Expanded Polystyrene Industry Overview

The global Expanded Polystyrene (EPS) Market, valued at USD 10.18 billion in 2022, is projected to grow at a robust compound annual growth rate (CAGR) of 8.59% from 2023 to 2030. This growth is significantly influenced by increasing social factors, including a greater focus on improving occupant health and well-being, promoting sustainable business practices, and fostering a sense of community. Furthermore, the inherent properties of expanded polystyrene (EPS), such as its resistance to moisture, excellent thermal insulation capabilities, and superior shock absorption, are driving its increased adoption in packaging applications. The substantial growth observed in the food service industry, fueled by a rising number of food retail chains and increasing consumer demand for packaged food, is also expected to significantly boost the consumption of EPS.

Within North America, the U.S. held a dominant position and is anticipated to be among the fastest-growing markets in the region in 2023. The escalating demand for EPS from the construction and packaging sectors within the U.S. is expected to be a key driver of market growth throughout the forecast period. The U.S. packaging industry has experienced positive demand across various end-user sectors, including consumer goods, retail, food, and pharmaceuticals. This rising demand can be attributed to high levels of urbanization, increasing e-commerce penetration, and the expanding packaged and processed food market in the country. The COVID-19 pandemic further accelerated the demand for online shopping and packaged & processed food due to movement restrictions and social distancing measures implemented by governments.

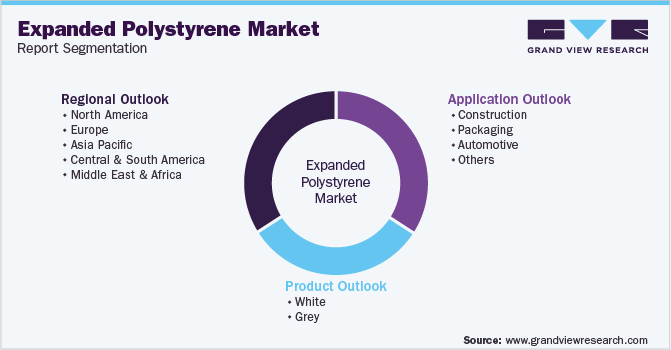

Detailed Segmentation:

- Application Insights

Based on applications, the global industry has been further segmented into construction, packaging, automotive, and others. The construction application segment dominated the industry in 2022 and accounted for more than 44.0% of the total revenue share. The demand for expanded polystyrene in construction applications is expected to witness significant growth over the forecast period owing to the various characteristics of EPS, including great thermal insulation, low weight, chemical inertness, and resistance to bacteria and pests, among others. Expanded polystyrene is widely used in packaging applications.

- Product Insights

Based on products, the global industry has been further bifurcated into white and grey EPS. The white product segment dominated the industry in 2022 and accounted for more than 62.70% of the overall revenue share. White EPS is majorly used in packaging applications, such as food packaging of food trays, drink cups & clamshell containers, consumer goods packaging, and electronics products packaging. The grey EPS segment is expected to register a significant growth rate over the forecast period on account of its usage in several applications.

- Regional Insights

The Asia Pacific region dominated the industry in 2022 and accounted for more than 40.70% of the overall revenue share. Asia Pacific is expected to be one of the largest as well as the fastest-growing regional markets over the forecast period, primarily fueled by the ascending demand for the product from key applications, including automotive, packaging, and construction, in emerging economies, such as China and India. Moreover, the rapidly growing construction industry in the Asia Pacific region will support regional growth. The construction sector in North America is expected to witness significant growth in the coming years owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges.

Gather more insights about the market drivers, restraints, and growth of the Expanded Polystyrene Market

Key Companies & Market Share Insights

The expanded polystyrene (EPS) industry is highly competitive in nature, with the presence of large multinational companies as well as medium-scale local players. In the recent past, the industry has been undergoing consolidation, with the efforts mainly aimed at greater integration into value-added products such as EPS-based insulation materials. For example, In October 2024, Carlisle Companies Inc. announced a definitive agreement EPS insulation business of PFB Holdco, Inc., which includes the latter’s Plasti-Fab and Insulspan brands. PFB is a key player in Canada and Midwestern United States. The acquisition, valued at nearly USD 260 million, focuses on Carlisle’s Vision 2030 strategy, focusing on M&As as a growth driver and identifying cost synergies through PFB’s vertically integrated polystyrene manufacturing capabilities.

Reprocessed PP and HDPE are produced by Lancashire-based Venture and Cheshire-based Venture, with a combined capacity of 20,000 tons. A majority of the global companies are expected to increase their polymer offerings to Asia Pacific, Central & South America, and the Middle East & Africa owing to high market growth potential in these regions given the expansion of the EPS market. Some of the prominent players operating in the global expanded polystyrene market are:

- Atlas Roofing Corp.

- Alpek S.A.B. de C.V.

- BASF SE

- Kaneka Corp.

- SIBUR Holding PJSC

- BEWI, SUNPOR

- Synthos

- TotalEnergies

- Flint Hills Resources

- NOVA Chemicals Corporate

- StyroChem

- Ravago Manufacturing

- UNIPOL

- Versalis S.p.A.

- SABIC

- Sundolitt Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment