Automotive Collision Repair Industry Overview

Fueled by a rising tide of automobile insurance subscriptions and cutting-edge advancements in vehicle technology, the global Automotive Collision Repair Market is poised for steady expansion. After reaching a valuation of USD 199.56 billion in 2023, projections indicate a consistent CAGR of 1.9% between 2024 and 2030.

This growth is further amplified by the unfortunate increase in road accidents and fatalities globally. Interestingly, a notable trend in suburban areas of South America and the Asia Pacific sees automobile retailers offering Do-It-Yourself (DIY) kits, catering to consumers who prefer at-home repairs.

Detailed Segmentation:

- Product Insights

The paints & coatings segment is expected to grow at the fastest CAGR of 2.7% from 2024 to 2030. The rapidly evolving paints & coatings technology, which meets the latest protective automobile materials and aesthetic demands, is the key reason for the growth of the segment in the automotive industry. Paints & coatings are anticipated to witness higher adoption in high-volume markets over the forecast period, owing to the surging environmental concerns about the use of detrimental synthetic coatings and refinishing materials. The paints and coatings segment is projected to grow steadily during the forecast period because of the environmental and health risks associated with automotive body paint materials.

- Service Channel Insights

The OE (handled by OEM's) segment dominates the market in terms of revenue share in 2023. The DIY (Do It Yourself) segment, on the other hand, is expected to grow at the fastest CAGR of 2.5% from 2024 to 2030. Globally, people have been retaining their car usage for longer periods, which has supported the demand for replacement parts. The automotive collision repair industry will continue to significantly grow, which is attributed to its robust demand from emerging economies. The DIY segment is expected to grow at the highest CAGR in the Asia Pacific region from 2024 to 2030, followed by South America. Manufacturers in the automotive industry are gradually shifting their focus to vehicle modification, where they can customize the vehicle to meet the needs of the customer rather than purchasing new vehicles.

- Vehicle Type Insights

The heavy-duty vehicles segment is expected to grow at a CAGR of 1.5% from 2024 to 2030. The heavy-duty vehicles segment includes commercial and multi-axle vehicles such as trucks and buses. Heavy-duty vehicles are anticipated to be used for the transportation of bulk products within any country or region. Increasing trade activities are expected to augment the demand for heavy-duty vehicles equipped with the latest technologies for hauling and loading.

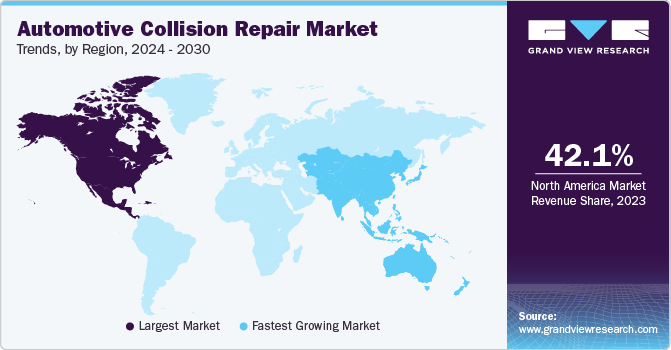

- Regional Insights

Asia Pacific is expected to grow at the fastest CAGR of 3.5% from 2024 to 2030. The increasing number of vehicle sales is leading to significant growth of the regional industry. An upsurge in vehicular damage due to lack of stringent driving regulations in Asia Pacific is further driving the regional market growth. The region is perceived to be a source of components for local companies and multinationals, who aim to supply low-cost components to prominent vehicle manufacturers.

Gather more insights about the market drivers, restraints, and growth of the Automotive Collision Repair Market

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is on developing new products and collaboration among the key companies. In February 2023, Classic Collision LLC, a U.S.-based auto repair center, acquired Gale’s Auto Body, a motor vehicle manufacturer in the Blaine. Through this acquisition, Classic Collision intends to extend its presence in Minnesota and provide improved customer service during the repair process.

Key Automotive Collision Repair Companies:

The following are the leading companies in the automotive collision repair market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Automotive Technology Products LLC (subsidiary of Lodi Group of Monterrey)

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Mann+Hummel Group

- Martinrea International Inc.

- Mitsuba Corporation

- Robert Bosch GmbH

- Takata Corporation ODU GmbH & Co.KG

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In July 2023- BMW North America joined Sustaining Partner Program by I-CAR. The program helps fund support initiatives and collision repair education that reduce training redundancies. It is also designed for partners to demonstrate advocacy and provide funding for industry-wide efforts by I-CAR.

- In July 2023, Classic Collision announced the acquisition of the Dayton Collision Center in Dayton, Tennessee, enabling the company to expand its operations in the state. This follows the company’s successful operational expansion in other states, including Minnesota, Georgia, Texas, Colorado, and Florida, in 2023

- In March 2023, DENSO Products and Services Americas, Inc. announced the expansion of its aftermarket ignition coils range with the addition of nine new part numbers covering over 9 million vehicles in operation. With this launch, DENSO has expanded its offering of high-quality replacement ignition coils for various Buick, BMW, Cadillac, GMC, Infiniti, Lincoln, Ford, Nissan, Chevrolet, and Volvo models

No comments:

Post a Comment