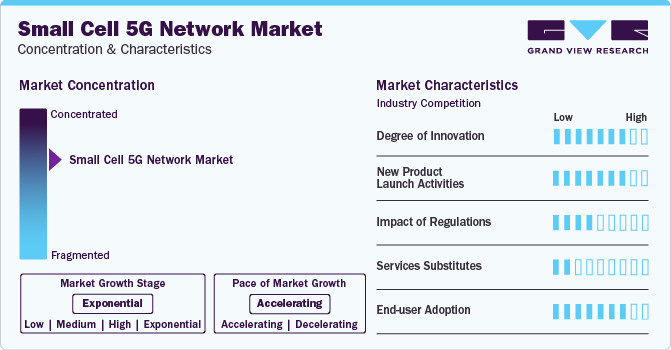

Small Cell 5G Network Industry Overview

The global Small Cell 5G Network Market, estimated at USD 2.76 billion in 2023 with a hardware volume of 2,170 thousand units, is projected to experience remarkable growth at a CAGR of 70.7% from 2024 to 2030. This surge is primarily driven by the rapidly increasing consumer demand for high-speed mobile data connectivity, leading to greater deployment of the next-generation 5G Radio Access Network (RAN). The expanding installation of small cell 5G networks across industrial, enterprise, and residential sectors aims to deliver enhanced coverage and capacity cost-effectively. Furthermore, the swift development of smart cities in nations like the U.S., Canada, Singapore, UK, Germany, Italy, and France has significantly boosted the deployment of small cell 5G networks for diverse applications spanning residential, industrial, commercial, and governmental uses.

The rapid global increase in mobile data traffic and 5G adoption is a key market driver. As demand for 5G services rises, telecom service providers are making substantial investments in developing and enhancing 5G infrastructure. While 5G services were initially launched utilizing existing (non-standalone) network infrastructure in several countries by 2022, the anticipated rapid growth in 5G users is expected to strain this infrastructure, necessitating a shift towards standalone 5G infrastructure deployment by telecom operators. Given that small cell 5G networks are a vital element of both standalone and non-standalone 5G ecosystems, the increasing demand for 5G and the growing deployment of standalone 5G network infrastructure are expected to generate significant market growth opportunities.

Detailed Segmentation:

- Component Insights

The Picocell segment is expected to register at a significant CAGR over the forecast period. Picocells play a vital role in covering a large portion of the population, delivering high-speed internet capacity in places like stadiums, concerts, festivals, and others, which is increasing its demand in the market. Moreover, telecom service providers still face uninterrupted data services across rural areas due to line-of-sight problems. Microcells provide seamless connectivity to consumers, especially in remote or rural areas up to 3 km of distance, which is anticipated to drive the demand for microcells in the market. The aforementioned factors it is expected to stimulate the implementation of picocells and microcells over the forecast period.

- Network Model Insights

Based on network model, the non-standalone (NSA) segment led the market with the largest revenue share of 82.0% in 2023. This is attributed to the early rollouts of the non-standalone network across the globe. The non-standalone network is commonly deployed in integration with the existing legacy network infrastructure, because of which it has been a time and cost-efficient option. Besides, several key service providers, such as AT&T, Inc. and Verizon Communications, have first deployed a 5G non-standalone (NSA) network model that caters to the primary use cases, including cloud-based AR/VR gaming, mobile streaming, and UHD videos.

- Network Architecture Insights

Based on network architecture, the virtualized segment led the market with the largest revenue share of 61.56% in 2023. The dominating share of the segment can be attributed to a robust deployment of a small cell 5G network with a centralized baseband unit controllable architecture. This helps service providers to reduce the Total Cost of Ownership (TCO) and increase the overall flexibility of the network by managing virtually all the small cell base stations. Besides, the introduction of Software-defined Networking (SDN) technology and Network Function Virtualization (NFV) to improve the operational efficiency of the RAN network is further expected to augment the segment growth over the forecast period.

- Deployment Mode Insights

Based on deployment mode, the indoor segment led the market with the largest revenue share of 76.0% in 2023. This is attributed to the growing demand for 5G indoor coverage. Small cells provide reliable 5G data connectivity across residential and non-residential applications. The non-residential uses mainly involve enterprises, retail malls, airports, and hospitals, among others. Moreover, the data published by China's Ministry of Industry and Information Technology (MIIT) states that high-value customers are devoting over 80% of their working hours to indoor premises. As a result, it is estimated to elevate the adoption of small cells for indoor applications over the forecast period.

- Frequency Type Insights

Based on frequency type, the sub-6 GHz led the market with the largest revenue share of 54.0% in 2023. This is attributed to the enormous investments by key communication service providers in acquiring low and mid-band frequencies to provide customers with high-bandwidth services for businesses and industrial applications. Recently, governments across major countries such as the U.S., China, South Korea, Japan, and many other countries unveiled sub-6 GHz frequencies to provide high-speed internet services in their countries. Furthermore, a few key small cell 5G component providers, such as Qualcomm Technologies, Inc., unveiled a new chipset for 5G small cells, which supports both sub-6GHz and mmWave frequency bands. Owing to the advantages of supporting multi-band frequencies, the sub-6GHz and mmWave segment is anticipated to gain considerable market growth in the forecast period.

- End-use Insights

Based on end-use, the commercial segment held the market with the largest revenue share of 42.2% in 2023. This is attributed to the growing deployment of small cell 5G networks across large as well as Small and Medium Enterprises (SMEs) across the globe. This 5G RAN network helps enterprises cater to the demand for massive data capacity and coverage needs at a very affordable cost. Moreover, small cell 5G networks also help organizations utilize the existing broadband infrastructure to deploy these next-generation networks. Besides, the small cell 5G networks have seen a colossal adoption across residential applications such as smart homes, cloud gaming, and home broadband.

- Regional Insights

The small cell 5g network market in Europe is expected to grow at a significant CAGR of 71.1% from 2024 to 2030. The European market's growth is attributed to the favorable regulatory policies in countries such as the UK, Germany, and France and large investments in 5G network infrastructure.

Gather more insights about the market drivers, restraints, and growth of the Small Cell 5G Network Market

Key Companies & Market Share Insights

- Airspan Networks Holdings Inc. is a technology leader in the 5G and 4G radio access network and broadband access solutions market. The company provides a broad range of software-defined radios, network management software, and broadband access products, which can potentially facilitate cost-effective deployment and efficient management of fixed, mobile, and hybrid wireless networks

- Mavenir is a cloud-native network software provider. It focuses on redefining network economics and accelerating software network transformation for Communications Service Providers (CSPs)

Key Small Cell 5G Network Companies:

The following are the leading companies in the small cell 5G network market. These companies collectively hold the largest market share and dictate industry trends.

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Fujitsu Limited

- CommScope Inc.

- Comba Telecom Systems Holdings Ltd.

- Altiostar

- Airspan Networks

- Ceragon

- Contela

- Corning

- Baicells Technologies

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In February 2023, Huawei Technologies Co., Ltd. unveiled a series of One 5G solutions, which can drive all bands to 5G. The company’s One 5G solutions can potentially unleash the power of all bands at a single site based on indoor digitalization, FDD, and TDD. The solutions were aimed at helping operators in building the most economical 5G networks

- In August 2022, Comba Network, a subsidiary of Comba Telecom Systems Holdings Ltd., was selected by China Mobile Limited, a telecom company, to participate in a significant 5G extended picocell deployment, which involves 20,000 small cell base stations

No comments:

Post a Comment