5G System Integration Industry Overview

The global 5G system integration market size was valued at USD 7.88 billion in 2021 and is expected to exhibit a compound annual growth rate (CAGR) of 27.3% from 2022 to 2030. 5G system integration is a process of integrating both virtual and physical components of any enterprise with new upgraded systems or applications to work over the new 5G network. Rising demand for high-speed bandwidth capacity has enabled enterprises to install upgraded network infrastructure to enhance overall operational efficiency as well as reduce the total process costs. Thus, robust deployment of upgraded network infrastructure across enterprises to deliver enhanced services to their customers is estimated to propel the demand for 5G system integration services.

Major global manufacturers are seeking opportunities to speed up their operations by embracing modern digital technologies to empower the fourth industrial revolution (Industry 4.0). Technologies such as big data analytics, industrial wireless camera, and collaborative robots are enabling manufacturing facilities to take a giant leap toward smart and data-driven flexible operations.

Gather more insights about the market drivers, restraints, and growth of the Global 5G System Integration Market

In addition, several manufacturers have developed and implemented these aforementioned technologies to compete in a highly competitive environment. Manufacturers need to integrate them with next-generation networks in order to provide unified communication to these 5G technologies, which also helps reduce the overall operational downtime and costs by delivering continuous connectivity and remote monitoring. Thus, the robust deployment of industrial internet of things (IIoT), coupled with the growing demand for 5G services to provide unified connectivity, is anticipated to bolster the demand for 5G system integration services during the forecast period.

With the evolution of fifth-generation mobile network services, various enterprises across the globe are aggressively focusing on integrating their legacy network infrastructure with the new upcoming 5G technologies. These companies are integrating their existing on-premise applications and cloud networks with modern 5G technologies to work seamlessly over a centralized network. This integration process allows enterprises to access high bandwidth capacity with low latency for their operations, thereby increasing the total operational efficiency by reducing the overall response time to customers. Therefore, a significant rise in demand for fast broadband to reduce overall response time is expected to drive the 5G systems integration market.

The growing popularity of Network Function Visualization (NFV) and Software-Defined Networking (SDN) across enterprises is also expected to be one of the major factors driving the market for 5G system integration. NFV allows enterprises to deploy several virtual machines and firewalls to lead an efficient economy of scale. On the other hand, SDN provides a smart network architecture that aims to reduce hardware constraints on the company premises.

Moreover, SDN allows these companies to manage the use of their network behaviors efficiently through an Application Program Interface (API). Thus, the rapid adoption of NFV and SDN technologies to minimize overall network infrastructure costs is anticipated to further surge the market growth. However, a rapidly increasing large chunk of datasets over the cloud, coupled with increasing demand for cloud-based application integration, creates a major security concern among the consumers, which may hinder the 5G system integration industry growth in the future.

The outbreak of the COVID-19 pandemic has severely impacted the overall 5G industry across the globe. Few countries such as the U.S., Spain, France, and U.K. have postponed the spectrum auctions to deliver 5G services initially. Additionally, several telecom network providers such as Huawei Technologies Co. Ltd, Ericsson, and Nokia Corporation have temporarily delayed the 5G network deployment for telecom operators globally in Q1 and Q2 of 2020. The delay in 5G network deployment is having an adverse impact on the demand for 5G system integration services. Furthermore, several federal governments across key countries such as U.S., U.K., Germany, and others, released various economy boost packages and provided ease in lockdown facilities and allow enterprises to resume their operation with limited workforce capacity. This, in turn, is expected to augment the overall market growth from 2022 to 2030.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Smart Cities Market - The global smart cities market size was valued at USD 1,226.9 billion in 2022 and is expected to register a compound annual growth rate (CAGR) of 25.8% from 2023 to 2030.

5G Services Market - The global 5G services market size was valued at USD 60.61 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 59.4% from 2023 to 2030.

5G System Integration Industry Segmentation

Grand View Research has segmented the global 5G systems integration market based on services, vertical, application, and region:

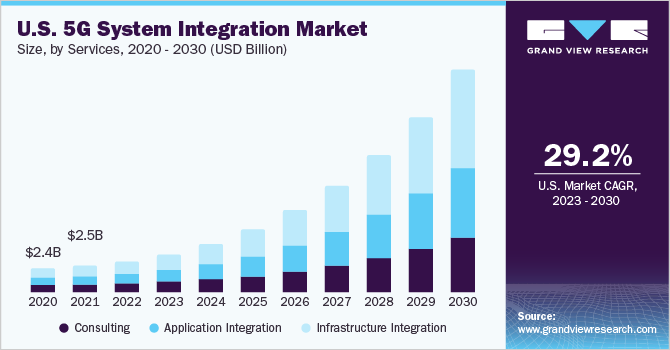

Services Outlook (Revenue, USD Million, 2019 - 2030)

- Consulting

- Infrastructure Integration

- Application Integration

Vertical Outlook (Revenue, USD Million, 2019 - 2030)

- Manufacturing

- Energy & Utility

- Media & Entertainment

- IT & Telecom

- Transportation & Logistics

- BFSI

- Healthcare

- Retail

- Others

Application Outlook (Revenue, USD Million, 2019 - 2030)

- Smart City

- Collaborate Robot /Cloud Robot

- Industrial Sensors

- Logistics & Inventory Monitoring

- Wireless Industry Camera

- Drone

- Home and Office Broadband

- Vehicle-to-everything (V2X)

- Gaming and Mobile Media

- Remote Patient & Diagnosis Management

- Intelligent Power Distribution Systems

- P2P Transfers /mCommerce

- Others

Regional Outlook (Revenue, USD Million, 2019 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

October 2021: Accenture, Stellantis, and TIM Brazil are collaborating on a private 5G network trial project at the Stellantis plant in Goiana, northeastern Brazil.

Key Companies profiled:

Some prominent players in the global 5G System Integration Industry include

- Accenture Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- Wipro Limited

- Radisys Corporation

- IBM Corporation

- HPE

Order a free sample PDF of the 5G System Integration Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment