Cannabis Pharmaceuticals Industry Overview

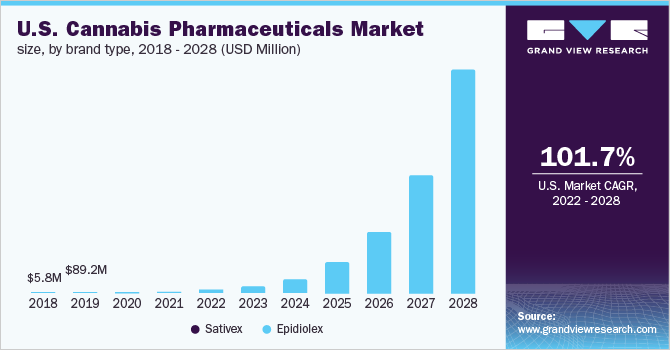

The global cannabis pharmaceuticals market size was valued at USD 943.5 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 104.2% from 2022 to 2028. Wide-scale applications of cannabis in various medical applications are driving the market. For instance, cannabis is widely used for treating patients suffering from chronic conditions, such as Parkinson’s disease, cancer, arthritis, and Alzheimer’s disease, as well as neurologic problems such as depression, anxiety, and epilepsy. Moreover, there is a growing disease burden of chronic pain and pain management therapies. This, in turn, is increasing cannabis product consumption as it is effective in pain management.

There is increasing legalization and decriminalization of cannabis in various countries owing to its therapeutic effects. For instance, medical cannabis is legal in countries such as the U.S., Canada, the U.K., Croatia, Czech Republic, Cyprus, Columbia, Chile, Australia, Barbados, Denmark, Finland, Poland, and Portugal among others. Moreover, a continuous political movement supporting cannabis legalization is driving the market for cannabis pharmaceuticals. For instance, in May 2021, the U.S. representative reintroduced the MORE (Marijuana Opportunity, Reinvestment, and Expungement) Act in the U.S. House of Representatives. Furthermore, in December 2020, the MORE Act was previously passed in the House of Representatives, but it did not advance in the Senate.

Gather more insights about the market drivers, restraints, and growth of the Global Cannabis Pharmaceuticals Market

The MORE Act, if passed, would drive the demand for cannabis products in the U.S. This in turn is estimated to positively impact the growth of the pharmaceutical cannabis market. An increasing number of cannabis physicians prescribing cannabis products owing to increasing consumer acceptance is estimated to drive market potential. For instance, the number of health care practitioners registered with federally licensed sellers in Canada in September 2019 was 6700 which increased to 7,781 in March 2021. Moreover, increasing consumer acceptance is supporting the growth of the market for cannabis pharmaceuticals. according to the Centers for Disease Control and Prevention, 48.2 million people in the U.S., or 18% of the American population have consumed marijuana at least once in 2019.

The COVID-19 pandemic and associated social distancing norms and lockdown affected all industries globally. Although the COVID-19 pandemic negatively impacted sales of various product categories, major cannabis pharmaceutical brand - Epidiolex, witnessed positive growth in sales. This is attributed to high refill rates due to customer satisfaction and expansion of payer coverage. Sales of legal cannabis increased drastically in 2020 during the COVId-19 pandemic. For instance, Americans purchased USD 10.7 billion in cannabis and its products in 2019 which increased to USD 18.3 billion in 2020, according to Leafly, a leading cannabis website. Governors of various states in the U.S. declared cannabis an essential product. Moreover, many retail stores and dispensaries started offering cannabis products through the online sales channel. Thus, increasing consumption of cannabis products is estimated to positively impact market growth.

Stakeholders in the cannabis industry and research institutes are undertaking various research studies to prove various claims made on CBD products which in turn is driving the market for cannabis pharmaceuticals. Moreover, innovative products are introduced to cater to growing consumer demand. For instance, in November 2021, Colorado State University opened a new research center for CBD. In November 2021, AMP Alternative Medical Products GmbH-a a fully owned subsidiary of Greenrise Global Brands, Inc.-introduced Dronabinol products into the German market. Additionally, companies are adopting various strategies to expand their market presence. In November 2021, Avicanna, a biopharmaceutical company, entered into an IP and distribution agreement with an established pharmaceutical company in Argentina. Under this agreement, Avicanna will be providing a nonexclusive license of the company’s IP with respect to its proprietary 10% CBD pharmaceutical drug preparation.

Browse through Grand View Research's Pharmaceuticals Industry Related Reports

Cannabis Extract Market - The global cannabis extract market size was valued at USD 2.74 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.6% from 2022 to 2030.

Cannabidiol Market - The global cannabidiol market size was valued at USD 5.18 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2022 to 2030.

Cannabis Pharmaceuticals Industry Segmentation

Grand View Research has segmented the global cannabis pharmaceuticals market report on the basis of brand type, and region:

Cannabis Pharmaceuticals Brand Type Outlook (Revenue, USD Million, 2016 - 2028)

- Sativex

- Epidiolex

Cannabis Pharmaceuticals Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

February 2021: Jazz Pharmaceuticals PLC announced its plans to acquire GW Pharmaceuticals. Upon completion of the acquisition, Jazz Pharmaceutical would have an enhanced neuroscience product portfolio with an increased global commercial footprint.

Key Companies profiled:

Some prominent players in the global Cannabis Pharmaceuticals Industry include

- GW Pharmaceuticals, plc

- Insys Therapeutics

- Abbvie

- Valeant Pharmaceuticals (Bausch Health Companies, Inc.)

Order a free sample PDF of the Cannabis Pharmaceuticals Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment