U.S. Virtual Visits Industry Overview

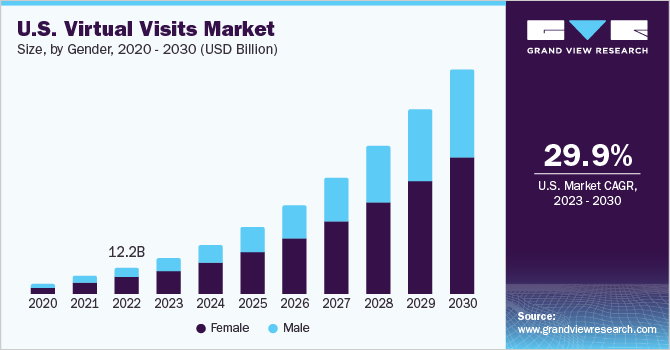

The U.S. virtual visits market is valued at USD 8.3 billion in 2021 in terms of revenue and 270 million in 2021 in terms of volume. The market is expected to expand at a compound annual growth rate (CAGR) of 30.9% in terms of value and 36.9% in terms of volume, during the forecast period. The increase in penetration of smartphones has positively affected the growth of the virtual visits market in the U.S. The pandemic brought about a change in the way patients took consultations, the new norm was teleconsultations to communicate with the healthcare practitioners, which was responsible for a substantial growth spurt in the virtual visits market. The ever-increasing and changing technology and fast adoption rates by the population is also a key factor driving the growth of the virtual visits market.

The landscape of telehealth has been continuously changing with apps and devices bringing patients and caregivers closer virtually, in the wake of the current situation and the pandemic, the preference for both patients and doctors was teleconsultations. This not only created a huge market opportunity for the technology to develop around different apps and devices to monitor various health conditions but also for people to connect to doctors even in remote locations where there were no functional hospitals or care centers. The virtual visit market has become a way to provide remote and rural as well as urban areas with safe and convenient access to healthcare for conditions like migraine, birth control, diabetes, hypertension, and other health conditions.

Gather more insights about the market drivers, restraints, and growth of the U.S. Virtual Visits Market

The demand for personalized care has risen in the recent years, in remote areas where hospitals and healthcare centers are already sparse, the needs for specialty care and personalized care are unmet, with the advent of teleconsultations, this problem has been solved, and the adoption by certified healthcare professionals has also risen, mostly due to the pandemic, but has now become the go-to way for remote care consultations. Patients in remote areas can connect to specialists and experts from the comfort of their home to anywhere in the country, this has resulted in faster and widespread adoption of telehealth and teleconsultations, resulting in the growth of the market. An increase in smartphone penetration and adoption of 4G & 5G technologies and devices have enabled both patients and caregivers to connect easily.

The increasing number of government initiatives has also positively affected the growth of the virtual visits market in the U.S. The Federal Communications Commission (FCC) established a USD 200 million COVID-19 Telehealth program, which connected and enabled caregivers to provide appropriate consultations to patients in rural settings and remote areas, the latest funding for this purpose was announced on January 26, 2022. FCC also launched a connected care pilot program, on June 17, 2021, wherein FCC approved guidance for this program to begin a 3-year project. Many more initiatives have been undertaken to improve the telehealth landscape in the country in turn boosting the growth of the virtual visits market.

The rising adoption of virtual visits and teleconsultations by healthcare practitioners is also propelling the growth of the market. In a survey conducted in 2019, by the Consumer Technology Association before the pandemic hit the world, 52% of the consumers were open to using a connected health device if recommended by a physician. Telehealth adoption rates have increased drastically over the last decade and are expected to increase given its benefits, further helping the virtual visits market to grow.

As the adoption of telehealth is increasing so are the risks associated with the data that is being generated, the plethora of apps and connected devices all create a mammoth amount of patient data which is at a constant risk of being hacked or patient information being leaked. There are several initiatives being implemented by the government to increase the security of patient data and create a safe space for virtual consultations and visits.

COVID-19 has had a positive impact on the overall virtual visits market. As per a report by McKinsey, the use of telehealth has increased more than 38 times when compared to pre-COVID times. There was a massive jump reported from February 2020 to April 2020, utilization of telehealth was up by 78 times in 2 months. The number of initiatives by the government has fueled the virtual visits market and it is expected to stay even post COVID-19.

Browse through Grand View Research's Healthcare IT Industry Related Reports

U.S. Behavioral Health Care Software and Services Market - The U.S. behavioral health care software and services market size was valued at USD 1.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 12.12% from 2022 to 2030.

U.S. Virtual Care Market - The U.S. virtual care market size was valued at USD 4.2 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.75% from 2022 to 2030.

U.S. Virtual Visits Market Segmentation

Grand View Research has segmented the U.S. virtual visits market based on service type, commercial plan type, age group, and gender:

Service Type Outlook (Revenue & Volume, USD Million & Million Units, 2016 - 2030)

- Cold & Flu management

- Allergies

- Urgent Care

- Preventive Care

- Chronic Care Management

- Behavioral Health

Age Group Outlook (Revenue & Volume, USD Million & Million Units, 2016 - 2030)

- Age 18-34

- Age 35-49

- Age 50-64

- Age 65 and above

Commercial Plan Type (Revenue & Volume, USD Million & Million Units, 2016 - 2030)

- Small Group

- Self-funded/ASO Group Plans

- Medicaid

- Medicare

Gender (Revenue & Volume, USD Million & Million Units, 2016 - 2030)

- Male

- Female

Key Companies profiled:

Some prominent players in the U.S. Virtual Visits market include

- American Well Corporation

- MDLive, Inc

- Doctor On Demand, Inc

- eVisit Telemedicine Solution

- Teladoc Health, Inc

- MeMD

- HealthTap, Inc

- Vidyo, Inc

- PlushCare, Inc

- Zipnosis

Order a free sample PDF of the U.S. Virtual Visits Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment