COVID-19 Sample Collection Kits Industry Overview

The global COVID-19 sample collection kits market size was valued at USD 6.48 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030. SARS-CoV-2 sampling is the most critical step in the effective diagnosis of active infection. False and imprecise specimen collection may lead to wrong or misleading test results. As a result, the Centers for Disease Control and Prevention (CDC) and other healthcare organizations have introduced standard procedures and guidance for effective specimen collection and streamlining the usage of COVID-19 sample collection solutions, thereby driving the market. In October 2021, the FDA granted Labcorp an Emergency Use Authorization (EUA) for a combination home collection kit that may detect COVID-19 plus influenza A/B in children as young as two years old. Those who match clinical standards, such as having symptoms, being contacted by someone with COVID-19, or being requested to be diagnosed by a health care physician, will receive the kit free of charge.

The key stakeholders have collaborated with regional authorities and suppliers for preserving the manufacturing conditions and accelerating the company’s growth in swabs and the viral transport medium market. With the ongoing surge in demand due to the COVID-19 outbreak, companies are focusing on strategic products to maximize product output and supply. Moreover, there have been 424,822,073 confirmed cases of COVID-19 till February 2022, as per the WHO. As the number of COVID-19 cases rises, more COVID-19 collection kits are required, thereby boosting the growth of the market in the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global COVID-19 Sample Collection Kits Market

Furthermore, despite the high vaccination rate, contaminated patients can still transfer the disease, driving the transmission. Moreover, ongoing virus mutation generates variations in the viral structure, making vaccinations ineffective. As a result of these circumstances, demand for COVID-19 detection kits rises, boosting the total market growth.

The availability of swabs in various configurations for advanced infection detection is one of the key market drivers. For instance, in November 2020, researchers at the University of South Florida (USF) Health introduced a 3D printed nasal swab prototype for commercial usage. As of 25th November 2020, the organization has developed 100,000+ products, and hospitals across the globe have implemented their 3D files to develop tens of millions more swabs for use in a point-of-care setting.

Furthermore, the advent of antigen tests to fill the timeline and capacity gaps in the testing landscape is anticipated to spur the usage of Nasopharyngeal (NP) swabs across the globe. The U.S. government signed a USD 760 million deal with Abbott over its BinaxNOW COVID-19 Ag Card in August 2020. With this, the government aimed at tripling the national testing capacity. Such collaborations between the diagnostic players and government bodies are anticipated to greatly benefit the swab suppliers in the country.

In September 2021, Quidel Corporation has stated that their non-prescription QuickVue In-Home OTC corona-virus Test will be available to more than 7,000 CVS Pharmacy branches nationwide as well as online at cvs.com. Two self-administered fast antigen tests are included per shelf-stable packet.

Browse through Grand View Research's Healthcare Industry Related Reports

Real-time PCR, Digital PCR, And End-point PCR Market - The global real-time PCR, digital PCR, and end-point PCR market size was valued at USD 31.64 billion in 2021 and is expected to decline at a compound annual growth rate (CAGR) of 8.2% from 2022 to 2030.

COVID-19 Diagnostics Market - The global COVID-19 diagnostics market size was valued at USD 97.4 billion in 2021 and is expected to decline at a compound annual growth rate (CAGR) of 7.7% from 2022 to 2030.

COVID-19 Sample Collection Kits Industry Segmentation

Grand View Research has segmented the global COVID-19 sample collection kits market based on product, application, site of collection, and region:

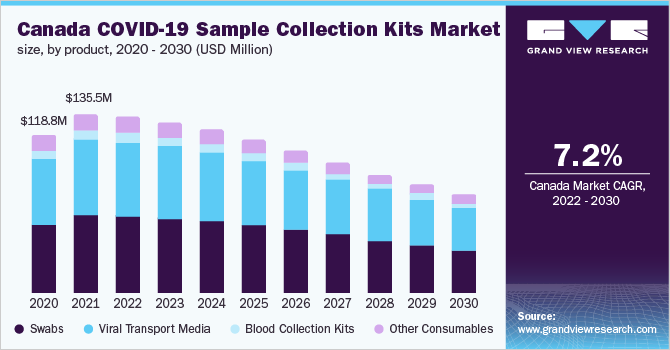

COVID-19 Sample Collection Kits Product Outlook (Revenue, USD Million, 2020 - 2030)

- Swabs

- Viral Transport Media

- Blood Collection Kits

- Other Consumables

COVID-19 Sample Collection Kits Application Outlook (Revenue, USD Million, 2020 - 2030)

- Diagnostics

- Research

COVID-19 Sample Collection Kits Site of Collection Outlook (Revenue, USD Million, 2020 - 2030)

- Hospitals & Clinics

- Home Test

COVID-19 Sample Collection Kits Regional Outlook (Revenue, USD Million, 2020 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Key Companies profiled:

Some prominent players in the global COVID-19 Sample Collection Kits Industry include

- Puritan Medical Products

- COPAN Diagnostics

- Becton, Dickinson and Company

- Thermo Fisher Scientific, Inc.

- Laboratory Corporation of America Holdings

- Lucence Diagnostics Pte Ltd.

- Hardy Diagnostics

- Trinity Biotech

Order a free sample PDF of the COVID-19 Sample Collection Kits Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment