Cloud Gaming Industry Overview

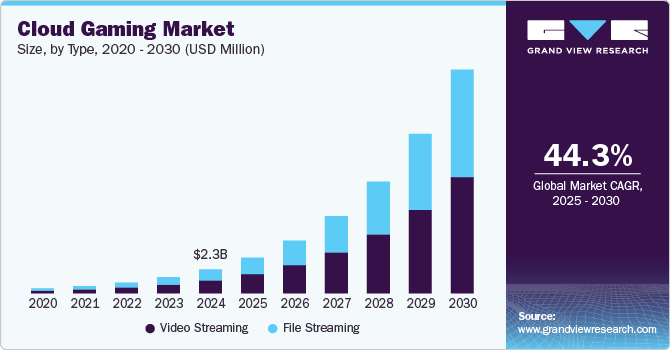

The global Cloud Gaming Market, valued at an estimated $2.27 billion in 2024, is poised for remarkable expansion, projecting a compound annual growth rate (CAGR) of 44.3% from 2025 to 2030. This significant market growth is primarily driven by the increasing availability of high-speed internet connectivity and the widespread integration of 5G technology. Furthermore, the cost-efficiency of cloud gaming is a crucial factor, as it removes the necessity for expensive gaming hardware, thus democratizing access to high-quality gaming experiences. The growing prevalence of smartphones as primary gaming devices further accelerates market expansion, alongside the availability of extensive game libraries and flexible, value-driven subscription models. These elements are anticipated to create substantial growth opportunities for the market.

Cross-platform gameplay is gaining significant traction within the cloud gaming sector, fueled by increasing consumer demand for fluid and adaptable gaming experiences. By allowing users to start playing a game on one device, such as a smartphone, and seamlessly continue on another, like a tablet, PC, or smart TV, platforms are overcoming traditional hardware barriers. This capability is powered by a central cloud infrastructure that ensures real-time synchronization of user data and game progress. This trend is expected to be instrumental in fostering long-term user loyalty and driving sustained growth within the competitive landscape of the cloud gaming industry.

Detailed Segmentation:

- Type Insights

The file streaming segment is expected to witness the highest CAGR of over 45% from 2025 to 2030, driven by the growing need for seamless, instant access to game files and content without needing physical downloads or storage. As internet speeds improve and cloud infrastructure becomes more reliable, gamers can access and play their games from any device with minimal latency, reducing the burden on local storage. This trend is particularly relevant in a world increasingly reliant on cloud storage, where gamers can switch between devices without losing progress, fostering a more flexible and accessible gaming experience.

- Gamer Type Insights

The casual gamer segment accounted for the largest market share in 2024, owing to the accessibility and convenience that cloud gaming offers. With no need for high-end gaming hardware, casual gamers can easily access a wide range of games through subscription services such as Xbox Cloud Gaming, Google Stadia, and Amazon Luna, which allow them to play on smartphones, tablets, or smart TVs. The appeal lies in the ability to play games on the go, the low barrier to entry, and the lack of need for consoles or powerful PCs. Moreover, the growing availability of affordable, casual-friendly game libraries and the increasing popularity of mobile gaming are driving segmental growth.

- Device Insights

The gaming consoles segment accounted for the largest market share in 2024, fueled by the evolution of consoles that integrate cloud gaming capabilities, offering players the option to stream games directly to their devices. In addition, the push towards digital-only games, coupled with more affordable and efficient cloud gaming services, is also driving the shift away from physical discs and towards streaming as the preferred method for gaming, thereby driving segmental growth.

- Regional Insights

The cloud gaming market in Europe is expected to grow at a CAGR of over 43% from 2025 to 2030. Increased internet speeds, a strong gaming culture, and a growing appetite for immersive gaming experiences drive this growth. Subscription-based services are gaining popularity, offering cost-effective access to a wide range of games. In addition, the integration of cloud gaming with other entertainment platforms is enhancing user engagement and expanding the reach of services.

Gather more insights about the market drivers, restraints, and growth of the Cloud Gaming Market

Key Companies & Market Share Insights

Some key players operating in the market include Amazon Web Services, Inc. and NVIDIA Corporation.

- Amazon Web Services, Inc., a subsidiary of Amazon.com, is a cloud infrastructure provider, offering a broad set of services, including computing, storage, databases, AI, and machine learning. In the cloud gaming space, AWS supports game developers and publishers through services such as Amazon GameLift, a managed service for deploying, operating, and scaling multiplayer game servers.

- NVIDIA Corporation is a global player in graphics processing technologies and AI computing. It has become a key player in cloud gaming through its GeForce NOW platform, which allows users to stream high-end games to low-power devices. The company is investing in AI and generative technologies for gaming, including collaborations with key companies to integrate AI-powered avatars and storytelling tools into the gaming ecosystem.

Key Cloud Gaming Companies:

The following are the leading companies in the cloud gaming market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Apple Inc.

- Backbone Labs

- Electronic Arts, Inc.

- Google LLC

- Intel Corporation

- International Business Machines Corporation (IBM Corporation)

- Microsoft Corporation

- NVIDIA Corporation

- Sony Interactive Entertainment

- Ubitus K.K.

- Tencent Holdings Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In March 2025, Amazon Web Services, Inc. (AWS) introduced Amazon GameLift Streams, a managed service enabling developers to stream games at up to 1080p resolution and 60 frames per second to any device with a WebRTC-enabled browser. This capability supports a variety of 3D engines with minimal to no code modification, allowing for quick deployment and testing.

- In January 2025, NVIDIA Corporation announced plans to launch its GeForce NOW cloud gaming service in India by the first half of the year. The service will be powered by a new data center equipped with GeForce RTX 4080 GPUs, enabling gamers to stream AAA titles in 4K resolution at 60fps without needing high-end hardware.

- In March 2024, Ubitus K.K. announced a strategic investment from NVIDIA Corporation to enhance its generative AI and cloud gaming capabilities across Asia. This partnership aimed to leverage NVIDIA's accelerated computing to advance Ubitus' AI-driven solutions.

No comments:

Post a Comment