Agriculture Equipment Industry Overview

The global agriculture equipment market size was evaluated at USD 155.68 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2030. Increasing mechanization in the agriculture sector coupled with the surge in farmers’ income is expected to be a primary factor driving the growth. Favorable climatic conditions for food production and government support with loan waiver schemes for farmers of all income categories are also presumed to favor the market growth. Technologically advanced agricultural robotics, such as autonomous tractors and flying drones to help farmers produce food at low costs to fulfill the growing demand for food, are anticipated to be better prospects for market growth over the forecast period.

The COVID-19 outbreak caused a slight slump in the agricultural equipment market in 2020. The restrictions imposed by governments to curb the novel coronavirus led to the temporary shutdown of manufacturing facilities, leading to production delays. As a result, the industry was negatively impacted in the first half of 2020. Several players such as AGCO Industries, Deere & Company, and Kubota Corporation witnessed a decline in agriculture equipment sales in H1/2020. However, as governments opened up economies in H2/2020, the demand for agriculture equipment bounced back and witnessed double-digit growth, a trend that continued till H1/2021.

Gather more insights about the market drivers, restraints, and growth of the Global Agriculture Equipment Market

The sudden increase in demand for tractors, harvesters, and planters in H1 /2021 led to lower inventory levels for OEMs and their dealers in H2/2021. In addition, OEMs worldwide are currently experiencing a shortage of semiconductors and high commodity prices of steel, aluminum, and other raw materials. As a result, OEMs are unable to balance supply and demand, which may allow OEMs to increase their product prices ranging from 4% to 22% in the next few quarters of 2022, a trend that is expected to continue till 2023. However, strong crop production in Asian economies, notably in China and India, along with the need to replace aging equipment are expected to drive the growth of the market.

The high initial cost of agricultural equipment is anticipated to be one of the bottlenecks for adopting agriculture equipment, notably for small income farmers. The rental business is expected to be one of the new revenue streams for market growth to overcome such challenges. Companies such as KwippedInc.; JFarm Services (TAFE Corporate Communications); Mahindra & Mahindra Ltd. (TRRINGO.com); and MACALLISTER RENTALS are established players in the agriculture equipment rental business. Moreover, several start-ups are now engaged in developing applications that will help farmers connect among themselves. These applications will also help the farmers connect with rental companies in their vicinity.

Favorable government initiatives are anticipated to drive the growth of the market during the forecast period. For instance, the Russian government is attempting to trigger investment in capital purchases by proposing several subsidies for strategically significant sub-sectors including meat and milk production. The Ministry of Agriculture sanctioned 464 projects worth USD 4 billion, expected to receive government support food security and reduce the livestock imports. Moreover, factors such as lack of human resources and the availability of easy credit and funds are projected to spur the demand for tractors and other farm equipment in other emerging countries over the forecast period.

Browse through Grand View Research's Technology Industry Related Reports

Agricultural Tractors Market - The global agricultural tractors market demand was valued at 2,765.3 thousand units in 2021 and is anticipated to expand at a compound annual growth rate(CAGR) of 6.8% from 2022 to 2030.

Autonomous Crop Management Market - The global autonomous crop management market size was valued at USD 1.45 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.2% from 2022 to 2030.

Agriculture Equipment Market Segmentation

Grand View Research has segmented the global agriculture equipment market based on product, application, and region:

Agriculture Equipment Product Outlook (Revenue, USD Million, 2018 - 2030)

- Tractors

- Harvesters

- Planting Equipment

- Irrigation & Crop Processing Equipment

- Spraying Equipment

- Hay & Forage Equipment

- Others

Agriculture Equipment Application Outlook (Revenue, USD Million, 2018 - 2030)

- Land Development & Seed Bed Preparation

- Sowing & Planting

- Weed Cultivation

- Plant Protection

- Harvesting & Threshing

- Post-harvest &Agro-processing

Agriculture Equipment Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

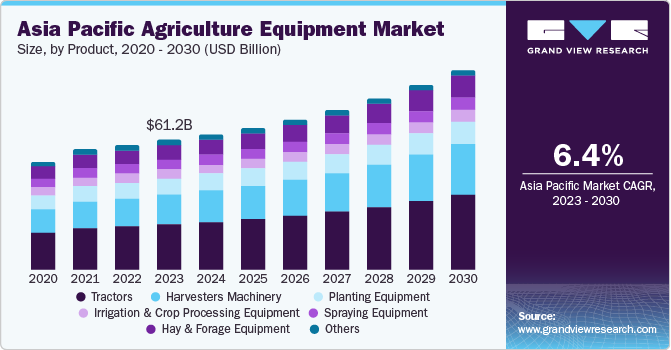

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

August 2021: John Deere introduced the new 6155MH Tractor, which delivers reliability and all the field-proven performance like the M series, envisage the company to attract a new customer base.

September 2019: CNH Industries N.V. opened new parts and service centers in Shanghai, China which helped reduce the product delivery time to the customers for New Holland Agriculture and Case IH agricultural equipment brands.

Key Companies profiled:

Some prominent players in the global Agriculture Equipment market include

- AGCO Corporation

- FlieglAgro-Center GmbH

- Agromaster

- Amazone Inc.

- APV GmbH

- Bellota Agrisolutions

- CLAAS KGaAmbH

- CNH Industrial N.V.

- Deere & Company

- Escorts Limited

- HORSCH Maschinen GmbH

Order a free sample PDF of the Agriculture Equipment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment