Construction Equipment Rental Industry Overview

The global construction equipment rental market size was estimated at USD 73.44 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 3.9% from 2022 to 2030. The increase in governments’ spending on the development of public infrastructure has catalyzed the construction and mining activities in emerging economies of the world. This factor has created a high demand for construction equipment in the market. Rising prices for new construction machines is encouraging construction companies and contractor to shift their interest toward renting construction equipment. Further, the emergence of advanced technologies and increasing level of automation is expected to propel the market's growth. Advancements such as equipment service tracking & mapping and digital service for automated service improvements are anticipated to drive market growth during the forecast period. However, many factors are driving the growth of the construction equipment rental market, and the pandemic has posed a severe challenge to its market. The 2019-20 pandemic has resulted in global supply chain disruptions, shutting down several production facilities, which harshly affected the infrastructure industry, subsequently affecting the equipment rental industry.

In 2021, the market witnessed higher growth, as many rental companies benefit from the uncertainty caused due to pandemics. The construction activities have been active at an irregular pace after being hit with each Covid-19 wave, which is motivating small and medium scale construction companies to rent the machine than purchase them. The uncertainty is expected to be amplified in the construction sector due to higher inflation in raw material prices, scarcity of skilled workforce, and high interest charged by the construction companies, therefore, the factors mentioned above are expected to increase the adoption of rental construction equipment in the market.

Gather more insights about the market drivers, restraints, and growth of the Global Construction Equipment Rental Market

Rapid technological advancement in the automobile and heavy equipment sector has increased the efficiency and performance of construction machines. The prominent players in the equipment market are majorly focusing on developing smarter machines by incorporating propriety technology systems. The Telematics system provides brief information about the location and level of the performance of construction equipment as well as the vehicle. Data relayed through the system includes engine hours idling, GPS location, and fuel consumption; however, the systems require huge investment which makes them unaffordable for many small builders and contractors. Thus, the construction equipment rental service has overcome the issue by removing the total cost of ownership and providing them with rental options.

Renting construction equipment saves the initial purchasing, maintenance, and inventory costs of the equipment and machinery. The rental companies invest more in repairing and maintaining their products to gain long-term profits from them. Further to expand the product and service offering, the rental companies have started providing onsite supporting services for customers at remote locations.

Browse through Grand View Research's HVAC & Construction Industry Related Reports

Wires And Cables Market - The global wires and cables market size was estimated at USD 192.48 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2022 to 2030.

Compact Electric Construction Equipment Market - The global compact electric construction equipment market was valued at USD 46.15 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.5% from 2022 to 2030.

Construction Equipment Rental Market Segmentation

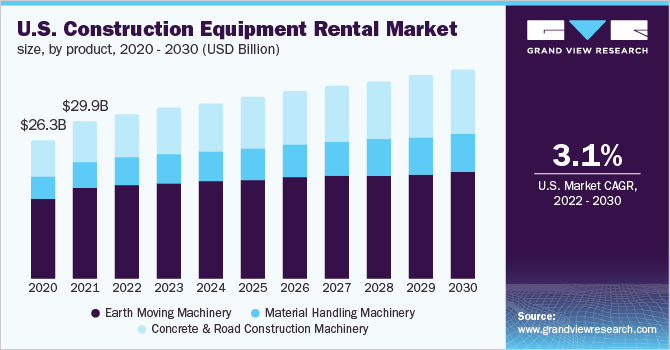

Grand View Research has segmented the global construction equipment rental market based on product and region

Construction Equipment Rental Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Earth Moving Machinery

- Material Handling Machinery

- Concrete & Road Construction Machinery

Construction Equipment Rental Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

April 2021: United Rental Inc. announced the complete asset acquisition of General Finance Corporation; this acquisition was part of the company’s strategic moves to expand its existing product portfolio.

Key Companies profiled:

Some prominent players in the global Construction Equipment Rental market include

- Ahern Rentals Inc.

- AKTIO Corporation

- Caterpillar Inc.

- Byrne Equipment Rental

- Cramo Plc

- Finning International Inc.

- Liebherr-International AG

- Kanamoto Co., Ltd.

- Maxim Crane Works, L.P.

- United Rentals, Inc.

Order a free sample PDF of the Construction Equipment Rental Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment