Cannabis Pharmaceuticals Industry Overview

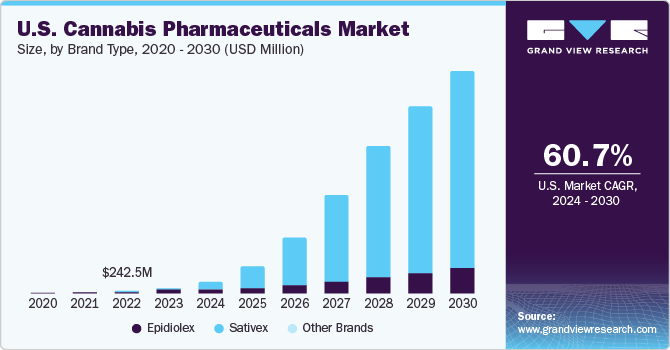

The global Cannabis Pharmaceuticals Market reached an estimated size of USD 3.4 billion in 2023 and is forecast to grow at a robust CAGR of 53.3% from 2024 to 2030. This growth is primarily attributed to increased awareness of medicinal cannabidiol (CBD) drugs and a growing trend towards prescribing cannabis-based medications. A significant driver is the rising adoption of pharmaceutical products containing cannabis for various medical disorders, including chronic pain, sleep disorders, anorexia, inflammation, schizophrenia, multiple sclerosis, and epilepsy.

Fueling this market expansion is the increasing number of clinical trials demonstrating the positive effects of cannabis pharmaceuticals in treating conditions like multiple sclerosis, epilepsy, chronic pain, and cancer. A Royal Australian College of General Practitioners (RACGP) study from October 2021 reported over 5.5 million Australians with chronic pain using cannabis as medication. Furthermore, over 125,000 SAS-B approvals were issued by July 2021, with over 60% for chronic pain. These positive clinical outcomes are shifting patient and healthcare professional perspectives on cannabis-based pharmaceuticals. As of 2023, ClinicalTrials.gov listed around 847 active studies for Sativex and approximately 401 for Epidiolex.

Detailed Segmentation:

- Brand Type Insights

Based on brand type, the Epidiolex segment led the market and accounted for 48.6% of the global revenue in 2023. Epidiolex is a prescription-based medicine that is utilized for the treatment of seizures associated with Dravet syndrome and Lennox-Gastaut syndrome detected in patients aged 1 year & above. In the European Union, it is approved in 27 countries, along with Liechtenstein, Iceland, and Norway. Growing awareness, clinical trials, and research claiming positive applications of the drug on certain medical conditions are expected to increase the adoption of Epidiolex over the forecast period.

Sativex is expected to grow at a lucrative rate over the forecast period. The increasing number of approvals for this medication for the treatment of symptoms such as spasticity caused due to multiple sclerosis in different countries is expected to boost the growth of this brand over the forecast period. In addition, as of 2023, Sativex had been approved in around 29 countries for the treatment of muscle spasticity associated with multiple sclerosis. Moreover, an increase in the number of clinical trials of the drug for other medical conditions such as spinal cord injury, posttraumatic stress disorder, neurological conditions, chronic pain, and cancer is further expected to drive the market over the forecast period.

- Regional Insights

The cannabis pharmaceutical market in Europe accounted for the largest revenue share of 41.9% globally. This is attributed to increasing cannabis consumption, rising awareness, and positive attitudes towards cannabis and its products. The presence of major manufacturers and various initiatives by key cannabis players in the region support the market growth. For instance, in August 2020, INFORMED I.P., a regulatory authority in Portugal, granted a license to Clever Leaves, a provider of legal cannabis, for the cultivation, import, and export of medical cannabis.

North America is the second largest cannabis pharmaceuticals market worldwide, owing to the rising awareness regarding the medical benefits of cannabis-based products, the easy availability of cannabis-based medicines, and the large distribution network of Sativex in the Canadian markets. Furthermore, the region has a large number of patients suffering from mental disorders, chronic pain, and cancer. These individuals depend more on cannabis-based products as compared to traditionally available pharmaceutical products owing to its high efficiency. This is further anticipated to drive the market in the region over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Cannabis Pharmaceuticals Market

Key Companies & Market Share Insights

Companies are turning to expansion in their product portfolios as well as expansion through mergers and acquisitions of small players in the industry. For instance, June 2023 marked a partnership between Avicanna Inc., a cannabinoid-based pharmaceutical company, and the Canadian Consortium for the Investigation of Cannabinoids to develop an educational course accessible to the medical community across Canada.

Key Cannabis Pharmaceuticals Companies:

The following are the leading companies in the cannabis pharmaceuticals market. These companies collectively hold the largest market share and dictate industry trends.

- Jazz Pharmaceuticals, Inc.

- AbbVie, Inc.

- Insys Therapeutics, Inc.

- Bausch Health Companies, Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In September 2023, SOMAÍ Pharmaceuticals, a European manufacturer of pharmaceutical cannabis products, received authorization from the Portuguese Health Authority INFRAMED to produce, import, and export for its facility in Lisbon, Portugal.

- In August 2023, Avicanna Inc. completed the acquisition of the Medical Cannabis by Shoppers operation from Shoppers Drug Mart, subsequently introducing a new medical cannabis care platform called MyMedi.ca.

- In February 2023, Aurora Cannabis Inc., a Canadian company, partnered with MedReleaf Australia to introduce CraftPlant, a new medical cannabis brand. This launch introduced three innovative products, Navana, HiVolt, and Greendae, to serve the Australian patient community.

- In January 2023, Celadon Pharmaceuticals Plc declared that the UK Medicines and Healthcare Products Regulatory Agency (MRHA) had officially registered its cannabis active pharmaceutical ingredient at its Midlands facility in the UK, meeting the Good Manufacturing Practice (GMP) standards.

No comments:

Post a Comment