Europe Mobility Aids Industry Overview

The Europe mobility aids market size was valued at USD 2.8 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 3.2% from 2022 to 2030. This growth can be attributed to the increasing geriatric population requiring Long-term Care (LTC), the growing availability of technologically advanced products, and the rising demand for home healthcare services & staff. The market is majorly driven by the growing prevalence of target diseases impairing mobility. The introduction of new mobility aids by market players is anticipated to increase the number of products available in the market and facilitate market growth. For instance, in February 2021, Invacare Corp. announced the introduction of their next-generation power assist device, the e-motion (M25).

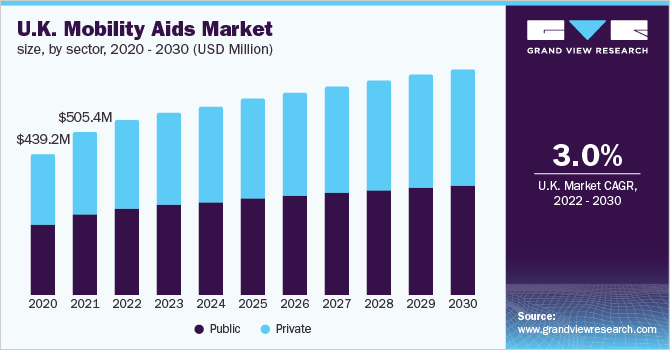

These power assist vehicles will feature wheels with a powerful in-hub motor and lithium-ion batteries, thus expanding the company’s product portfolio and driving the market growth. The COVID-19 pandemic had significantly affected the transport and mobility sector. It had disrupted the -supply channel of the wheelchair to a great extent. Wheelchair operations were halted across several countries owing to strict lockdowns being implemented. Hospitals witnessed consistent demand owing to a spike in the number of geriatric patients with COVID-19 infection. With the ease of lockdown, companies are expected to resume operations. The U.K. private sector segment is expected to grow at a steady CAGR during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Europe Mobility Aids Market

The iWalkActive program initiated by Ambient Assisted Living (AAL) aims to integrate the ICT technology with the conventional walkers to provide a smart walker platform for the aging European population to assist in walking. Such initiatives are anticipated to drive market growth. Furthermore, the rising geriatric population coupled with the rising prevalence of diseases, such as Parkinson’s, arthritis, and paralysis, is anticipated to increase the demand for mobility aids. For instance, in the U.K., one of the important economies in Europe, the geriatric population accounted for nearly 18.65% of the country’s population in 2020. Moreover, approximately 20,000 new cases of rheumatoid arthritis are diagnosed in the country annually, eventually increasing the demand for rehabilitation equipment.

The various funding mechanisms implemented by several European countries for aiding patients in need of LTC are also likely to support market growth. For instance, several European countries provide universal long-term care coverage. The availability of a range of long-term care funding systems, such as social insurance, private insurance, universal health coverage, and others, across European countries will greatly improve the affordability of mobility devices. In addition, England’s tax-based system prioritizes the provision of rehabilitation and rehabilitative services to patients. These factors are expected to result in lucrative growth of the market over the forecast period.

Browse through Grand View Research's Medical Devices Industry Related Reports

Long-term Care Market - The global long-term care market size was valued at USD 991.6 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 6.55% during the forecast period.

Home Healthcare Market - The global home healthcare market size was valued at USD 336.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.93% from 2022 to 2030.

Europe Mobility Aids Market Segmentation

Grand View Research has segmented the Europe mobility aids market based on product, sector, type of split, distribution channel, and region:

Europe Mobility Aids Product Outlook (Revenue, USD Million, 2018 - 2030)

- Rollators

- Walkers

- Wheelchairs

- LTC Beds (Home)

Europe Mobility Aids Sector Outlook (Revenue, USD Million, 2018 - 2030)

- Public

- Private

Europe Mobility Aids Type of Split Outlook (Revenue, USD Million, 2018 - 2030)

- Rehabilitation

- Aged Care

Europe Mobility Aids Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

- Online

- Offline

Market Share Insights

February 2020: Sunrise Medical acquired Oracing, a Spain-based designer and manufacturer of innovative sports, made-to-measure wheelchairs, and E-Mobility power products.

Key Companies profiled:

Some prominent players in the Europe Mobility Aids market include

- Human Care HC AB

- Drive DeVilbiss Healthcare

- Roma Medical

- Day’s Mobility Ltd.

- Van Os Medical

- Invacare Corp.

- Z-Tec Mobility

- Sunrise Medical

- Karma Mobility

- TOPRO Ltd.

- Remploy (RHealthcare)

Order a free sample PDF of the Europe Mobility Aids Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment