Europe Mobility Aids Industry Overview

The Europe Mobility Aids Market was estimated at $3.1 billion in 2022 and is projected to expand at a CAGR of 3.1% from 2023 to 2030. This growth is primarily driven by several factors, including an expanding geriatric population that requires long-term care (LTC), an increasing prevalence of diseases that impair mobility, and the rising availability of technologically advanced products. Furthermore, the growing demand for home healthcare services and personnel is contributing to market expansion.

The introduction of new mobility aids by key market players is also expected to boost product availability and fuel market growth. For instance, in March 2023, Drive DeVilbiss Healthcare launched the UltraFold, an auto-folding scooter recognized as the lightest scooter (battery removed) in the mobility market.

Detailed Segmentation:

- Sector Insights

The private segment accounted for the largest revenue share of around 50.0% in 2022 and is expected to grow at the fastest CAGR of 3.3% over the forecast period. The private sector is characterized by the presence of a large number of privately held companies. These market players offer an array of innovative products and are actively involved in the launch of new products to outperform the market competition.

- Distribution Channels Insights

The online segment is expected to grow at the fastest CAGR of 3.4% over the forecast period. The major e-commerce sites offering mobility aids are Wayfair and Amazon. Amazon offers a wide range of products in the mobility aids section, which consists of products from various companies. The availability of a wide range of products coupled with offers and discounts makes these platforms lucrative for users to buy the products online. The manufacturers of mobility assistive devices have their own e-commerce distribution channels or online sales sites for these products. Many companies like Invacare, Sunrise Medicals, Meyra, and Rehasense provide wide options for assistive medical aid devices online with products ranging from manual wheelchairs to power wheelchairs, mobility scooters, and LTS beds.

- Type of Split Insights

The aged care segment is expected to grow at the fastest CAGR of 3.2% over the forecast period. The increasing geriatric population coupled with favorable government initiatives are the key factors driving the segment growth. The UK is one of the important economies in Europe and has projected that the elderly population in the UK will increase, accounting for 24% of the total population (17.4 million people) by 2043. The percentage of people 75 and older is anticipated to increase from 8% in 2018 to 13% in 2043, while the percentage of people 85 and older is anticipated to increase from 2% to 4%. Approximately 20,000 new cases of rheumatoid arthritis are diagnosed in the UK annually, eventually increasing the demand for rehabilitation equipment.

- Product Insights

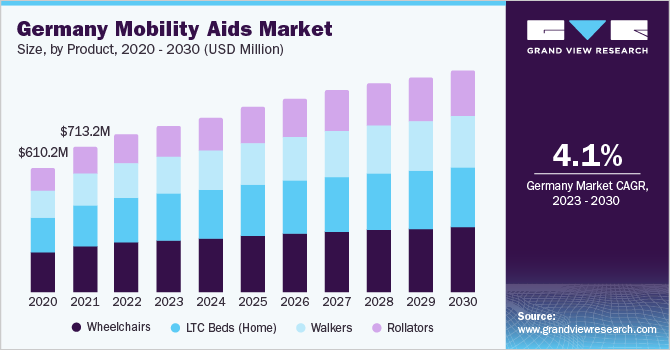

The rollators segment is expected to grow at the fastest CAGR of 4.1% during the forecast period. This is due to various technological advancements, which have led to the availability of rollators with adjustable handle heights that enable the most comfortable and correct walking postures for patients, thereby increasing their adoption. In October 2020, HUMAN CARE, launched the neXus 3, which has the world’s first-ever cross-folding frame, to enhance the mobility of the user. Other prominent players in the rollators market are TOPRO and Eurovema AB.

- Regional Insights

The Europe regional market has been segmented into Germany, the UK, Italy, France, Spain, Switzerland, and Poland. According to the Economist Intelligence Unit, in 2019 osteoarthritis (OA) affected about 57 million persons in Western Europe, resulting in the loss of almost 2 million years of healthy life. Germany dominated the market with the largest revenue share of 25.2% in 2022 and is expected to grow at the fastest CAGR of 4.1% during the forecast period. This can be attributed to the presence of advanced technologies, easy product availability, favorable reimbursement structure, and a strong healthcare system. Germany is one of the largest medical equipment markets, which is anticipated to contribute to the country’s overall share.

Gather more insights about the market drivers, restraints, and growth of the Europe Mobility Aids Market

Key Companies & Market Share Insights

The market is highly competitive marked by the presence of a large number of local as well as international players. Companies are engaging in new product launches, mergers, and acquisitions to strengthen their product portfolios and provide competitive differentiation. For instance, in May 2022, OCR Canada Ltd. announced the acquisition of Day’s Mobility Ltd., which will widen its product offerings. In February 2020, Sunrise Medical acquired Oracing, a Spain-based designer and manufacturer of innovative sports, made-to-measure wheelchairs, and E-Mobility power products.

A number of industry players are offering their products through various e-commerce platforms, which have improved product accessibility for patients and increased market competition. Some prominent players in the Europe mobility aids market include:

- Human Care HC AB

- Drive DeVilbiss Healthcare

- Roma Medical

- Day’s Mobility Ltd.

- Van Os Medical

- Invacare Corp.

- Z-Tec Mobility

- Sunrise Medical

- Karma Mobility

- TOPRO Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment