Cochlear Implant Industry Overview

The Cochlear Implant Market reached $1.86 billion in 2023 and is projected to expand at a compound annual growth rate of 6.02% between 2024 and 2030. Several factors are fueling this expansion, including greater public knowledge of hearing loss, improved diagnosis rates, a growing trend towards bilateral implants, and supportive government policies. Increased insurance coverage for cochlear implants in the U.S. is largely attributed to heightened awareness of their benefits and legislation like the Americans with Disabilities Act.

A key driver of market growth is the increasing occurrence of hearing impairment in the elderly population. This rising burden of hearing loss in older adults is anticipated to further propel market expansion. The United Nations' 2023 World Social Report indicated that 761 million individuals worldwide were 65 years or older in 2021. The World Health Organization estimates that the global geriatric population will nearly double from 12% in 2012 to 22% by 2050, reaching two billion by 2050 from 900 million in 2015. This demographic shift is expected to boost both short-term and long-term demand for hearing solutions, thus driving market growth.

Detailed Segmentation:

- Age Group Insights

The adult segment held the largest revenue share of 57.70% in 2023 and is expected to maintain its dominance from 2024 to 2030. However, adult cochlear implant segment’s growth is slower than pediatric segment. The high patient pool with severe-to-profound hearing loss, advancements in adult cochlear implants, and increasing number of speech therapy centers are some of the key factors likely to boost the growth.

- End Use Insights

The clinics segment is anticipated to dominate the global market with maximum share in 2023. Cochlear implant surgery is increasingly being performed in outpatient clinics, as opposed to hospitals. This is due to advancements in surgical techniques and development of smaller, more portable cochlear implant devices.

The others segment is expected to register the fastest CAGR from 2024 to 2030. This segment includes rehabilitation centers, auditory implant centers, and University Medical Centers (UMCs). The demand for auditory implant centers and rehabilitation centers is growing. These centers are dedicated to hearing restoration procedures, including cochlear implantation. These centers often have the expertise and equipment specifically tailored to such surgeries.

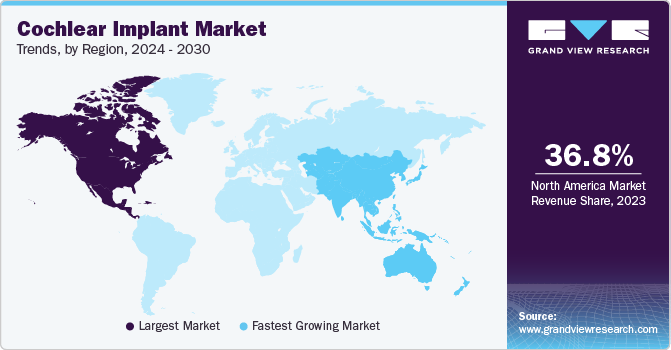

- Regional Insights

Asia Pacific is expected to register the fastest CAGR from 2024 to 2030. The rising urbanization within developing nations, characterized by increased noise levels from vehicles & industrial activities and lack of noise pollution regulations, are contributing to the prevalence of hearing loss across Asia Pacific. Hence, cochlear implants, benefiting individuals with severe to profound sensorineural hearing loss, are becoming increasingly essential.

Gather more insights about the market drivers, restraints, and growth of the Cochlear Implant Market

Key Companies & Market Share Insights

Some of the key market players include Sonova, Cochlear Ltd., MED-EL Medical Electronics, and Demant A/S.

- Cochlear Ltd. is engaged in developing and commercializing cochlear implants, bone conduction implants, & acoustic implants to treat hearing-impaired individuals. It is a global company with major manufacturing facilities in Sweden and Australia.

- MED-EL Medical Electronics (MED-EL) is a privately held company focusing on R&D to create a rich product pipeline. It develops and commercializes cochlear, bone conduction hearing, middle ear, auditory brainstem, and electric-acoustic stimulation hearing implants.

Key Cochlear Implant Companies:

- Cochlear Ltd.

- Sonova

- MED-EL Medical Electronics

- Demant A/S

- Zhejiang Nurotron Biotechnology Co., Ltd. (Nurotron)

- Amplifon S.p.A. (GAES)

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In March 2023, MED-EL Medical Electronics provided direct streaming to their cochlear implant patient in their new MED-EL cochlear implant systems.

- In November 2022, Cochlear Ltd. expanded its manufacturing facility plant in Kuala Lumpur, Malaysia. The expansion involved an asset of more than USD 6.28 million (RM 30 million) to help the growing demand for acoustic and cochlear hearing implants.

No comments:

Post a Comment