Trade Credit Insurance Industry Overview

The global Trade Credit Insurance Market, estimated at USD 10.58 billion in 2023, is anticipated to grow at a robust CAGR of 11.2% from 2024 to 2030. The increasing volume of trade across diverse geographical locations is a primary driver for the demand for trade credit insurance, as businesses seek to reduce the risk of non-payment from international buyers. Furthermore, the escalating levels of uncertainty and protectionism within global trade are expected to significantly boost the demand for trade credit insurance (TCI).

The business insights provided by insurers empower companies to identify potential payment issues, thereby allowing insured entities to conduct their operations with greater assurance. The adoption of digital software to optimize banking and insurance services, alongside the application of data analytics and blockchain technology in trade finance, is projected to stimulate market growth. Additionally, market participants are increasingly offering tailored trade credit solutions for digital platforms to gain a competitive advantage.

Detailed Segmentation:

- Enterprise Size Insights

Large enterprises led the market and accounted for 60.3% of the global revenue in 2023 and is expected to retain its dominance over the forecast period. The growth can be attributed to the increasing demand for trade credit insurance policies by large enterprises to reduce the risks of non-payments. Furthermore, market players such as Allianz Trade are involved in offering trade credit insurance specifically designed for large enterprises to protect their cash flow and receivables. Additionally, large enterprises trade in large sales volumes over long payment terms, where the risk of non-payment can be significant. Hence, large enterprises are adopting trade credit insurance policies worldwide.

- Coverage Insights

The single buyer coverage segment, on the other hand, is anticipated to register a significant growth rate over the forecast period. The growth of this segment can be attributed to the credit limit offered that enables underwriters to cover all financial transactions with the customer. This policy provides highly tailored protection against a single buyer failing to pay for goods or services provided. The companies involved in dealing with new customers commonly opt for single-buyer insurance to avoid a customer’s payment issues.

- Application Insights

The domestic application segment is expected to grow at the fastest CAGR over the forecast period. The growth of this segment can be attributed to a rise in the adoption of trade credit insurance within domestic sales. The rise in the adoption of trade credit insurance in the domestic market can be attributed to businesses focusing on avoiding bad debts and improving their cash flow. Furthermore, trade credit insurance offers companies the protection they require as their customer base consolidates, creating a larger receivable from minimal customers and protecting them from great risk.

- End-use Insights

The automotive segment is anticipated to register the fastest CAGR over the forecast period. The growth of this segment can be attributed to the automotive sector being a major industry facing uncertainties due to rapid technological advancements, changing consumer tastes, government regulations, and relative pricing. Furthermore, trade credit insurance can be particularly important in the automotive industry, given the high value of transactions and the potential risks associated with supplying goods to a wide range of customers. The growing awareness regarding the benefits of trade credit insurance among businesses in the automotive industry is also driving the segment’s growth.

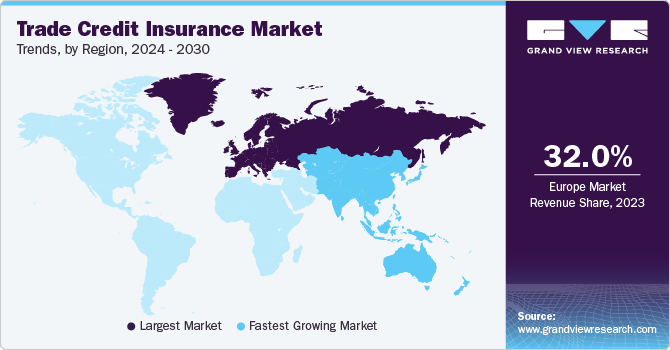

- Regional Insights

The trade credit insurance market in North America is expected to grow at a significant CAGR from 2024 to 2030. There has been an increasing interest in trade credit insurance among North American businesses, as trade tensions, economic uncertainty, and supply chain disruptions have increased credit risk. As a result, many businesses have turned to trade credit insurance as a way to protect their cash flow, manage risk, and ensure that they are paid for their goods and services.

Gather more insights about the market drivers, restraints, and growth of the Trade Credit Insurance Market

Key Companies & Market Share Insights

Some of the key players operating in the market include Allianz Trade, Coface, Atradius N.V., Zurich, and American International Group, Inc.

- Allianz Trade is a global trade insurance firm that specializes in areas such as debt collection, surety, structured trade credit & political risk, and fraud insurance. It leverages market knowledge, economic intelligence, and industry risk analysis to assist customers in better anticipating, analyzing, and responding to changes in market conditions.

- Atradius N.V. is a global insurance company operating in areas such as trade insurance, debt collection, and surety. It also provides tailor-made solutions through its special products unit division. The company has a dedicated team called Atradius Global that is committed to the individual trade credit insurance needs of multinational businesses.

Key Trade Credit Insurance Companies:

The following are the leading companies in the trade credit insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Allianz Trade

- Atradius N.V.

- Coface

- American International Group, Inc. (AIG)

- Zurich

- Chubb

- QBE Insurance Group Limited

- Great American Insurance Company

- Aon plc

- Credendo

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In May 2023, TradeCreditTech (TCT) announced its partnership with TreasurUp. Through this collaboration, the companies aim to digitize trade credit insurance and credit risk management for small and medium-sized businesses through banks. Through the partnership, certain banks will get access to TreasurUp’s trade credit platform and integrate it into their online Commercial Banking portal.

- In March 2023, Origin India, a trade credit insurance provider based in India, partnered with AU Group, a Paris-based broker specializing in trade receivables. This partnership enabled Origin India to offer a broad range of insurance products and services to its Indian customers. As a result of this partnership, AU Group expanded its geographical scope, enhancing its service capabilities.

- In January 2023, Coface, a term credit insurance provider, acquired Rel8ed, a North American data analytics boutique. With this acquisition, Rel8ed’s analytics capabilities and wealthy data sets will benefit Coface trade credit insurance.

No comments:

Post a Comment