U.S. Healthcare Discount Plan Industry Overview

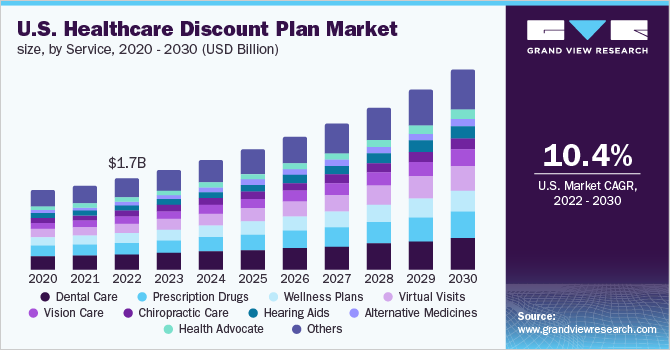

The U.S. healthcare discount plan market size was valued at USD 1.6 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030. The strong presence of Discount Medical Plan Organizations (DMPOs) offering affordable discount plans for distinct services, such as health advocacy, vision care, virtual visits, chiropractic care, dental care, alternative medicines, and prescription drugs, in the U.S. is a key factor expected to boost the DMPOs familiarity among the U.S. patient population. The U.S. market has a wide array of highly discounted health programs packaged with multiple benefits, such as individual coverage & family coverage.

Furthermore, these programs offer higher discounts as compared to traditional high monthly premium insurance plans. The abovementioned factors accelerate the adoption of healthcare discount plans. Key market players are focusing on devising strategies to increase public-private partnerships, collaborations, & investments and expand business coverage to minimize medication costs and offer users affordable & accessible healthcare solutions. Furthermore, increasing collaborative efforts among care providers and healthcare payers & insurance providers to reduce costs & expenses and enhance patient experience & quality of care is significantly improving clinical outcomes and boosting the market growth.

Gather more insights about the market drivers, restraints, and growth of the U.S. Healthcare Discount Plan market

However, the presence of affordable health insurance companies in the country offering multiple health service plans is hindering the market growth. Some players, such as United Healthcare, Cigna, BlueCross, Kaiser Permanente, and BlueShield, offer affordable and better insurance plans compared to medical discount plans. Thus, the high adoption of cheap insurance coverage plans over conventional discount plans is expected to limit the growth of the market. However, despite the presence of a significant number of players, there is a greater need to reinstate a well-structured insurance market, which is capable of providing healthcare coverage at reasonable prices to most individuals not covered by employer-sponsored insurance policies or who are not considered under public entitlement programs.

The growing healthcare costs are driving consumers to rapidly adopt health discount plans. Although healthcare bundled payments offer value for providers, payers, and patients, consumers are not capable of exploiting their full potential. However, a wide range of healthcare discount solutions is being actively developed in the private health sector with the motive of encouraging demand for forward-looking health plans. Key market participants are focusing on devising innovative product & service offerings to expand their portfolio and serve the growing demand. These key players promote affordable medical treatment plans through their service portfolio.

For instance, the Health Care Transformation Task Force-an association of key health payers and health providers including Anthem, Aetna, and state-level Blue Cross Blue Shield plans, Sentara Healthcare, and Geisinger-had around 50.0% of its payer and provider members’ payment arrangements done via APMs in 2017, which is expected to increase to nearly 75.0% by 2020. Similarly, United Healthcare in March 2019, through its California Health Care Investment Program, invested USD 19 million to develop multiple health centers in California, improve the patient care experience, enhance clinical outcomes across California and deliver care to underserved communities of Santa Clara, Solano, and Santa Barbara.

The growing demand for health/medical discount plans to curb rising costs is anticipated to propel market growth. According to Centers for Medicare & Medicaid Services (CMS) and National Health Expenditure Accounts (NHEA) estimates, the healthcare spending in the U.S. in 2020 is USD 4.1 trillion or USD 12,530 per individual, accounting for 19.7% of the country’s overall GDP, thus, making the U.S. healthcare industry one of the largest industries. A growing number of mergers & acquisitions, collaborations, partnerships, and joint ventures among industry players enhance the quality of care, offer affordable treatment options, and deliver patient satisfaction.

For instance, in April 2020, Cigna & Express Scripts partnered with Buoy Health to provide screening tools for COVID-19 and help customers & members understand their risks regarding the pandemic. In December 2019, Humana acquired Enclara and this acquisition helped Humana advance in its clinical management expertise by expanding and leveraging Enclara’s capabilities.

Browse through Grand View Research's Healthcare IT Industry Related Reports

U.S. Advance Care Planning Solutions Market - The U.S. advance care planning solutions market size was valued at USD 85.9 billion in 2021 and is anticipated to expand at a CAGR of 12.7% from 2022 to 2030.

Surgical Planning Software Market - The global surgical planning software market was valued at USD 102.1 million in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030.

U.S. Healthcare Discount Plan Industry Segmentation

Grand View Research has segmented the U.S. healthcare discount plan market based on service:

U.S. Healthcare Discount Plan Service Outlook (Revenue, USD Million, 2016 - 2030)

- Health Advocate

- Virtual Visits

- Alternative Medicines

- Prescription Drugs

- Dental Care

- Vision Care

- Hearing Aids

- Chiropractic Care

- Nurse Services

- Vitamins & Supplements

- Wellness Plans

- Podiatry Plans

- Others

Market Share Insights:

January 2020: Cigna and Oscar entered a strategic partnership to deliver commercial health solutions to small businesses, enabling them to expand their network & product choice, while remaining cost-effective.

June 2019: Optum acquired DaVita Medical Group serving more than 80 health plans to lower healthcare costs (primary, specialty, urgent, and surgical care) and improve patient experience & health.

Key Companies profiled:

Some prominent players in the U.S. Healthcare Discount Plan Industry include

Discount Medical Plan Organizations (DMPOs)

- New Benefits, Ltd.

- Access One Consumer Health, Inc.

- CARRINGTON International Corporation

- Ameriplan

- Coverdell

- Alliance Healthcard of Florida, Inc.

Marketer

- United Health Group

- American Dental Care Partners, Inc.

- Blue Cross and Blue Shield Association

- DentalPlans.com, Inc.

- Sam’s West, Inc.

- Humana, Inc.

- Cigna

- Freshbenies

- Discounts by Design

- Xpress Healthcare

Order a free sample PDF of the U.S. Healthcare Discount Plan Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment