Metal Forging Industry Overview

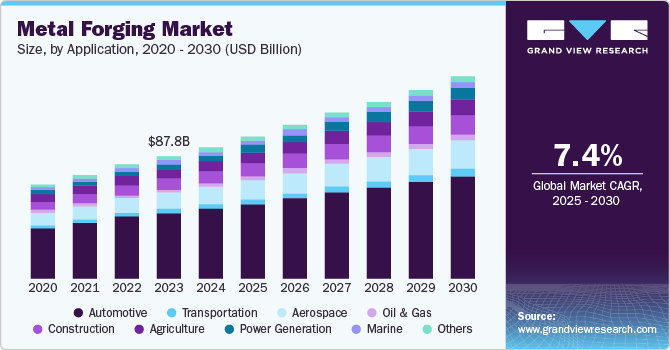

The global Metal Forging Market, valued at USD 94.38 billion in 2024, is projected to grow at a CAGR of 7.4% from 2025 to 2030. This growth is significantly propelled by the increasing demand for lightweight and high-strength materials across key industries, including automotive, aerospace, and construction. As manufacturers prioritize enhanced performance and improved fuel efficiency, forged components are gaining preference due to their superior mechanical properties compared to cast or machined alternatives.

Furthermore, ongoing advancements in forging technologies, such as closed-die and precision forging, are enhancing both production efficiency and the quality of the final products, thereby further driving market expansion. For example, the automotive industry's transition towards electric vehicles (EVs) is creating a demand for innovative forging solutions to produce lightweight components that contribute to the overall efficiency of these vehicles.

Detailed Segmentation:

- Application Insights

Power generation segment is expected to grow at fastest CAGR of 11.3% over the forecast period. Rising global energy consumption is driving investments in both conventional and renewable energy infrastructure. Forged components are essential in power plants due to their durability and ability to withstand extreme conditions like high temperatures and pressures.

- Raw Material Insights

Aluminum segment is expected to grow at the fastest CAGR of 8.4% over the forecast period. Aluminum offers a high strength-to-weight ratio, making it ideal for applications that require both durability and lightness. This is particularly beneficial in industries like defense and sports equipment. Aluminum’s natural corrosion resistance makes it suitable for use in harsh environments, where other metals may degrade more quickly. Aluminum is 100% recyclable, and its use aligns with global sustainability goals, driving demand in industries focused on reducing environmental impact.

- Regional Insights

North America metal forging market is expected to register a CAGR of 4.8%, in terms of volume, from 2025 to 2030. Significant investments in infrastructure development, driven by government initiatives and funding programs, are fueling demand for forged metal products in construction and public works of North America. Further, increasing investments in both traditional and renewable energy sectors are driving demand for forged components, including those used in power generation and transmission equipment.

Gather more insights about the market drivers, restraints, and growth of the Metal Forging Market

Key Companies & Market Share Insights

Some of the key players operating in the market include Aronic, ATI, Bharat Forge Ltd.

- Aronic is a prominent player in the global metal forging market, specializing in providing high-quality forged components and solutions to various industries, including automotive, aerospace, energy, and construction. Aronic has developed a comprehensive range of products that includes precision forged parts, custom forgings, and specialized components tailored to meet the unique needs of its clients. The company employs advanced forging technologies and manufacturing processes, ensuring that its products meet stringent quality standards and performance requirements.

- Allegheny Technologies Incorporated (ATI) is a leading global manufacturer of technically advanced specialty materials and complex components, primarily serving the aerospace, defense, oil and gas, and energy industries. The company offers a comprehensive range of products, including forged bars, discs, and shapes, which are engineered for demanding applications. ATI's forging capabilities enable the production of high-strength, lightweight components that meet stringent quality and performance standards.

- Bharat Forge operates across various sectors, including automotive, aerospace, defense, railways, and energy, providing a diverse range of forged products. The company's product offerings include critical components such as crankshafts, connecting rods, gears, chassis parts, and various specialty forged products. Bharat Forge's advanced manufacturing capabilities are supported by state-of-the-art technology, including computer numerical control (CNC) machines and automated forging lines.

Key Metal Forging Companies:

The following are the leading companies in the metal forging market. These companies collectively hold the largest market share and dictate industry trends.

- Bruck GmbH

- China First Heavy Machinery Co., Ltd.

- ELLWOOD Group, Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- Nippon Steel Corp.

- Precision Castparts Corp.

- Larsen & Toubro Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In May 2024, Balu Forge Industries Ltd. announced the strategic acquisition of 72,000-tonne forging lines in Karnataka, India significantly enhancing its manufacturing capabilities and market position in the metal forging sector. This acquisition is a critical step in the company's efforts to expand its production capacity and meet the growing demand for high-quality forged components across various industries, including automotive, aerospace, and defense. The new forging lines are equipped with advanced technology, allowing Balu Forge to produce a wider range of precision-engineered products while ensuring superior quality and efficiency in manufacturing processes.

- In October 2024, Bharat Forge Ltd. announced an agreement to acquire AAMIMCPL, a strategic move aimed at bolstering its position in the global metal forging market. This acquisition will enable Bharat Forge to integrate AAMIMCPL's advanced manufacturing technologies and extensive expertise in producing high-quality forged components. The collaboration is expected to enhance Bharat Forge’s product offerings, particularly in the automotive and aerospace sectors, by leveraging synergies in research and development, operational efficiencies, and supply chain management.

No comments:

Post a Comment