Payment Gateway Industry Overview

The global payment gateway market size was valued at USD 26.79 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 22.2% from 2023 to 2030. The market growth can be attributed to the increasing demand for mobile-based payments across the globe. Rising e-commerce sales and growing internet penetration globally are other significant factors that are anticipated to contribute to the growth of the market for payment gateway. Additionally, the shift in merchant and consumer preference to digital channels for enabling online money transfers is projected to propel the growth of the market in the forthcoming years.

Companies are increasingly seeking payment gateways that provide secure internet transactions and help prevent credit or debit card scams and other fraudulent activities. Reliable payment gateways encrypt sensitive information such as bank account details and debit or credit numbers to ensure that the information is transferred securely from the customer to the issuing bank. Moreover, they eliminate the need for consumers to deal with the hassles of shopping from physical stores and waiting in long queues. Consumers can efficiently complete the entire transaction online, enjoying a seamless shopping experience.

Gather more insights about the market drivers, restraints and growth of the Global Payment Gateway Market

Technological advancements and the rapid rate of internet penetration globally have enabled financial service providers to offer novel digital services to customers. The rising popularity of mobile-based apps for making money transfers also propels internet banking demand. Governments globally are making efforts to promote internet services across rural areas. The British government in 2020 has invested USD 5.9 billion in the country's rural areas to provide fast broadband services. 95% of the country's rural areas were expected to receive 4G coverage in the coming years owing to the USD 606.3 million investments made by the government in 2020 in the shared rural mobile phone network project.

E-commerce companies are partnering with payment service providers to offer a digital payments infrastructure to merchants and customers. Merchants manage a large volume of transactions, which has encouraged the integration of gateway systems into their sales channels. For instance, in July 2021, PayU, a payment gateway service provider, announced its partnership with WooCommerce, a customizable e-commerce platform, to enable WooCommerce merchants with digital payment infrastructure and end-to-end digitalization of business processes. This partnership is expected to offer merchants contactless payment solutions to scale the profitability and growth, exclusive pricing on transactions, and no hidden charges.

Numerous banks across the globe are also making efforts to enter into partnerships with payment gateway service providers to offer real-time payment facilities to consumers and merchants. For instance, in November 2021, Yes Bank announced its collaboration with Amazon Pay and Amazon Web Services (AWS) to provide a real-time payment system through the Unified Payment Interface (UPI) transaction facility. Through this collaboration, UPI facilitates inter-bank person-to-merchants and peer-to-peer network transactions through the Yes Bank digital payment platform.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Contactless Payment Market - The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030.

Digital Payment Market - The global digital payment market size was valued at USD 68.61 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.5% from 2022 to 2030.

Payment Gateway Market Segmentation

Grand View Research has segmented the global payment gateway market based on type, enterprise size, end-use, and region:

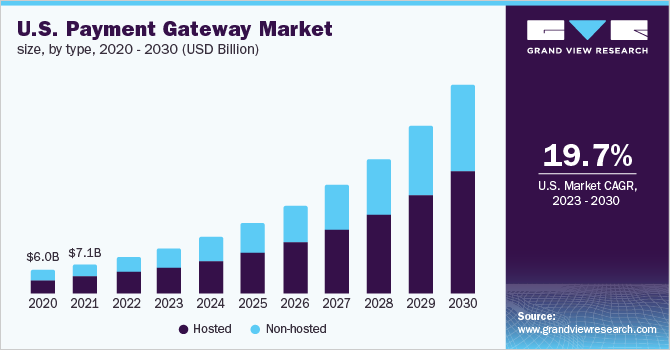

Payment Gateway Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Hosted

- Non-hosted

Payment Gateway Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

- Large Enterprises

- Small & Medium Enterprises

Payment Gateway End-use Outlook (Revenue, USD Billion, 2017 - 2030)

- BFSI

- Media & Entertainment

- Retail & E-commerce

- Travel & Hospitality

- Others

Payment Gateway Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

May 2021: Stripe announced its partnership with GrabPay, a provider of payment solutions to businesses, allowing businesses in Malaysia and Singapore to offer consumers a more convenient and rewarding online payment method through GrabPay’s e-wallet.

October 2020: Stripe, a financial service company, announced the acquisition of Paystack, an online payment processing company. Paystack operates in Nigeria and has plans to expand across South Africa.

Key Companies profiled:

Some prominent players in the global Payment Gateway market include

- Adyen

- Amazon Payments Inc.

- Authorize

- Bitpay, Inc.

- Braintree

- PayPal Holdings Inc.

- PayU Group

- Stripe

- Verifone Holdings Inc.

- Wepay, Inc.

Order a free sample PDF of the Payment Gateway Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment