Halal Food and Beverage Industry Overview

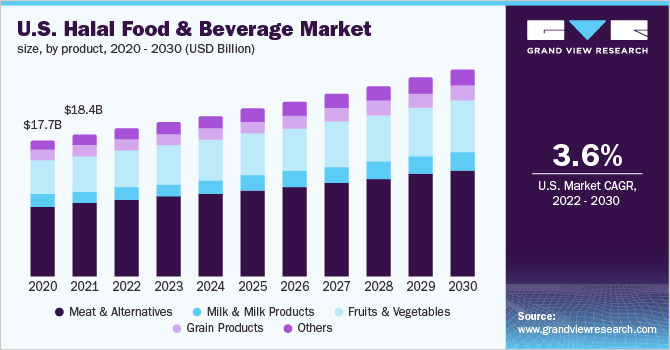

The global Halal Food and Beverage Market, valued at USD 774.93 billion in 2021, is projected to grow at a compound annual growth rate (CAGR) of 3.6% from 2022 to 2030. This expansion is primarily driven by the increasing global Muslim population and a growing emphasis on food safety, hygiene, and reliability. According to a 2019 Pew Research Centre article, there are 1.8 billion Muslims worldwide. In response to rising demand, manufacturers have expanded their product offerings to include various value-added halal items like pasta, vegetables, juice, milk, yogurt, and cheese. Furthermore, the production of halal-certified foods by key market players will enhance product visibility among consumers.

The COVID-19 pandemic caused significant disruptions to the food supply chain, impacting the halal food industry through labor shortages and import/export issues, which negatively affected consumption and sales. Additionally, safety and hygiene concerns led to a slowdown in meat product demand. For instance, a July 2021 Bloomberg article reported a over 12% decrease in U.S. grocery store meat sales compared to pre-pandemic levels. However, the increasing consumer preference for nutritious and safe quality food is expected to drive market growth in the forecast period.

Detailed Segmentation:

- Product Insights

The meat & alternatives segment held the largest market share of 51.6% in 2021 and is expected to maintain dominance during the forecast period. Growing consumer preference for bacteria-free meat owing to health, hygiene, and safety concerns, the demand for these products will witness a rise in the foreseeable period. According to an article published in the National Library of Medicine, in June 2020, 70% of consumers in England prefer halal meat over normal meat. Also, 50.8% of consumers eat meat once a week, 45.6% once a day, 3.2% once a month, and 0.4% eat meat occasionally. Moreover, respect for the welfare of animals, and a degree of acculturation are also some of the vital influencers in the growth of the segment.

- Distribution Channel Insights

Hypermarket & supermarket was a larger distribution channel with a market share of around 75.5% in the global revenue in 2021. An increasing number of these stores across various regions have experienced a surge in the distribution of halal food in the market. According to an article published by Taylor & Francis Online, in October 2020, 16% of consumers from educated big families, 13% from educated small families, and 5% of young residents prefer to buy these products from national supermarkets in Norway. Further, the convenience of physically verifying halal-certified products in these stores will vouch for the growth of this segment.

- Regional Insights

Asia Pacific made the largest contribution to the global market with a share of 60.3% in 2021. The migration of people from Muslim-dominated nations to other regions is a part of the vital dynamics responsible for the significantly rising Muslim population in the Asia-Pacific region. With the increase in the number of Muslims, the demand for these types of food has also increased, and this trend is anticipated to continue during the forecast period, hence, driving the market in this region. According to an article published by Pew Research Centre, in April 2019, India will host an 11.1% Muslim population in 2060 in the country. The rapidly increasing Muslim population and their psychological development are the main factors expected to drive the market during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Halal Food and Beverage Market

Key Companies & Market Share Insights

The halal food & beverage market is highly fragmented with the presence of a large number of regional and local players. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

- For instance, in August 2021, Crescent Foods, an American pioneer in premium hand-cut halal meat and poultry products launched a turnkey foodservice program for college and university dining halls, nationwide. The company will offer a wide range of products including hand-cut beef, lamb, turkey (seasonally), and chicken products for on-campus dining, including restaurants.

- In January 2021, Nigeria leveraged on public-private partnership with OneAgrix for better Agriculture and Halal market access under AfCFTA. This will enable the country to gain better market access by using OneAgrix’s trading platform both regionally and globally.

- In February 2022, Chicken Cottage announced to enter the East African market through a franchising partnership agreement with Express Kitchen, a subsidiary of AAH Limited to expand their business line.

Some of the key players operating in the halal food and beverage market include:

- Nestlé S.A

- Cargill, Incorporated

- Unilever

- American Halal Company, Inc.

- Al-Falah Halal Foods

- Prima Agri-Products

- One World Foods Inc.

- Midamar Corporation

- QL Foods

- Rosen's Diversified Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment