Shared Mobility Industry Overview

The global shared mobility market size was valued at USD 166.3 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 16.9% from 2022 to 2030. Shared mobility is an emerging market wherein transportation resources and services are shared concurrently or one after the other among its users. Apart from being cost-effective and environmentally friendly, shared mobility is also convenient. Because of this, shared mobility will only partially be able to replace car ownership. There has been observed a rise in customer demand for self-driving taxis and shuttles in comparatively lower density locations.

New modes and services have emerged like peer-to-peer car sharing, pooled ride-sharing, shared electric scooters, etc. This emergence has been attributed to their potential integration, automated processes, personalized travel on demand, and environment-friendly nature. The growth in penetration of connected cars and smartphones is one of the key factors driving the market for shared mobility. The increase in the cost of road vehicles and the cost of fuel, combined with a reduction in parking, especially in developed countries around the world, is estimated to boost the market growth in the coming years.

Gather more insights about the market drivers, restraints, and growth of the Global Shared Mobility Market

Additionally, shared mobility solutions are less expensive compared to other modes of transportation and eliminate limited parking problems. Various governments worldwide are launching programs to promote the growth of these solutions to reduce congestion. This has a significant impact on commuters' lifestyles and the market as a whole, such as increased accessibility, improved transportation, reduced driving, and decreased personal car ownership. Environmental, social, and transportation system benefits are frequently realized through shared mobility schemes. Multiple ways in which commuters commute are public transit which is through shared public transport, Micro mobility (bike-sharing or scooter sharing), Automobile-based mode (via car sharing, rides, micro-transit, and Ride on-demand), Commute-based modes or ridesharing (car or vanpooling).

Other reasons that support the growth of the market for shared mobility would be lack of parking space, growing traffic congestion on the road, high cost of owning personal vehicles, and mainly high fuel prices. With rising growth in private sector employment, the market is expected to grow further since many private-sector employees would want to commute through shared mobility services. COVID-19 has had a negative impact on expanding the market for shared mobility due to changes in mobility patterns of people worldwide. Mobility of people during the pandemic decreased significantly, also diminishing the number of visits to workplaces which was one of the main reasons and drivers of the market.

The pandemic has also led to a shift in priorities regarding Commute. Pre-COVID, the emphasis of commuters would be the cost of service, convenience, and other variables like time taken and mode of transport. Now, commuters look for safe, sanitized, and lower risk of infection modes of transportation. Hence, considering health as a priority is likely to decrease the use of sharing and public transport. Moreover, due to the loss of demand in the market, car-sharing services were either reduced or suspended during the global pandemic.

The leading market players are always focused on working with car manufacturers to improve their portfolio of electric car-sharing services in Asian countries. Adopting such strategies will likely work for the market during the forecast period. The market for shared mobility is expected to witness many opportunities during new product development. The introduction of advanced/uninterrupted technology and the rise in investors in the market are essential strategies that most industry players are expected to expand their customer base in the next few years.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

E-Scooter Sharing Market - The global e-scooter sharing market size was valued at USD 925.3 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 18.8% from 2022 to 2028.

Shared Vehicles Market - The global shared vehicles market size was valued at USD 127.9 billion in 2021 and is expected to expand at a CAGR of 14.4% from 2022 to 2028.

Shared Mobility Market Segmentation

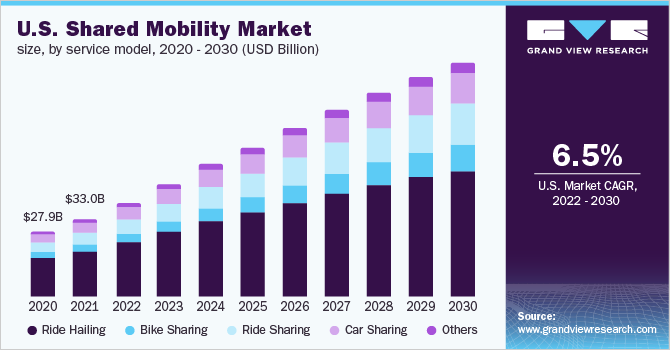

Grand View Research has segmented the global shared mobility market based on service model, vehicle, and region:

Shared Mobility Service Model Outlook (Revenue, USD Billion, 2018 - 2030)

- Ride Hailing

- Bike Sharing

- Ride Sharing

- Car Sharing

- Others

Shared Mobility Vehicles Outlook (Revenue, USD Billion, 2018 - 2030)

- Cars

- Two-Wheelers

- Others

Shared Mobility Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

March 2022: Chalo, a Bangalore-based mobile app that books and enables bus tracking across cities, acquired Vogo, a two-wheeler shared mobility business startup. As part of this acquisition, Vogo has planned to switch to EVs (electric vehicles) in all its vehicles and extend services beyond two wheels and provide other EV models to suit market needs.

Key Companies profiled:

Some prominent players in the global Shared Mobility market include

- Car2Go

- Deutsche Bahn Connect GmbH

- DiDi Chuxing

- Drive Now (BMW)

- EVCARD

- Flinkster

- Grab

- GreenGo

- Lyft

- Uber

- Zipcar

Order a free sample PDF of the Shared Mobility Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment