U.S. Corporate Wellness Industry Overview

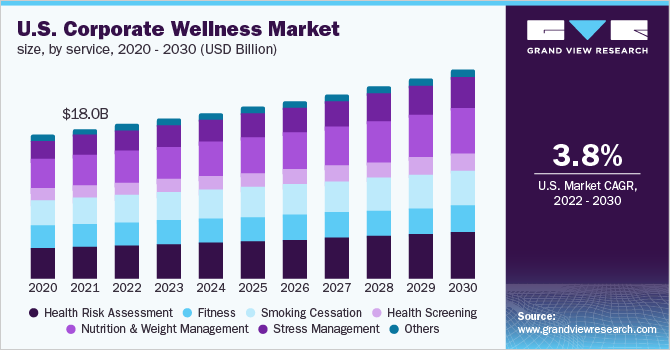

The U.S. corporate wellness market size was valued at USD 18.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.77% from 2022 to 2030. The reduction in the overall healthcare costs of the employee and the increasing onset of chronic diseases are expected to boost the market growth. Employee wellbeing has proved to be an essential feature of the modern-day business world. Employees are likely to perform more diligently for employers that make them feel loved. Around 60% of employees approve that corporate wellness programs have made them opt for a healthy lifestyle outside of the office as well.

Stress in the workplace is common among U.S.-based adults and is progressively increasing over the past few decades. The American Institute of Stress, in September 2019, reported that around 85% of employees in the U.S. suffer from work-related stress, which costs the employers around USD 300 billion annually. Moreover, according to SHRM, the cost of treating depression alone is approximately USD 110 billion annually, half of which is spent on treating employees.

Gather more insights about the market drivers, restraints, and growth of the U.S. Corporate Wellness Market

There is an increasing awareness regarding employee health programs and their benefits in countering the various physical and mental disorders. This has resulted in increased adoption of programs by employers. According to a study published by the American Journal of Health Promotion, in 2017, almost half of the entire U.S. worksites offered some kind of health promotion program.

The high return on investment (ROI) in corporate wellness services is also a factor that attracts employers to offer these services. Employers pay a substantial amount of healthcare premiums to insurance providers, especially, in large-scale organizations. The increasing number of unhealthy employees leads to an upsurge in the premium cost putting employers under an increased financial burden. This motivates the employers to readily invest in programs for the employees to reduce the healthcare costs for the organization and increase productivity at work.

The government is taking initiatives to promote corporate wellbeing services. The Health Insurance Portability and Accountability Act (HIPAA) protects employee health information held by employers. Moreover, in May 2016, the U.S. Equal Employment Opportunity Commission (EEOC) passed a rule to implement Title II of the Genetic Information Nondiscrimination Act (GINA) associated with employer wellness programs. The final rule implies that employers may provide limited financial and other incentives in exchange for employee participation in wellness programs.

Most workplace wellness programs compensate for gym memberships. Businesses may need to provide alternatives to their employees because many individuals may not feel safe coming to gyms until there are fewer incidences of COVID-19. Providing access to online workout sessions is an easy substitute for gym memberships. The financial burden of the crisis has impacted people’s willingness to spend on well-being. Corporate wellbeing programs can help by giving reimbursements for employees who purchase yoga mats, resistance bands, and other basic gym equipment for at-home activities.

Browse through Grand View Research's Medical Devices Industry Related Reports

Wellness Tourism Market - The global wellness tourism market size was valued at USD 451.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.93% from 2022 to 2030.

Medical Tourism Market - The global medical tourism market size was valued at USD 4.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 32.51% from 2022 to 2030.

U.S. Corporate Wellness Market Segmentation

Grand View Research has segmented the U.S. corporate wellness market based on service, end-use, category, delivery model, and region:

U.S. Corporate Wellness Service Outlook (Revenue, USD Million, 2016 - 2030)

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition & Weight Management

- Stress Management

- Others

U.S. Corporate Wellness End-use Outlook (Revenue, USD Million, 2016 - 2030)

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

U.S. Corporate Wellness Category Outlook (Revenue, USD Million, 2016 - 2030)

- Fitness & Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

U.S. Corporate Wellness Delivery Model Outlook (Revenue, USD Million, 2016 - 2030)

- Onsite

- Offsite

Market Share Insights:

May 2019: Wellness Corporate Solutions launched an upgraded employee wellness portal to include the client and participant feedback to make screening, administering flu shots, and health coaching easier.

Key Companies profiled:

Some prominent players in the U.S. Corporate Wellness market include

- ComPsych

- Wellness Corporate Solutions

- Virgin Pulse

- EXOS

- Marino Wellness

- Privia Health

- Vitality

- Wellsource, Inc.

- Sonic Boom Wellness

Order a free sample PDF of the U.S. Corporate Wellness Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment