ltd. manufactures air conditioning systems and chemical products. The company was formerly known as Daikin Kogyo Co., Ltd. and changed its name in 1982. The company operates through its major business segments: air conditioning, oil hydraulics, chemicals, and defense systems. Through its air conditioning segment, the company offers air conditioning systems, room heating and heat pump hot water supply systems, room air conditioning systems, air filters, industrial dust collectors, and air purifiers for plants, facilities, and office buildings.

Key Industrial Air Filtration Companies:

The following are the leading companies in the industrial air filtration market. These companies collectively hold the largest market share and dictate industry trends.

- MANN+HUMMEL

- Donaldson Company Inc.

- Honeywell International Inc.

- Daikin Industries, Ltd.

- Danaher

- SPX FLOW, Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In April 2024, MANN+HUMMEL established a new branch in Indonesia named "PT MANN AND HUMMEL Filtration Indonesia." This expansion enhances the company's worldwide footprint, reinforces its position in the crucial Asian market, and improves its sales and logistics operations in the area. The newly opened subsidiary is set to serve major regions, including Bali, Borneo, Java, Papua, Sulawesi, and Sumatra.

- In January 2023, K&N Engineering launched a new industrial group focused on providing sustainable air filtration solutions for data centers and various industrial applications. Committed to reducing the thousands of tons of air filter waste generated by data centers, the company aims to revolutionize the industry with its high-performance, washable, and reusable filters. CEO Randy Bays highlighted the environmental challenges posed by conventional filters and emphasized the importance of innovation in achieving sustainability.

No comments:

Post a Comment