U.S. Hospital Emergency Department Industry Overview

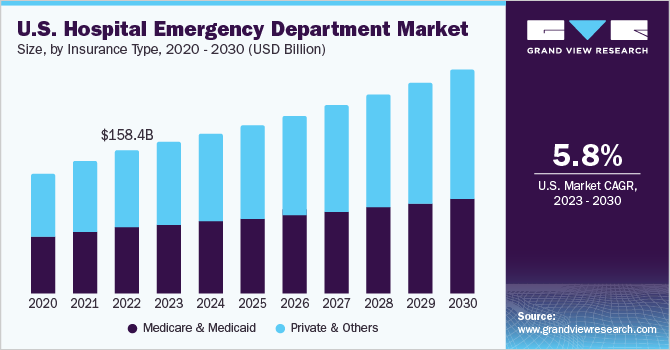

The U.S. hospital emergency department market size was valued at USD 146.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030. The major factor driving the growth of this market includes a high number of visits to hospital Emergency Departments (EDs) and the availability of insurance. According to CDC, there are approximately 130 million ED visits in the U.S. each year. Approximately 22% of adults aged 18 and over visited EDs in 2019. Around 60% of the emergency care was provided during non-business hours, making the non-availability of less expensive options an important factor contributing to the high number of ED visits.

Hospital EDs provide treatment for various indications such as cardiology, neurology, gastroenterology, infectious diseases, and psychiatry. Increasing the incidence of these conditions is rising the number of ED visits. Furthermore, the growing geriatric population in the U.S. is favoring the market, as the elderly often require urgent medical interventions. Many hospitals are adopting advanced technologies and tools, such as Artificial Intelligence (AI), to provide improved diagnosis and to expedite routine procedures, such as devising treatment plans and prescriptions for patients. The COVID-19 pandemic increased the adoption of telehealth in hospitals to multiple folds. The use of telehealth is helping the hospital to reduce waiting time and overcrowding in the EDs.

Gather more insights about the market drivers, restraints, and growth of the U.S. Hospital Emergency Department market

Medicare and Medicaid offer insurance for emergency health services. According to CDC, over 40% of ED visits by adults over the age of 65 are by ambulance, which is covered under Medicare Part B. Part B Medicare also covers air ambulance trips by helicopter or airplane if care is necessary. Medicare Part A covers a portion of the cost if the patient enters the emergency room and is admitted as an inpatient, while Medicare Part B covers the portion of the cost if the patient receives care from a doctor but is not admitted as an inpatient. Favorable reimbursement for ED services is contributing to the growth of the market for U.S. hospital emergency departments.

Various measures are taken to expand EDs to accommodate more patients are expected to help in addressing the problem of ED overcrowding. For instance, in November 2019, a not-for-profit hospital, Augusta Health, expanded its ED capacity, almost doubling its size, to include 48 treatment rooms.

Browse through Grand View Research's Medical Devices Industry Related Reports

U.S. Independent Diagnostic Testing Facility Market - The U.S. independent diagnostic testing facility market was valued at USD 3.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.52% from 2023 to 2030.

U.S. Physical Therapy Services Market - The U.S. physical therapy services market was valued at USD 44.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.56% from 2023 to 2030.

U.S. Hospital Emergency Department Industry Segmentation

Grand View Research has segmented the U.S. hospital emergency department market on the basis of insurance type and condition:

U.S. Hospital Emergency Department Insurance Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Medicare & Medicaid

- Private & Others

U.S. Hospital Emergency Department Condition Outlook (Revenue, USD Billion, 2017 - 2030)

- Traumatic Conditions

- Gastrointestinal Conditions

- Psychiatric Conditions

- Cardiac Conditions

- Neurologic Conditions

- Infectious Conditions

- Other Conditions

Market Share Insights:

May 2018: St. Joseph’s Health Geriatric Emergency Department received accreditation from the American College of Emergency Physicians (ACEP). The hospitals are also partnering with other organizations to improve their medical services.

March 2017: Clarion Hospital partnered with Allegheny Health Network Emergency Medicine Management to receive physician staffing for its ED. This is expected to intensify the market competition over the forecast period.

Key Companies profiled:

Some prominent players in the U.S. Hospital Emergency Department Industry include

- Parkland Health & Hospital System

- Lakeland Regional Health

- St. Joseph’s Health

- Natchitoches Regional Medical Center

- Schoolcraft Memorial Hospital

- Clarion Hospital

- USA Health

- Baptist Health South Florida

- Montefiore Medical Center

- Lac+Usc Medical Center

Order a free sample PDF of the U.S. Hospital Emergency Department Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment