Virtual Cards Industry Overview

The global Virtual Cards Market, estimated at $19.02 billion in 2024, is poised for substantial growth, with projections indicating a compound annual growth rate (CAGR) of 21.2% from 2025 to 2030. The increasing volume of digital transactions worldwide is expected to fuel demand for various types of virtual cards, thereby boosting market expansion. For instance, a May 2021 report by the MasterCard Payment Index revealed that 93% of surveyed consumers favored emerging payment methods like biometrics, digital currencies, and QR codes, in addition to contactless payments. Consequently, payment providers are continuously implementing diverse payment and shopping solutions for consumers.

The growing requirement for enhanced security measures, such as tokenization, within digital payment gateway systems is anticipated to drive the demand for virtual cards. Furthermore, the integration of tokenization technology in virtual cards offers numerous advantages for both businesses and customers, including an improved user experience and reduced security costs. By incorporating tokenization, merchants can securely transfer data across networks while safeguarding their customers' sensitive information. These factors are expected to create a favorable outlook for the market throughout the forecast period.

Detailed Segmentation:

- Card Type Insights

The debit card segment is expected to grow at a significant CAGR during the forecast period. The segment is expected to be driven by growing net banking users across the globe, which is expected to drive the demand for virtual debit cards. For instance, in May 2022, Google announced the development of two new payment initiatives, such as digital wallets and virtual cards. This launch is aimed at offering enhanced security and greater convenience for its users across the globe.

- Product Type Insights

The B2C remote payment virtual cards segment is expected to register at the fastest CAGR of 22.6% during the forecast period. Banks provide these cards to their retail clients, which helps retailers in making effective online payments. In addition, these cards are only used for one-time payments and have a specific validity period. The virtual card number, expiration date, and security code (CVV) can be generated by the customer using the bank's website or mobile application.

- Application Insights

The consumer use segment is projected to grow at the fastest CAGR of 21.8% over the forecast period. The increasing consumer inclination towards digital payments due to the pandemic is among the influential factors that are expected to drive the growth of the segment. Consumers across the globe prefer virtual card payments over cash payments owing to various benefits they offer, such as convenience and accessibility. For instance, according to a global Findex report by the World Bank in 2021, 89% of adults in China had a bank account, of which 82% were engaged in digital payments.

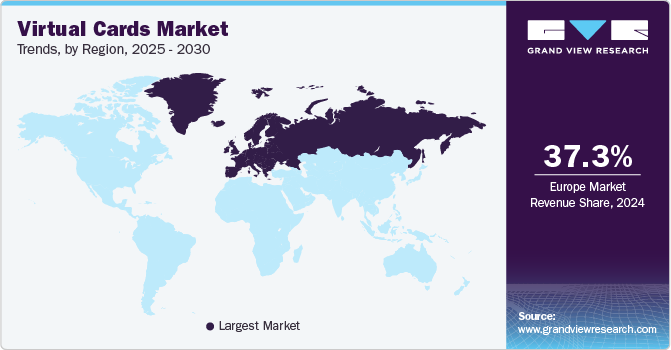

- Regional Insights

The virtual cards market in Asia Pacific is anticipated to grow at the fastest CAGR of 22.6% during the forecast period. The regional market growth is attributed to the increasing smartphone penetration in countries such as India, China, and Japan. In addition, the growing smartphone usage in these economies has led to an increasing inclination toward digital payments among consumers, thereby creating more demand for virtual card payment solutions. For instance, in October 2021, according to a report published by Asian Bankers Worldwide, Japan had a 70.6% penetration of digital wallets, which is expected to increase up to 98.6% by 2025.

Gather more insights about the market drivers, restraints, and growth of the Virtual Cards Market

Key Companies & Market Share Insights

Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

- Mastercard is a financial services organization known for its payment processing solutions, including credit, debit, and prepaid cards. Mastercard’s virtual card offerings are integrated across its wide range of payment platforms, including consumer wallets, mobile banking apps, and corporate payment systems. For businesses, Mastercard provides virtual cards through its Mastercard InControl and Commercial Card programs, enabling more efficient expense management, secure online procurement, and easier reconciliation for accounts payable processes.

- American Express Company (Amex) is a provider of financial services including credit card, charge card, and payment solutions. Amex virtual cards are designed for businesses to make secure and flexible payments without using physical cards. These virtual cards allow businesses to generate single-use or limited-use card numbers for specific purchases or vendors, significantly reducing the risk of fraud and unauthorized transactions.

Key Virtual Cards Companies:

The following are the leading companies in the virtual cards market. These companies collectively hold the largest market share and dictate industry trends.

- American Express Company

- BTRS Holdings, Inc.

- Wise Payments Limited

- JPMorgan Chase & Co.

- Marqeta, Inc.

- MasterCard

- Skrill USA, Inc.

- Stripe, Inc.

- WEX, Inc.

- Adyen

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In August 2024, Mastercard partnered with Aquapay to introduce the Mastercard In Control for Business Travel solution in India, aimed at enhancing the efficiency of business travel payments. This innovative virtual card solution allows travel management companies (TMCs) to issue virtual cards for central travel accounts, streamlining payment processes and improving security.

- In May 2024, HDFC bank launched a virtual credit card named PIXEL in collaboration with Visa. PIXEL is designed to cater to the needs of tech-savvy consumers who prefer seamless and customizable financial solutions. The card comes in two versions-PIXEL Play and PIXEL Go-allowing users to select tailored benefits and offers that align with their spending habits. This innovative offering is fully integrated into HDFC Bank's PayZapp mobile application, which provides a comprehensive suite of features such as card controls, rewards management, and real-time transaction notifications.

No comments:

Post a Comment