Healthcare Contract Development and Manufacturing Organization Industry Overview

The global healthcare contract development and manufacturing organization market size was valued at USD 217.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.2% from 2022 to 2030. An increase in uptake of outsourcing services by pharmaceutical companies and growth in R&D investments are expected to drive the market. Medical devices & pharmaceutical companies are outsourcing low-end services to reduce the overall cost of production. This trend is expected to contribute to the growth of the market for healthcare contract development and manufacturing organization (CDMO), in the forecast period. The presence of end-to-end service providers that offer value-added services for an integrated or risk-sharing business model is expected to bolster market growth.

The COVID-19 pandemic has significantly impacted the global economy in 2020 and has had an ongoing impact on various industries. However, the market for healthcare contract development and manufacturing organization (CDMO) witnessed a positive impact due to this pandemic. CDMOs are playing an important role in meeting the needs of pharmaceutical companies, biotech companies, and other end-users during this crisis. For instance, Lonza signed a 10-year manufacturing contract with Moderna for manufacturing the COVID-19 vaccine. CDMO players are offering pharma, biotech, and other end-user companies cost-efficiency, time-saving, and specialized expertise. The rapid rise in demand for COVID-19 vaccines and therapeutics is propelling the IND CDMO market. Even post-pandemic, the future seems upright for the IND CDMO market owing to the robust drug pipeline of pharmaceutical and biotech companies.

Gather more insights about the market drivers, restraints, and growth of the Global Healthcare Contract Development And Manufacturing Organization Market

According to the 2019 PhRMA member annual survey, pharmaceutical companies invested USD 79.6 billion in R&D. As the healthcare industry is undergoing a process of dynamic change, factors such as rapid technological advancements (e.g., automation & artificial intelligence), the need for CROs/CMOs/CDMOs, and rising investments in research are influencing the healthcare market. Outsourcing activities are befitting many pharmaceutical companies in improving operational efficiencies, expanding geographical presence, decreasing resource costs, gaining therapeutic expertise, and enhancing on-demand services. Medical device companies are focusing on emerging countries to gain access to newer markets and increase their revenues. OEM consolidation has also boosted the overall medical devices contract manufacturing market.

For pharmaceutical companies, increasing R&D costs is a challenge, which significantly affects their bottom line therefore they have partnered with CROs & CMOs for integrated outsourcing services. Outsourcing research activities to CMO or CDMO helps accelerate the workflow of companies, provide unique specialized services, decrease drug development costs, and provide the expertise & experience needed for assisting research.

For many pharmaceutical companies, innovations and speed-to-clinic factors are of critical importance. Small companies and specialty pharmaceutical players increasingly rely upon delivering these important requirements within the industry. Many CROs and CDMOs promote themselves as one-stop-shop companies. The one-stop-shop service model is where a CRO handles everything from API to dosage form and early development to commercialization. To provide these services, a CDMO must have a wide range of enabling technologies and specialized handling capabilities to address specific problem statements. Although these services address many problem statements, there is a wide range of product design capabilities among CDMO players that can be critical in scaling a product concept and bringing it to the market.

Browse through Grand View Research's Medical Devices Industry Related Reports

Large Molecule Drug Substance CDMO Market - The global large molecule drug substance CDMO market size was valued at USD 11.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030.

Investigational New Drug CDMO Market - The global investigational new drug CDMO market size was valued at USD 4.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2021 to 2028.

Healthcare Contract Development And Manufacturing Organization Industry Segmentation

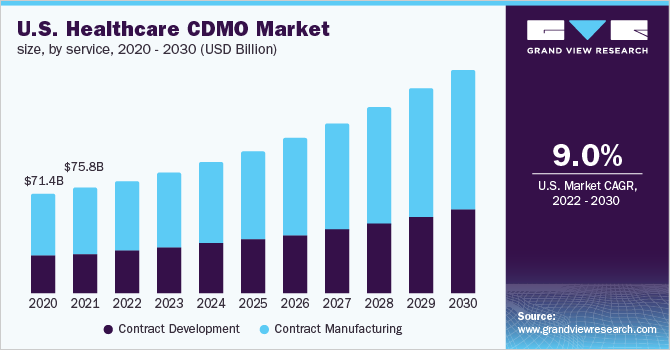

Grand View Research has segmented the global healthcare contract development and manufacturing organization market based on services and region:

Services Outlook (Revenue, USD Billion, 2018 - 2030)

- Contract development

- Contract manufacturing

Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Key Companies profiled:

Some prominent players in the global Healthcare Contract Development And Manufacturing Organization Industry include

- Catalent Inc.

- Lonza Group Ltd.

- Recipharm AB

- Siegfried Holding AG

- Thermo Fisher Scientific Inc.

- Covance Inc.

- Jabil

- Sanmina Corporation

- IQVIA Holdings Inc.

- Flex

Order a free sample PDF of the Healthcare Contract Development And Manufacturing Organization Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment