Digital Remittance Industry Overview

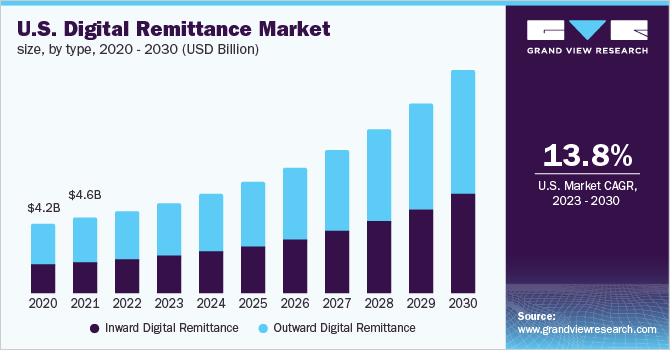

The global digital remittance market size was valued at USD 19.65 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 15.6% from 2023 to 2030. The global digital remittance transactions were valued at over USD 390 billion in 2022. The market growth can be attributed to the increasing fund transfers from migrant workers to their families. Moreover, the increasing number of cross-border transactions and the growing adoption of mobile-based payment channels are expected to propel market growth over the forecast period. According to GSM Association, in 2020, funds worth around USD 12.7 billion were processed through mobile money in cross-border remittances.

The proliferation of the digital platform for remittance is expected to encourage customers to move toward online transactions. Moreover, the rising penetration of mobile devices across the globe in recent years has encouraged the adoption of digital technology in remittance services and cross-border payments. Customers across the globe are also shifting toward digital remittance services as they help reduce the money transfer time and remittance costs. Moreover, digital remittance services offer high privacy and protection for consumers’ money.

Gather more insights about the market drivers, restraints, and growth of the Global Digital Remittance Market

The endless chains of mediators, hidden charges, and paperwork involved in money transfer made the process costly and arduous. However, the adoption of digital remittance services has helped businesses and customers enjoy more affordable, faster, and value-added money transfer services. The costs involved in transferring money have reduced drastically as a result of healthier competition between market players.

The rising popularity of digital remittance services among low-wage migrant workers, who use these services to send money to their families, is compelling several governing bodies to pay attention to and regulate the digital remittance industry. Moreover, foreign remittances play an important role in the economic development of emerging markets. Due to this, authorized regulators control and monitor money transfer fees to encourage customers to continue using digital remittance services and effectively contribute to their home country’s economic growth. These factors are expected to contribute to the market growth over the forecast period.

The increasing adoption and ease of digital payments are expected to create growth opportunities for the market over the forecast period. However, the lack of awareness about digital remittance services and high remittance prices are expected to hinder market growth. Moreover, security hindrances such as terrorist financing and money laundering could negatively impact the growth prospects of the market over the forecast period.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Contactless Payment Market - The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030.

Cross-border B2C E-commerce Market - The global cross-border B2C e-commerce market size was valued at USD 719.02 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 25.8% from 2022 to 2030.

Digital Remittance Market Segmentation

Grand View Research has segmented the global digital remittance market on the basis of type, channel, end use, and region:

Digital Remittance Type Outlook (Revenue, USD Million, 2017 - 2030)

- Inward Digital Remittance

- Outward Digital Remittance

Digital Remittance Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Banks

- Money Transfer Operators

- Online Platforms

- Others

Digital Remittance End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Migrant Labor Workforce

- Personal

- Small Businesses

- Others

Digital Remittance Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

August 2021: WorldRemit Ltd. launched its money transfer services in Malaysia, allowingWorldRemit users to send money from Malaysia, in addition to 50 other countries, including the U.S. and the U.K., to more than 130 destinations.

Key Companies profiled:

Some prominent players in the global Digital Remittance market include

- Azimo Limited

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- PayPal Holdings, Inc.

- Ria Financial Services Ltd.

- TransferGo Ltd.

- TransferWise Ltd.

- Western Union Holdings, Inc.

- WorldRemit Ltd.

Order a free sample PDF of the Digital Remittance Market Intelligence Study, published by Grand View Research.