U.S. Active Adult (55+) Community Industry Overview

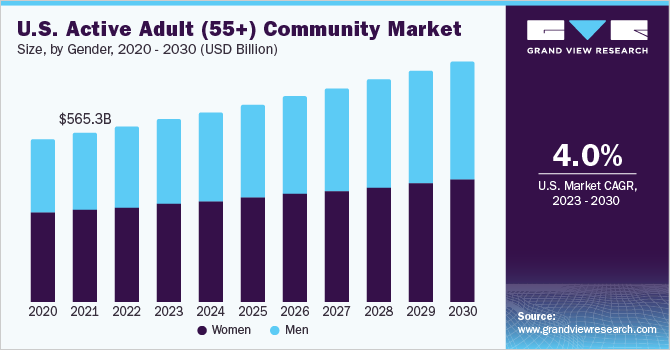

The U.S. active adult (55+) community market size was valued at USD 565.3 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 4.01% from 2022 to 2030. Increasing demand from baby boomers, reduction in the stigma of retiring, and growing interest of investors in senior living facilities are driving the market. Active adult housing is a purpose-built multifamily rental housing for younger seniors and has a heavy emphasis on community space and activities. The living preferences of baby boomers are changing, as this population wants to stay independent and lead an active lifestyle. Thus, post-retirement they prefer to relocate to communities that have residents with shared values and not senior living or assisted living facilities.

Moreover, for this population, retirement is not about settling down and living the rest of their life following the same routine. They are more willing to explore new things, maintain a social life, and enjoy their life savings. Active adult communities have, thus, become the most suitable option for baby boomers.

Gather more insights about the market drivers, restraints, and growth of the U.S. Active Adult (55+) Community Market

Active adult communities have gained tremendous market appeal from investors, which is believed to be one of the most opportunistic investments in recent years. According to a recent senior housing & care investor survey, around 22% of respondents believed active adult communities as a profitable investment and the hottest selling property in the senior housing market. Moreover, these properties are specially marketed to younger seniors (55+) and are categorized as a form of lifestyle senior housing. In addition, as these communities are not associated with any type of healthcare component they are growing in popularity with investors among other senior housing product types.

According to mid-year estimates published by the U.S. Census Bureau, the majority of the baby boomers have been turning 65 years of age and by 2030 the remainder will also reach age 65 and will account for approximately 21.0% of the total United States population. Among the senior living market, the active adult community has gained a huge market demand and investor appeal in the last few years. This is attributed to the growing demand for independent and maintenance-free living among the age group of 55 to 64 years.

In the U.S., the active adult community is often referred to by different names. They are termed as lifestyle seniors housing based on the type of population it caters to. Sometimes used in reference to multifamily but most 55+ communities are sold as single-family housing communities.

Browse through Grand View Research's Medical Devices Industry Related Reports

U.S. Concierge Medicine Market - The U.S. concierge medicine market size was valued at USD 5.5 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 10.27% from 2022 to 2030.

U.S. Hospital Facilities Market - The U.S. hospital facilities market size was valued at USD 1,318.9 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 7.62% from 2022 to 2030.

U.S. Active Adult (55+) Community Market Segmentation

Grand View Research has segmented the U.S. active adult (55+) community market based on gender

U.S. Active Adult (55+) Community Gender Outlook (Revenue, USD Billion, 2017 - 2030)

- Women

- Men

Market Share Insights:

December 2021: The Villages announced the expansion of its community by over 241 acres which were to include a new hospital.

Key Companies profiled:

Some prominent players in the U.S. Active Adult (55+) Community market include

- The Villages

- Pultegroup, Inc.

- Latitude Margaritaville

- Hot Springs Village

- Rossmoor Walnut Creek

- Robson Ranch

- Sun Lakes

- Green Valley

Order a free sample PDF of the U.S. Active Adult (55+) Community Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment