Intravenous Infusion Pumps Industry Overview

The global intravenous infusion pump market size was estimated at USD 5.0 billion in 2021 and is anticipated to register a CAGR of 8.2% from 2022 to 2030. Intravenous infusion pumps are used to administer medications, hormones, and nutritional fluids into the circulatory system through veins in controlled amounts. These pumps are in extensive use in clinical settings such as hospitals, nursing homes, and the home. The pump is operated by the trained operator by programming the rate and duration of fluid delivery by means of built-in software. Intravenous infusion pumps can deliver nutrients, hormones, antibiotics, chemotherapy drugs, and pain relievers.

The advent of COVID-19 resulted in burdening of healthcare infrastructure globally as the majority of elective healthcare treatments were postponed. However, the demand for these pumps such as insulin infusion pumps and volumetric infusion pumps witnessed an increase, as the majority of the patients suffering from chronic diseases were treated remotely from home to prevent the risk of disease transmission and unburden healthcare facilities.

Gather more insights about the market drivers, restraints, and growth of the Global Intravenous Infusion Pumps Market

Infusion pumps offer various advantages over manual administration of medicated fluids like the ability to deliver fluids in very small volumes, and the ability to deliver fluids at precisely programmed rates or automated intervals and is therefore highly adopted by healthcare systems currently. However, product recalls and infusion pumps malfunctions such as software defects and user interface issues are major growth restraining factors for the market

These pumps are mainly used to administer critical fluids that include high-risk medication. Most of the infusion pumps are equipped with safety features and inbuilt alarms for operator alerts intended to activate in the event of a problem. Many conditions such as immune deficiencies, cancer, and congestive heart failure cannot be treated with oral medications and require infusion therapy.

While administering medication, vitamins, minerals, amino acids, and varied essential micronutrients can also be added to the infusion for collateral nutrition. Smart pumps are intravenous pumps that are technologically advanced with automation, drug libraries, and various operator and patient safety features for accurate, precise, and controlled delivery of fluids into the patient system especially beneficial in the treatment of chemotherapy, and this is the reason smart pumps are gaining a lot of popularity in the medical sector.

The demand for these pumps increased considerably after the onset of COVID-19. Smiths Medical stated that demand for items such as ventilators, airway management products, patient monitors, and infusion pumps increased substantially. The company’s revenue from infusion systems increased by 4% in 2020, driven by COVID-19-related demand. ICU medical also reported that the demand for its infusion systems increased due to high demand from existing customers and government stockpile orders.

The demand for intravenous pumps in the post-pandemic era is also expected to witness significant growth as the prevalence of diseases like diabetes, cancer, and heart ailments are expected to rise due to rapid lifestyle changes. These factors will boost market growth throughout the forecast period.

Browse through Grand View Research's Medical Devices Industry Related Reports

Home Infusion Therapy Market - The global home infusion therapy market size was valued at USD 33.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030.

Intrathecal Pumps Market - The global intrathecal pumps market size was valued at USD 325.6 million in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030.

Intravenous Infusion Pumps Industry Segmentation

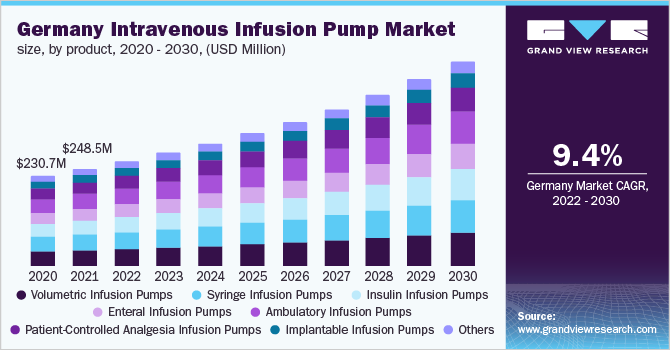

Grand View Research has segmented the global Intravenous infusion pumps market based on product, disease indication, end-user and region:

Intravenous Infusion Pumps Product Outlook (Revenue, USD Million, 2018 - 2030)

- Volumetric Infusion Pumps

- Insulin Infusion Pumps

- Syringe Infusion Pumps

- Enteral Infusion Pumps

- Ambulatory Infusion Pumps

- Patient Controlled Analgesics (PCA)

- Implantable Infusion Pumps

- Others

Intravenous Infusion Pumps Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Chemotherapy

- Diabetes

- Gastroenterology

- Analgesia/Pain Management

- Pediatrics/Neonatology

- Hematology

- Others

Intravenous Infusion Pump End-User Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals & Clinics

- Home Healthcare

- Other End-user

Intravenous Infusion Pumps Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

January 2020: Medtronic announced the launch of software Efficio to efficiently manage targeted drug delivery in SynchroMed II.

May 2018: Baxter International launched SpectrumIQ, an infusion pump technology with integrated EMR (Electronic Medical Records), and DeviceVue, an asset tracking software to improve the efficiency of drug delivery.

Key Companies profiled:

Some prominent players in the global Intravenous Infusion Pumps Industry include

- Baxter International

- B. Braun Melsungen AG

- Medtronic

- Micrel Medical Devices SA

- Boston Scientific Corporation

- Becton, Dickinson, and Company

- Fresenius Kabi

- Smiths Medical

- F. Hoffmann-La Roche Ltd.

- Tandem Diabetes Care, Inc.

- Terumo Corporation

- Mindray

- Moog Inc.

- IRadimed Corporation

Order a free sample PDF of the Intravenous Infusion Pumps Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment