Food Waste Management Industry Overview

The global Food Waste Management Market reached a valuation of USD 69.8 billion in 2022 and is anticipated to register a CAGR of 5.4% between 2023 and 2030. The increasing amount of food waste, a consequence of rising populations and heightened manufacturing and consumption rates, is a key driver. Shifts in consumer preferences further contribute to market expansion. According to the FAO, approximately 1.4 billion tons of food are wasted globally each year, while the U.S. alone discards between 40 and 80 billion pounds annually. The U.S. Department of Agriculture estimates this equates to 219 pounds of food waste per person in the U.S., a figure expected to positively influence the food waste management market. The COVID-19 pandemic also played a role, causing supply chain disruptions that increased food waste, especially for perishables, in countries like South Africa, UAE, and Saudi Arabia.

Detailed Segmentation:

- Waste Type Insights

The fruit and vegetable segment dominated the market and accounted for 20.3% of the total revenue share in 2022 owing to improper handling, storage, processing, and cultivation of the produce. Improper storage and handling of fresh produce lead to spoilage, which, in turn, is expected to lead to higher amounts of waste as compared to other segments, thereby driving the demand for the food waste management market.

The dairy & dairy product segment is expected to register a CAGR of 5.2% over the forecast period, due to product spoilage brought on by unsanitary storage at the wrong temperature. The demand for the food waste management industry is anticipated to increase due to developing nations' lack of infrastructure for cold storage of dairy products.

- Source Insights

The residential source segment dominated the market and accounted for 44.2% of the total revenue share in 2022. Residential food waste is anticipated to increase due to the rapidly expanding population and changing lifestyles. Inadequate food management, excessive food preparation, excessive shopping, poor cooking skills, and inadequate storage are some factors that contribute to food waste in homes.

The commercial segment is expected to register a CAGR of 6.0% over the forecast period owing to several factors such as overstocking, inefficient production, unskilled trimming, unidentified demand, spoilage, expiration, and overproduction of food items by hotels, restaurants, street food vendors, and cafes.

- Service Types Insights

The collection segment dominated the market and accounted for 55.8% of the total revenue share in 2022. Segregation of food waste, loading, and unloading of waste, selection of a suitable area for food waste storage at a minimum distance from where the food waste is created, and food waste upkeep are part of food waste collection. Food waste collection companies must consider frequent cleaning and maintenance of these storage areas.

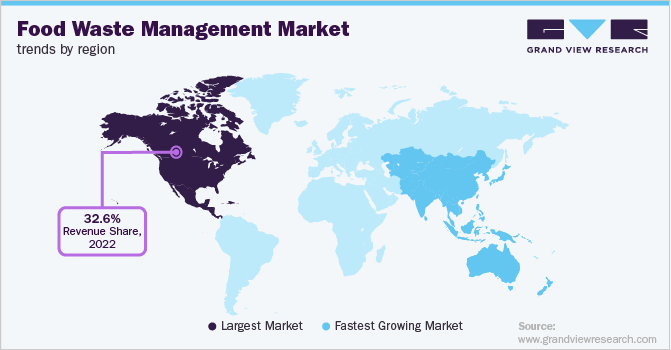

- Regional Insights

Asia Pacific region is expected to witness a CAGR of 5.9% over the forecast period. The food and beverage industry in Asia Pacific is a major factor in the economic development of the region. Substantial growth is expected in food trade with increasing levels of national and regional specialization. With a growing population and rising income, the food sector is likely to expand rapidly over the forecast period, thereby contributing to the market growth.

Gather more insights about the market drivers, restraints, and growth of the Food Waste Management Market

Key Companies & Market Share Insights

Availability of skilled technical professional personnel, specialized equipment, quality of service, diversity of services, and prices are the key competitive factors in the industry. In addition, factors such as government policies, technology, high EPA fees, high capital investment, and the high cost of licensing restrict the entry of new players into the market. For instance, the U.S. has set a goal of reducing food waste by 50% by 2030 through its Department of Agriculture (USDA) and Environmental Protection Agency (EPA). Some of the prominent players in the global food waste management market include:

- Veolia

- Suez

- Waste Management, Inc.

- Republic Services, Inc.

- Covanta Ltd.

- Stericycle, Inc.

- Remondis SE & Co., KG

- Clean Harbors, Inc.

- Biffa

- Rumpke

- Advanced Disposal Services, Inc.

- Cleanaway

- FCC Recycling (UK) Limited

- DS Smith

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment